I’m jumping in because I will soon receive a sum of money and my idea is to lump sum half of it and DCA the remaining half in around 12 months.

I would like to earn a bit of interest on the amount I will DCA and I’m asking myself which currency should I hold.

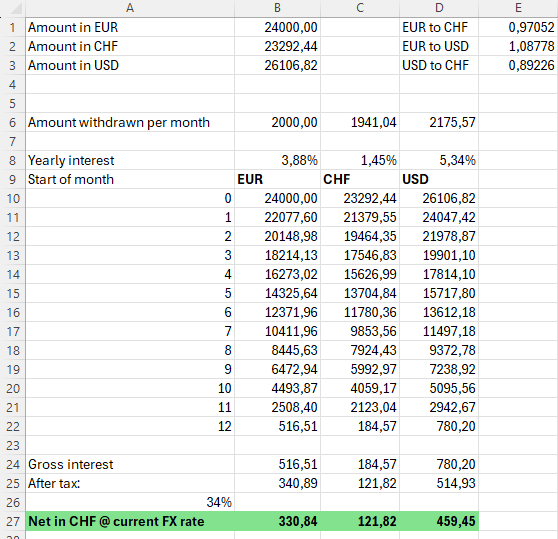

At the moment, these are the different options for short term gains:

- EUR: buy XEON, get 3.88% (discussed here)

- CHF: buy LU0128498697, get 1.45% (discussed here)

- USD: buy BOXX, get 5.34% (discussed here)

Let’s image to start with 24’000 EUR, I was expecting that the final amount (in any currency) would be always the same, because of the currencies being efficient.

That’s what I learnt from this forum: if USD is returning 5.34% it also means that it is losing value agains CHF (which is returning only 1.45%). So, in the end, the only difference between short term investing USD or CHF will be taxes.

I ran a simulation on Excel and what I found is contradicting the above statement:

I start from 24’000 EUR, that are converted using yesterday’s FX rates and then invested. During 12 months I DCA and at the end I pay taxes. Finally I convert everything to CHF.*

Surely there is something wrong in all this. Because if it was like that, today I could buy 1000 USD with 890 CHF, make it compound at 5.34% and convert it back to CHF earning more money than what I would make sticking to CHF only. ![]()

*I know in 12 months the FX rate will be different, but not that different that 121 CHF will be equal to 514 USD!