Anyone else attending the Fundsmith Annual Shareholders‘ Meeting on 28 feb in London this year?

Would love to listen to the stream, is there going to be one?

I think they‘ve been posting recordings shortly afterwards - but no live stream.

Right, if I remember correctly they are all on Youtube but it could take a few days or weeks until they publish the video. I think last year I was eager to watch it and waited and waited…

VWRA in GBP went down only -8.17% in 2022, so nothing to be really proud of ![]() .

.

Oh, Terry definitely wasn’t. But to be fair, they did mention on previous occasions that a time would come where they’d trail the benchmark.

By the way: most undervalued stock in their portfolio? Terry thinks it‘s Meta - while admitting they didn’t do well on the timing for their purchase.

Also, while it technically shouldn’t have been on the agenda, they did briefly comment on the reasons for winding down of FEET (their emerging markets counterpart), also citing the currency headwind, and that currencies like the INR can’t be hedged properly.

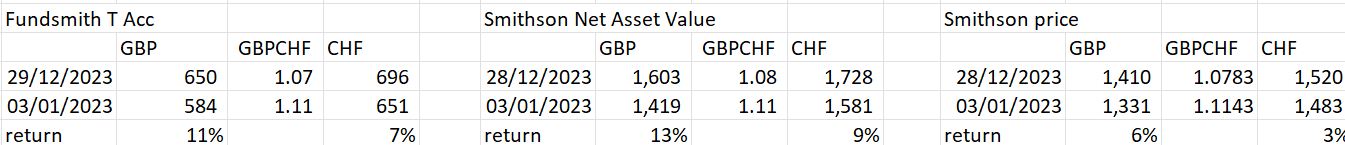

Calculation of 2023 returns in CHF & some personal thoughts:

By comparison: MSCI World returned 11% in CHF and S&P500 13%

I am sticking with Fundsmith as my no 1 holding and Smithson as no 2.

I am not too worried about the short term difference in performance vs MSCI world. It is to be expected FS returns are lower during a year of rising interest rates. This could flip next year if rates drop. Also if there is a 50% general market crash I feel better being in quality stocks.

I have questions in the back of my mind if Terry Smith is taking is eye off the ball (living in Mauritius, nasty divorce etc) and if he his in the process of handing over the reigns.

I feel less bullish on Smithson than I was - the FS concept applied to smaller companies has not yet been proven.

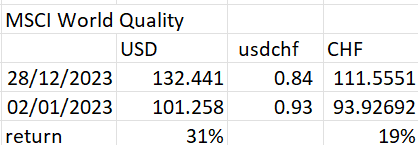

What is interesting is the return on MSCI Quality - 19% in CHF:

Biggest difference seems to be NVIDIA. Until now I have not been convinced in the concept of factor algorithms but something to be looked into…

I’ve been reading around Quality since late last year, and decided to dedicate my 3A to it.

I’ve written earlier that I also buy BRK.B, and Terry Smith is sometimes called “Britain’s Buffett”, so the premise is good, but butts heads quite hard with my otherwise Bogle conviction of buying the haystack. The question is one of too many eggs in a single bucket. I take great comfort in the (Bogle) VT/VT-equivalent approach of getting average and safe returns, while struggling with the idea of them containing heaps and heaps of trash (like a Russian leisure/camping company I found in the last page of VT’s holdings), and the time it’d take for the next Apple to crawl through.

Interested in SSON, but not necessarily enough to buy into it yet as anything more than a bet. It could turn out smashing it if Small Cap + Value turn after 10+ years of Growth dominance. Is this part of the reason more experienced people here have bought into it (e.g., @Julianek, @Barto, @dbu)? More interested in the Fundsmith mutual fund itself through IBKR but still wondering if Finpension’s Quality mutual fund has it covered regardless, and staying happy with that.

Edit: “better is the enemy of good” is a roughly translated popular Greek quote (I’m Greek), meaning people often screw up a good thing trying to make it better. Now after googling I see it attributed to Voltaire, possibly nicked from an Italian proverb and/or Montesquieu, also showing up 100 years earlier in Shakespear, as well as Chinese and ancient Greek philosophy.

(nota bene: I am not “one of the experienced” ones ![]() )

)

SSON has not really done much in the past ~3 years, while the likes of SLYV/AVUV (small cap value) have knocked it out pretty decently.

I am sticking with Fundsmith, bought SSON only at the beginning before I found out I could get “the OG” through IBKR.

It was just for the tag man!

Edited for kudos ![]()

Personally I just believe in the methodology/strategy that Fundsmith uses (I own both SSON and Large Cap Equity) and I would do the same if I had more time to reasearch individual stocks.

Is FEET still running? I sold mine end 2022 (at a loss), after they announced they were closing it, because they weren’t expecting to be able to beat the market with it. Did they “change their mind”?

What is the OG? The mutual fund? As I own SSON, what is the advantage of changing to OG?

Ups, that was I typo from my side. I meant the large cap equity mutual fund. Fixed my post.

I assume he means the Fundsmith Equity Fund, which at the beginning was not available in IB, but only directly with them.

They are different things, the Smithson holding company is holding small cap +/- value +/- moats, no breakthrough innovators/fast movers (here: Fund Factsheet | Smithson), while the mutual fund is mostly huge companies.

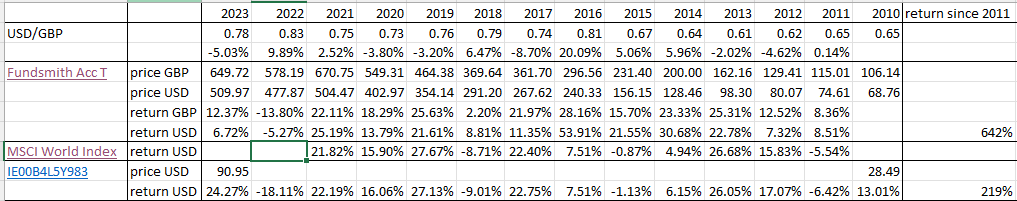

I tried to compare the annual returns for the Fundsmith Acc T with the MSCI World Index. I used the USD/GBP exchange rate and the price of the Fundsmith Acc T on the last day of the respective year. I multiplied the exchange rate by the price to get the value in USD. Since the beginning (2010) Fundsmith Acc T performs much better compared to an ETF (IE00B4L5Y983, acc) with MSCI as benchmark. But no idea if my calculation and data are correct. ^^

what would you say?

Your conclusion is correct. On the website of the fund, the fund has returned 550% since inception (November 2010) to end of 2023, compared to 316% for the MSCI World in the same period (Performance is calculated in GBP for fund and msci world).

I would however also argue that the msci world is not necessarily the ideal benchmark. Since the fund focuses on quality, something like a msci world quality index would be more suitable?

Terry smith has mentioned the choice of benchmark (in general fund management context, not in terms of his own fund) is important to compare apples to apples. Because msci world replicates developed markets without any consideration of quality, it might not be the ideal benchmark.