Spending 100k-120k/y still seems very feasible (to me) with 2150k assets at age 50 and another 850k to 1000k (or more, with tax sheltered payouts) starting at age 60.[∑]

Here is how I would invest the money (at FIRE/50, or maybe before, YMMV):

- decide for yourself whether you can live with FX risk (don’t hedge, though, IMO)

- pick suitable dividend and/or dividend growth ETFs

- enjoy the cash flow they generate

– fin –

- optional: put together your own “ETF” of dividend payers and/or dividend growers based on your personal preferences[$]

I.e.:

- No★ FX risk, just ETFs: pile into CHDVD and equivalents (MSCI Switzerland IMI Dividend ESG, etc).

- FX risk, just ETFs: I believe there’s topics in this forum that discuss some of these ETFs (Monkey-brain ETFs: Dividend ETFs - Investing / Portfolios - Mustachian Post Community)

- No★ FX risk, hand-picked companies: I’ll share a more detailed recipe below under “Cash Flow Picking” below.

- FX risk, hand-picked companies: I’ll share a more detailed recipe below, see Cash Flow Picking.

The great thing about the ETF approach is that they – for a small fee – have already picked (some of) the most suitable companies for you (for an approach of living off the dividends). The (IMO) sad thing is that you’ll also pile money into businesses that IMO are just … well, turds.

Stock Cash Flow Picking

- Pick your ETFs depending on your level of risk you’re willing to take with FX.

- Use the companies in those ETFs (or just that one ETF) as your universe.

- Pick the companies you like. Allocate according to mechanical rules or your personal preferences.

– fin –

- optional: once you feel comfortable, add other companies not in the holdings of your ETF(s) to your universe.

E.g. let’s say you’ve settled on CHDVD as your ETF (aka “no” FX risk, just the ETF’s universe).

Your universe is now (as of August 1 2025):

- ZURN

- NOVN

- ROG

- NESN

- SREN

- SLHN

- HOLN

- PGHN

- SCMN

- SGSN

- KNIN

- CHF (cash)

- GALE

- BARN

- BUCN

- LAND

- EFGN

- CLN

- DKSH

- BCHN

- SRAIL

- F-GSI (cash collateral … don’t really understand this. We anyhow won’t invest in this)

- GBP (cash)

- SMU5 (futures)

Analyze these companies with your favorite tool and pick the ones you like based on your criteria.

and pick the ones you like based on your criteria.

I would look for a history of consistent earnings and dividend growth and from the universe above pick:

- ZURN: has grown or at least kept steady their dividend since the Great Financial Crisis (GFC), nice almost 5% yield, earnings keep growing since the GFC. Excellent credit rating (S&P: AA), just 25% long term debt to capital.

FASTgraph:

- NOVN: has consistently grown their dividend for the past 20 years, 3.7% yield. Great credit rating (S&P: AA-). About 33% long term debt to capital, which is fine.

FASTgraph:

- ROG: 3.8% yield. AA credit rating. Otherwise see my NOVN comment.

FASTgraph:

- NESN: No debt? 4.28% yield. AA- rating. Much like the above.

FASTgraphs:

- SREN: This one’s a little more iffy. Their dividend history is a little volatile, but I still like their credit rating and their low level of debt. Nice 4% yield.

Maybe a smaller sized position.

FASTgraph:

- SLHN: Yup, looks fine. A bit overvalued right now. For your purposes: certainly part of the “ETF”, maybe buy into it underweight and add positions as their valuation comes down again.

FASTgraph:

- HOLN: pass for now. Somewhat inconsistent dividend history, definitely overvalued currently.

Add to the “ETF” when valuations are more sane and if the dividend keeps growing.

FASTgraph:

- PGHN: probably a pass for now. Overvalued. Payout ratio seems really high (does not look better when looking at Operating Cash Flow or Free Cash Flow).

There’s more attractive brides/grooms out there IMO …

FASTgraph:

- SCMN: this is essentially a bond. If you want a bond, add it to the portfolio, if not, avoid it.

Goofy would not put this into his “ETF” as the dividend payouts won’t grow (they’re expected to grow in the next couple of years, but look at the last 20 years: mostly Flatliners™).

FASTgraph:

- SGSN: Nah, worse than above.

