This probably refers to the form R-US164, in which case it’s applicable only to stocks/etfs paying distributions, held at a swiss broker and domiciled in the USA

I also understand so

Oh that sounds easy, have to try this out at home to see what PDF output I’ll get and if there is a DA-1 form included.

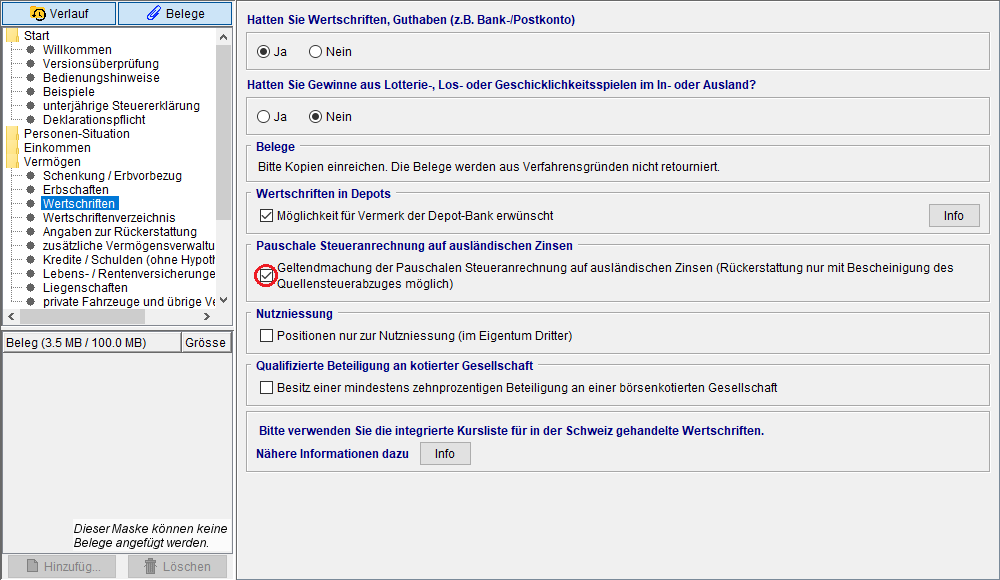

Why don’t you click the box “mit zusätzlichem Steuerrückbehalt USA”? It says “with additional tax withholding USA”? Isn’t that the case?

It’s only if you have a swiss broker (clicking this box when it doesn’t apply seems to be the most common DA-1 rejection)

@Mik34

@nabalzbhf

Thank you very much for your contributions. I couldn’t apply for DA-1 because I didn’t cross the required amount, but I will do it for sure in 2022.

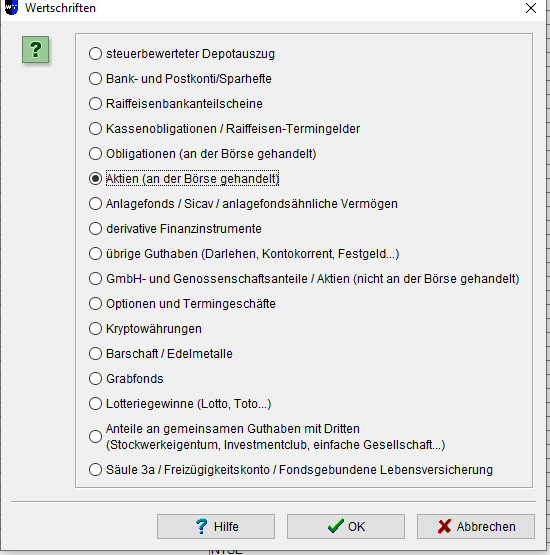

Here is what they told me: To retrieve part of dividend withheld in US for US based funds, bought via IB for example for funds below, you need to choose in Easy Tax:

