I get that you don’t like the Meta company, but I am a bit surprised when I see this kind of statement:

Is that just a gut feeling, or really based on rational analysis?

Fundsmith’s investment strategy is “Buy good companies, don’t overpay, do nothing.”

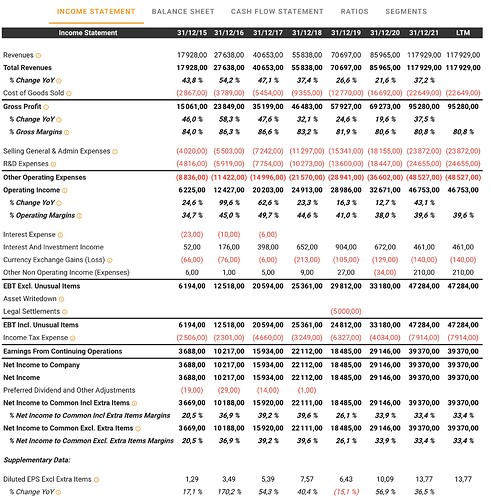

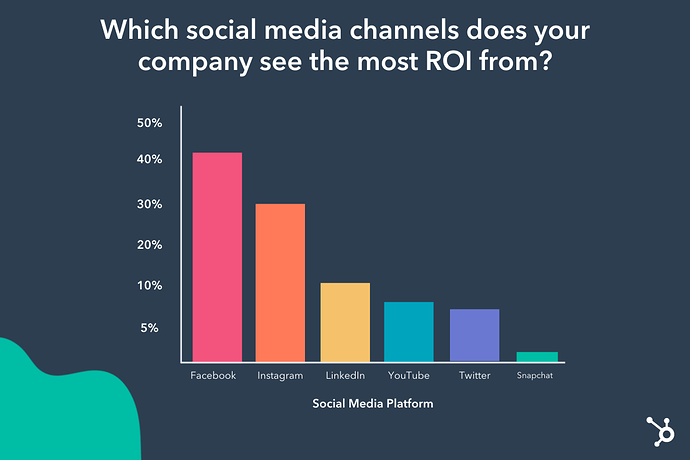

Last time I checked, FB was still part of the duopoly with Google for online advertising. And it shows in their financial results:

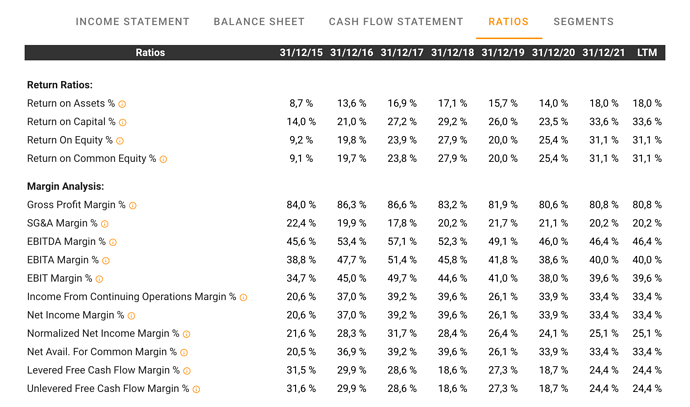

In the last five years, they multiplied by ten their profits per share. In 2021 alone, profits grew by 33%. Return on capital is an eye-watering 33%. All of this while having to endure major headwinds (who remembers the billion they had to invest in security because of controversies on data privacy and security?).

So:

- FB is an outstanding business

- available at a current price of 18 times forward earnings

- FEF holds this business since a few years and plans to continue to do so.

I fail to see how FEF is deviating from its strategy.

Now it is true that currently FB is getting a lot of flak because the market is not convinced by their investment in the metaverse. But it’s not like the main business is going away. It’s an initiative that may pay off or not, the same way that google and amazon had major failures (who remembers google wave and amazon fire phone) as well as incredible new ventures (youtube and AWS).

I agree that the video is a bit light on FB, they should not have insisted that much on the metaverse (which at this stage is only a bet, nobody knows if it’s going to be successful). But saying that they should ditch it altogether is a bit farfetched. They will do it when the core business will start deteriorating, not before.

It looks like James O’shaughnessy was right: “In markets, prices don’t follow the narrative. Narratives follow prices.” Now that FB stock is down, everybody seems to think that the company will be a failure and that fund managers should ditch it.