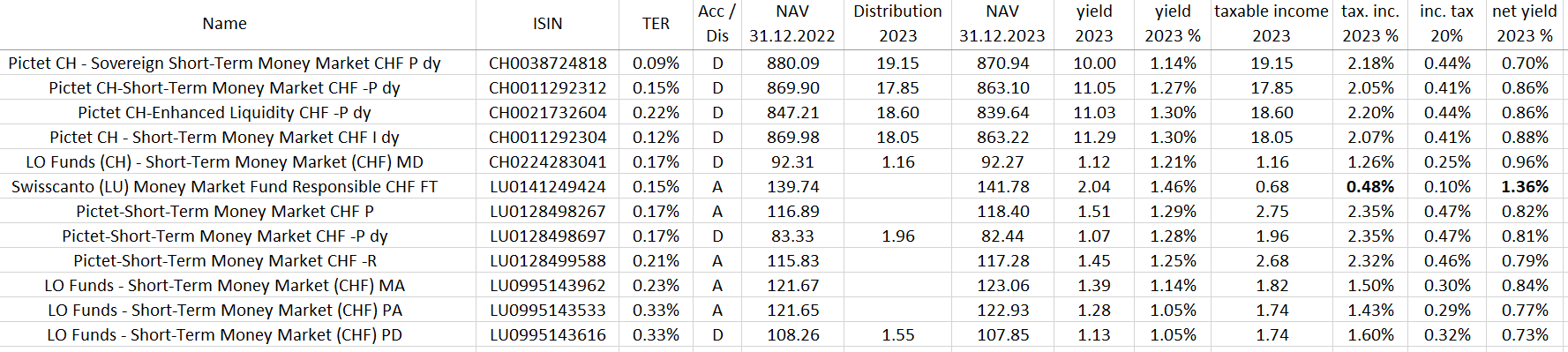

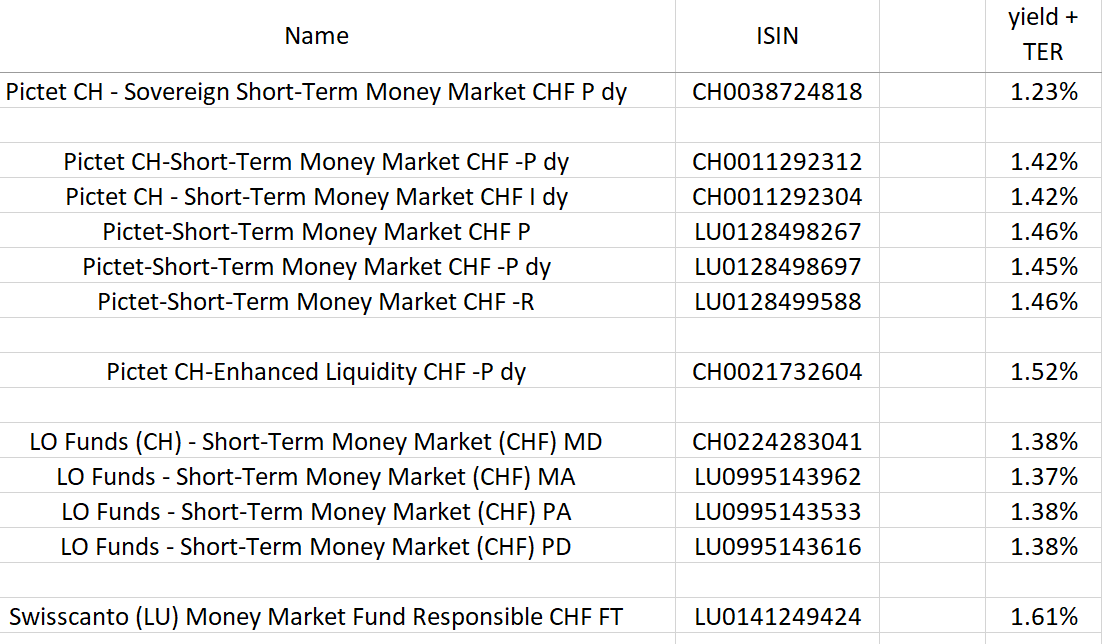

It looks like that the pre-tax yield is more or less the same for the same level of risk or, which is the same, what kind of instruments they are buying. Yes, MMF also have risks:

Here you can see it well with Pictet funds: “Sovereign Short-Term Money Market”, which I would say carry the lowest risk (95% of holdings are AAA), has the lowest gross yield, mixed but conservative “Short-Term Money Market” is the second, more risky “Enhanced Liquidity” is the second. LO funds are the same as the second level Pictet fund.

I don’t know what exactly Swisscanto is doing, but the investing policy of this fund is different:

Each sub-fund invests 100% of its net assets in instruments within the meaning of the MMFs Regulation, where at least 80% of these are denominated in the currency indicated in the sub-fund’s name.

The problem with other funds that they invest in debt in other currencies and then hedge it. So they “earn” more in taxable coupons but lose on non-tax-deductible loses in FX swaps. This is what I suspected, @nabalzbhf

As Swisscanto invest mostly in Swiss debt, maybe there are just less defaults?

All in all, I again think that MMF in CHF is not a good investment for individuals and one would do better with savings account up to 100k limit. I mean, their goal is not to get the best yield for retail investors. MMFs is a liquidity management tool for institutions, they were buying them when the yield was -0.75% and they didn’t care.