I was wondering the other day how people usually manage their finances when FIREd. Better to know in advance ![]()

I didn’t read much about it since it’s not an issue for me so I’m a bit lost. I suppose no one on that phase has only 100% stocks so I wonder what are the possibilities.

For those with enough dividend income, they just have to move the dividends to the main account either monthly or whenever they get paid. Maybe they leave them on BOXX or some 100% safe ETF (if there is any?)

If the portfolio is more balanced, what is the strategy? In case like now, are you selling the bond/reit/safe part of the portfolio to finance your life or selling that part to buy more stocks etf and at the same time finance your life? Or just sell stocks anyway?

If the stocks weren’t falling I suppose the stocks part get sold. or not? How do you decide?

I’m not FIREd yet, but my plan is:

- 20% Pension

- 30% Real estate income

- 50% Investment portfolio income (or manufactured income from sales)

Real estate income gets used up first, then the portfolio income. If I use less than the income generated, then it stays in portfolio and re-invested and compounds. If I need more, I sell part of the portfolio.

From your portfolio income, how do you sell? If it’s 60/40, do you sell 60/40 or you might check how the market is going? If is tanking, would you sell more of the “stable” part ?

My strategy would be to normally sell shares of one asset each month to cover my expenses and choose the asset in such a way that it brings the portfolio closer to the strategic asset allocation. I.e., nudge the portfolio towards the desired balance.

Additionally, when assets are significantly out of balance (trigger points should be defined beforehand), rebalance it independent of withdrawals.

Right now I haven’t really thought it through in that detail. I do so much tinkering with the portfolio, it doesn’t matter.

But I hope in retirement, I will chill out and leave it to be purely mechanistic, in which case, I will freeze the proportions of the components and set it up to automatically re-balance twice a year. Then I’d just sell from the short term bond component and let it re-balance automatically.

Actually 11 years since FU day. I started a dividend portfolio from which I take out money whenever I need it. 2020 I started a second strategy, a momentum portfolio.

I own real estate for my own use, so I only invest in stocks. No bonds, no money funds, just stocks. Over the long term this is best if you can stand the volatility. Check my mechanical investment thread for details. I always have short positions in CHF, USD and EUR of at least the cash I hold in my bank accounts. Cash is trash.

I always take out the money I need more or less for one year, EUR, CHF and USD. I take it out on credit and then cover the debt with the natural flow of the portfolio (sales, dividends and “market dividends”). I always thought that selling stock just because I need money is a bad reason.

Well, selling stocks is just the same as not reinvesting dividends. If you then tilt the stock portfolio to non-dividend stocks (in order to optimize Swiss taxes), then you have to manufacture the dividends yourself.

Did someone show the real difference in taxes for Acc and Div funds? You pay taxes on virtual dividends on Acc funds, so I was wondering what’s the difference (maybe vs. time and cost of selling)

There are stocks that pay no/low dividends e.g. BRK. and ETFs like BOXX which are designed to avoid producing taxable income.

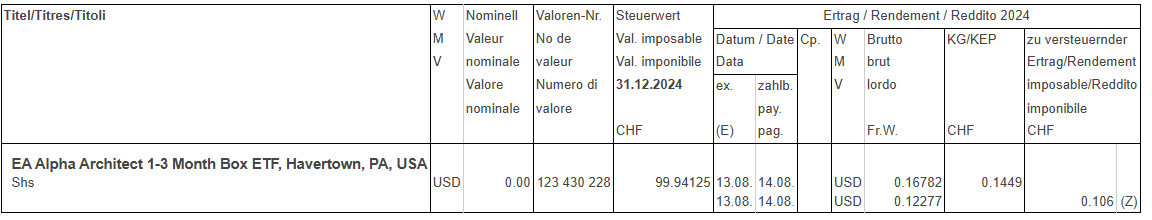

BOXX is the core of my T-BILL equivalent (replacing BIL).

That’s basically ~0 taxes, there was a tiny technical redistribution (the return was 4-5%, the taxable return is 0.1%)

I am intrigued by this BOXX that many mention but I totally not understand.

I’m not even sure the distribution was taxable anyway (IIRC, it was the distribution of a capital gain).

Per ictax there was a taxable distribution, check the screenshot. (only ~half of it was taxable).

BOXX is an ETF that tries to give you T-Bill like returns but instead of buying T-bills, it uses box spreads to synthetically create a similar return. Since these are non-taxable, it has a tax advantages where capital gains are taxed favourably vs income.

How does the risk differ from real T-bills?

Yes

Thought so

Give this a listen

Please add a summary: some of us can’t listen to it.