That‘s also the case in Bern.

Also in Aargau. But only reason that it is not more than 100 is because it does not flag ETFs for DA-1. I think that I have to fill it out manually for whatever reason as the software is not set correctly to work with ETFs.

Then you will find an answer to most of your questions in there.

- The description of assets is in ictax

- Bruttoertrag is in ictax

As for DA-1 you don’t need to list all transactions, just the year-end tax value and total dividend by position.

Also in Aargau.

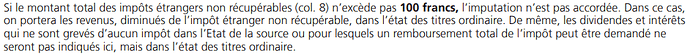

It’s the same all over Switzerland, as stated in the form from the estv website:

But only reason that it is not more than 100 is because it does not flag ETFs for DA-1.

By the way, that’s somewhat expected, until recently ictax didn’t mark the dividend as eligible for most US funds. It’s possible Aargau is using an older version of the ictax database.

As for DA-1 you don’t need to list all transactions, just the year-end tax value and total dividend by position.

Perfect! Thanks a lot. You just saved me 700 francs for going with a tax filer because I was thinking of giving up. Beer (or wine) on me if there is ever an opportunity ![]()

So how does the DA-1 thing work in AG? As I was below 100 CHF I didn’t mind. I just entered my IBKR positions with their 31.12.2020 value and entered the shares I had on each dividend payout.

I guess you have to fill out the form manually if you are like me and mainly have invested in ETFs. I will report back how it works out.

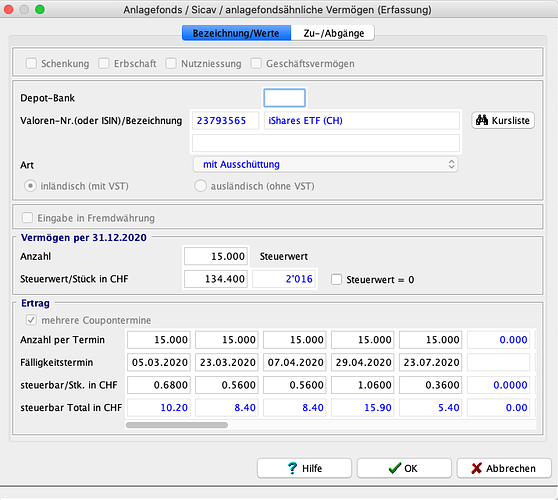

I’m in aargau, filling my taxes, and for the first time adding the small investment i made last year (first time ever). the easytax software made some magic here that i don’t know what it’s about. can someone explain?

Thanks

can someone explain?

What’s the question?

first why they are splitted in chunks? then, hoping is everything right, it asks me something in the end like this that i did not get it.

anyway this seems rights, numbers are similar to my degiro document.

but then i’ve tryed with the VANGUARD FTSE AW IE00B3RBWM25 but it does not seems working properly. it seems selecting the US version with different numbers, while I bought the EU version.

splitted in chunks

It gives you the detail of each individual distribution if you refer to the multiple columns at the bottom of your first screenshot.

i’ve tryed with the VANGUARD FTSE AW IE00B3RBWM25 but it does not seems working properly. it seems selecting the US version with different numbers, while I bought the EU version

Afaik there’s no “US version” of VWRL, it’s just traded in different currencies but for tax purpose it doesn’t matter.

If you have a doubt you can compare the values in your tax software with the ictax official rates here:

https://www.ictax.admin.ch/extern/en.html#/security/IE00B3RBWM25/20201231

Thanks, so i guess everything is fine.

Nice tool, more advanced than the one used in TI.

Only thing you have to check is that you were the owner of those stocks in the stated number for the whole period, otherwise you would be taxed on more dividends than the reality. But this you can verify quickly also by comparing the broker’s statement with the software outcome.

2nd tab is how much you bought/sold on which date. I don’t enter every month, I just make sure that the amounts are correct before each dividend payout.

I thought it’s 3 promille, not 3 %

Hey guys,I am filling the taxes. I have some questions for the fellow Aargauers.

- Does any of you report the fee of 0.03% as the broker cost? Is this is a fixed amount? Do you need proof? So you cannot really deduct it (I have IBKR) since it has no custody fees? Right?

- Can you deduct, donations of up to 300chf per year like in other cantons for street donations? I only found donations for specific institutes. If yes, how much are you allowed to deduct and how do you write it?

- Somebody referred to 500chf for work related expenses. I guess this is already covered in the pauschal deduction 2-4k per year?

- any other deductions? like the bike deduction? Or anything else canton specific?

- You can’t just deduct 0.3% for Vermögensverwaltung like our ZH neighbors. Need proof for all the costs.

- You need proofs for all donations, I think.

- I always just use defaults for work deductions.

- CHF 700 for bike works everywhere, I believe.