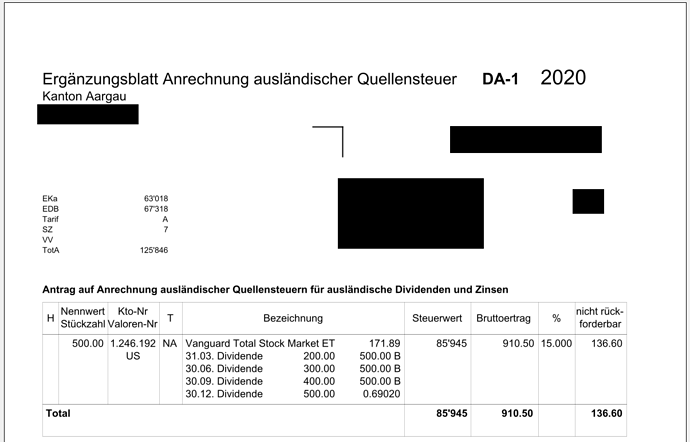

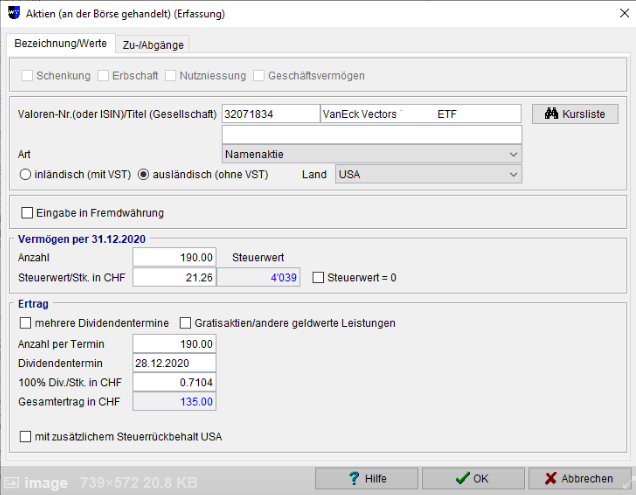

then you fill out manually like below:

Also she said me that no need to fill out DA-1 manually after all it should come out of Easy Tax at some point, how I haven’t figure out yet.

Oh man, I wish I had seen this before filing it manually. Next time. Thanks!

I click this box right?

Chose Aktien/shares and then enter it like that?

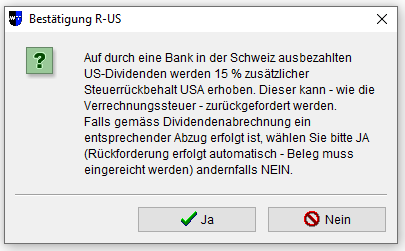

Then I chose NEIN/no so that the box “mit zusärtzlichem Steuerrückbehalt USA” won’t be selected. This way a DA-1 form is included in the tax declaration. If you chose JA/yes, then you’ll end up with a RUS form which is wrong?

DA-1 for US dividends from US brokers and RUS for US dividends from Swiss brokers?

I got this at the end of my tax declaration (I increased the dividends for this example because otherwise I wouldn’t be above the required 100 CHF). So it actually works!

Yes, I checked mine, I did the same. Will handle in it today. Fingers crossed

Thank you for updating us in the future!

Thanks to this thread I managed to do it right this time. Everything in DA-1 showing now.

Is there anything special required from the IBKR output?

Actually, last year I did it for the first time all online (Zurich) and did not have to send anything separately for DA-1. Can someone confirm that I have done right?

How do you see if you got a refund?

Past years I got a letter in the mailbox 1-2 months after filing and soon after the money was in my account. Haven’t got anything yet for 2021, I only filed end of November but I suddenly got worried that I might have missed something.

So it’s not just a reduction in taxes but an actual seperate refund?

Yes, I receive money in my bank account a few months later.

it’s the 15% tax that the US withheld on your dividends

I know but I assumed that they will just subtract it from the taxes that you need to pay. An actual refund on your account sounds great, so you know if it worked.

Actually, the DA-1 refund takes a couple of weeks. The processing of the tax declaration takes about a year. (ZH)

Yes, since tax year 2020 there is no need to separately print and send DA-1 anymore, if you use ZHprivateTax online. I filed my taxes in February and got the DA-1 refund in June.