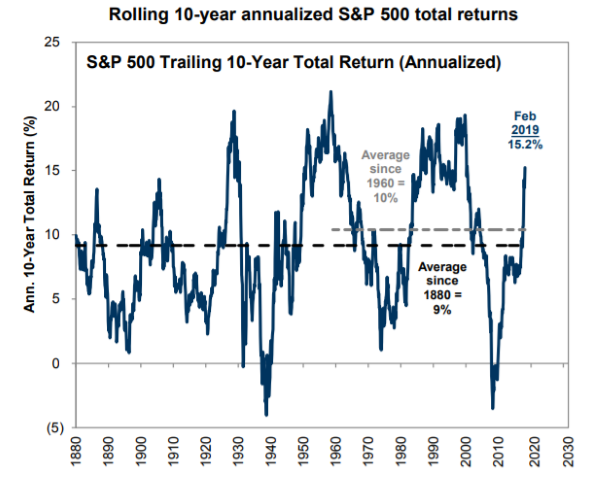

I find that when comparing return of two different products over time, it’s useful to use the annualized 10-year trailing return. For S&P 500 it looks this this, for NASDAQ I couldn’t find any.

Domino Pizza outperformed AAPL, AMZN, GOOG over the last 11 years.

Stock price is mainly determined by expectation of future returns, not growth of companies.

So tech may continue to grow but stock prices may still fall if that growth is smaller than expected.

Thousands of various stocks outperformed those over 10 years, this is hardly a valid proof. Let’s talk sectors.

My point is that the same reasoning is applicable to sector performance. You can’t just look at which sector has performed the best the last 10,20 or 30 years and assume it will be the same for the next 10, 20 or 30 years.

HmL and BmS have a solid foundation that holds across different epochs and different regions.

You can easily assume that tech as a factor outperformed other sectors historically and this will be of equal merit.

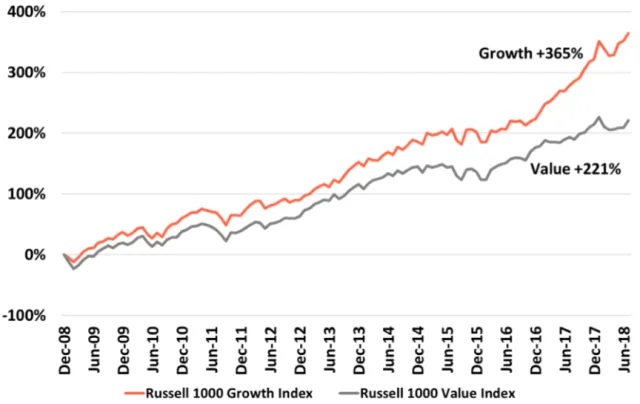

Just spend a minute to calculate the compounded opportunity cost of investing in value over the last 10 years:

It will take quite a while to reverse, if it ever will.

Either invest in VT, or overweight what works now, instead of hoping that past will repeat itself.

How do I know what “works now”? How will it perform in the next 25 years?

Well… make some bets, take some guesess.

Unless you really believe in one-click solution to outperformance, then buy hml and smb.

It is normal for factors to be negative for some time. That doesn’t change the positive expected return of them.

Investing in what worked well the past 10 years is a very bad way to make your investment decisions, you most likely invest based on random noise and don’t have a solid foundation for it.

DFAs US Small cap value fund returned 10.68% after fees(0.52%) since inception in 1993, SP500 is 9.8%. So before fees it outperformed by 1.4%.

Value and small caps underperformed in the last 10 years, especially in the last 2 years. Seems like a great time to buy it now because it looks pretty cheap.

Believe me, you are not the only one who knows about the French-Fama thesis. Don’t think you can outsmart the market with such basic knowledge.

No need to outsmart it. Value and size are risk-based premiums. Similiar to equities having higher expected returns than bonds due to higher volatility.

Btw, the recent underperformance is part of that risk. If value and size would never underperform in 10-20 years periods, there wouldn’t be any risk and no premium to begin with.

There are other factors other than size and value. Why exactly are you focused so badly on the two which happen to underperform currently? Are you really hoping to time it so perfectly that future growth will offset the lost opportunities?

The recent underperformance is part of that risk. If value and size would never underperform in 10-20 years periods, there wouldn’t be any risk and no premium to begin with. Why value and size? Because value, size and market risk explain 90% of the performance difference in portfolios and are well documented for the last 90 years.

Momentum and other factors aren’t really convinging because there are behavioral aspects in those factors and it’s not really risk-based.

Academics don’t make good investors. This is probably why Keynes went bankrupt.

The most proven solution to outperformance is betting on long term winners and it absolutely doesn’t matter in what basket of artificially defined factors do they happen to fall into, although it does help if you buy the winners at a cheap price (Buffett style).

Buffet outperformed the market because he had a overweight in small and value stocks.

Keynes went bankrupt? Oh this is gold ![]() I had no idea. I googled and found this quote:

I had no idea. I googled and found this quote:

He was a financial genius whose ideas dominated western economic policymaking for 50 years but he came perilously close to bankruptcy

I guess you could also say about Justin Bieber that he is a music genius, whose hits dominated the charts for a good part of the 2010s…

If Buffett had an overweight on Small Cap Value he would have outperformed by 0.5% and you would know him by the name of “average Joe”.

He made good bets (deviated from the index) at good price points (timed the market). That’s all there is to it.

What the hell are you talking about? SCV outperformed the market way more than 0.5%.

Read this.

https://www.msci.com/documents/10199/9f8cadb3-5923-442d-96d1-7434b6593416

0.88%/y since 1994 before fees. I’m pretty much spot on with 0.5% ![]()

You are looking at just one period where the last 10 years small caps and value underperformed. Read the damn paper or stop posting bullshit.