FASTgraph:

- KNIN: Cyclical in earnings as well as in dividends. Maybe consider it if you don’t mind income fluctuations. Currently (and, mostly, over the past 20 years) overvalued anyhow, despite its (IMO) anemic growth.

Actually, having said this, I’d stay away from it unless it was severely undervalued.

FASTgraph:

- GALE: Currently overvalued, otherwise meh-dividend growth history, relatively low yield, relatively high payout ratio. Pass.

FASTgraph:

- BARN: Earnings growth is too low, so is dividend growth. Pass.

FASTgraph:

- BUCN: Cyclical, not enough growth for me, but if you want a bond like investment that is cyclical … ok, ok, I’ll stop here. Pass.

FASTgraph:

- LAND: No. PoS.

FASTgraph:

- EFGN: They’re probably fairly valued right now, but nothing that attracts me really.

FASTgraph:

- CLN: No. Do you want a volatile non-growing business / bond with a low yield? This is for you!

(Pass)

FASTgraph:

- DKSH: Actually, I’ve seen worse. Steady earnings and dividend growth, slightly overvalued.

Goofy would add this company to his portfolio if it became a little cheaper.

FASTgraph:

- BCHN: Posterchild of the Swiss (export) industry. Kind of like them for their story (specialty vacuum pumps IIRC), but their earnings and dividend track record is kind of shite.

They’re also severly overvalued. Pass.

FASTgraph:

- SRAIL: What the actual … nope. The CEO is a “posterchild” Swiss billionaire CEO, but IMO he can keep his company to himself. Thank you very much.

FASTgraph:

The selection above is admittedly a little on the low end in terms of diversification. This gets much better if you expand on your FX risk willingness as your universe of companies to pick from will just explode to the point where there’s almost too many companies to pick from.

Good luck, be well and invest well!

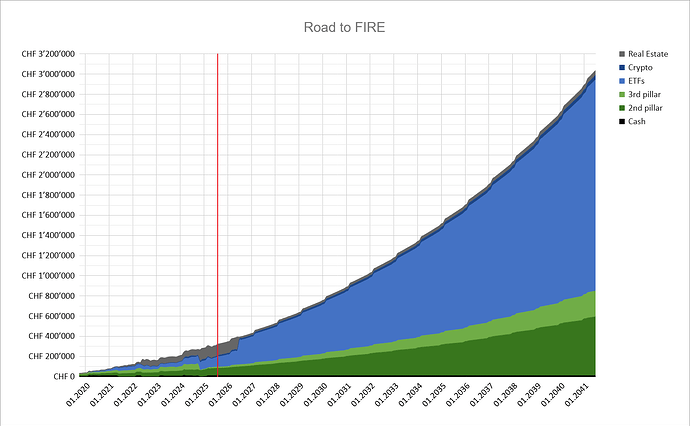

∑ For comparison, we – as a family – have fired on about CHF 3M (USD 4M) with some residual income piling in and I feel no anxiety at all. Yearly expenses clock in at about CHF 180k, another CHF 2M are coming in in pillars 2 and 3a with the first 3a 100k withdrawal this year.

$ This can be a partial (and possibly growing) replacement of your ETFs depending on how comfortable you feel with picking stocks.

Maybe to soften the tone since active investing has such a bad reputation: you’re picking the companies you want steady and ideally payed out cash flows from versus picking the stocks that will the highest total return over your timeline.

I personally strongly believe the former is easy while the latter is really hard.

As you mention yourself (and apparently suggested by @xerox5003: it’s the opposite when you’ve FIRED – it’s incredibly easy to live off those steady cash flows coming in via interest payments and mostly steady and growing dividends, while i’s hard(er) to do this from cash flows with realized capital gains.

★ Well, you won’t ever have no FX risk – unless you invest in your town’s local bakery (well, even that bakery is probably exposed to FX risks via commodity exposure via grains/flour). Plus most liquid and listed Swiss companies are probably exposed to FX risks. Some very significantly. Anyway …

Crystal ball, Bloomberg, tarot, Wall Street Journal, tea-leaf reading, FASTgraphs, hepatoscopie (please consult with @Mirager on this), analyst ratings, company 10-K reports, you name it.

Crystal ball, Bloomberg, tarot, Wall Street Journal, tea-leaf reading, FASTgraphs, hepatoscopie (please consult with @Mirager on this), analyst ratings, company 10-K reports, you name it.