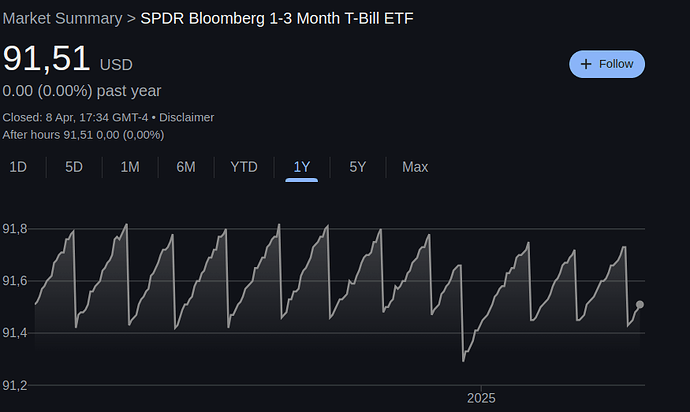

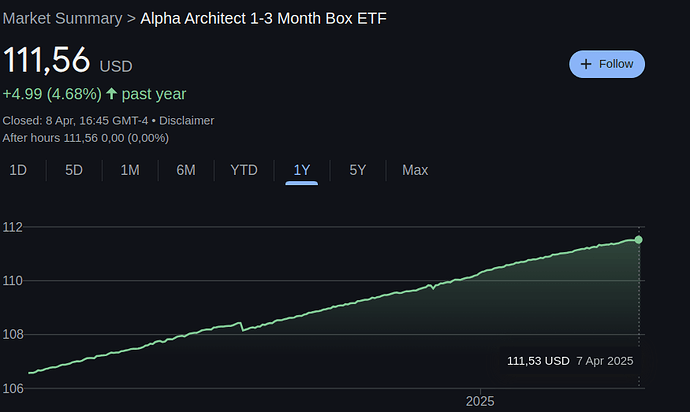

If you can’t listen to it, use the magic of google to arrive at a summary on how Wes Gray and his team at Alpha Architect / ETF Architect do the thing they do. ![]()

So I listened to it and I guess I just don’t grasp enough basics concepts: When they started talking about puts and options I got lost. But I heard something like “we don’t talk about taxes” with a reference to Fight Club but also that the guy lives in Puerto Rico so that he pays a lot less taxes than it’d have to in the USA…

So I buy this ETF, it’ll act like an accumulating fund and grow similarly to a T-bill but when I’ll do the tax declaration I’ll pay zero taxes? In the podcast they talked about taxes being only deferred but I guess they referred to the US tax system and here, without capital gain tax, people just don’t pay them?

You pay the taxes I mentioned above. ridicously slow.

In essence yes, the tax is meant to be minimal as it apparently counts as capital gains. I looked at it a lot at some point but balked at the idea of having anything to do with US govt debt, plus the fact it’s in USD which is not a currency I use or foresee using and on a losing trajectory vs the currency I do use and foresee using (CHF, EUR).

I was thinking to exxchange back the dividends I got from VT since I don’t want to invest atm, but instead I bought some boxes. If it was for this week, I should have exchanged it back to CHF but now it’s probably too late for that.

Not retired yet but here is my current plan that I am building towards

Annuity and pillar 1-type pensions to cover 1/3 expenses

1 year expense in cash

+5-7 years expenses in 50:50 mix of short term bonds and USD MM accounts

+Rest in EFTs, reinvest dividends.

Not a fan of dividend stock, is imv false sense of security. In downmarket, stock prices AND dividends will have major hits. Just wait and see fallout from current mess

In years with positive EFT returns, replenish from EFTs by selling 1-2 times. Roll bonds and MM funds over to extend safety net

In years with negative growth, use bonds/MM and replenish those once market recovers

Which products are you using?

Exact products yet to decide, this is where I will use pillar 2a funds, once free‘d up (i view this as my bonds part of portfolio currently)

There are USD MM funds in CH, offered by UBS for example

On bonds I am thinking building a 5 year ladder, US gov bonds

90% FIREd and apologies to those who have heard me preach my gospel before (do yourself a favor and just skip this post):

-

no real plan (apart from having planned yearly cash flows several decades out)

-

we just live off the cash flow generated and as cash flow reliably distributed by The Portfolio

- converted roughly monthly at the custodian bank(s) into CHF when necessary and moved to the Raiffeisen bank / account where we do our bills

- overflow cash flow gets invested (mostly into stock picks)

-

cash flow consists of

- about 15% bond distributions

- the rest is (mostly)* dividends from equity

- equity cash flow portion can be further divided into 3/4 from stocks picked and the rest from equity ETFs

-

tax optimizing strategies via BOXX other other schemes aren’t interesting to me as I don’t want to sell cash (equivalents) and – as a

staunch communistsocial democrat, centrist (like fellow forum member @Mirager) I’m fine with paying the taxes on the dividends.**

* Plus a tiny bit from premiums collected via Cash Secured Puts.

** Censored, because too political Yes, I get it: the dividends have already been taxed. Do I have enough? Yes. Do others in my community have enough? No.

Yadda yadda ya.