Ex-US, US domicile is on average a little better than IE actually, but only if you get the DA-1 refund of course. Japan, Canada and Switzerland are a lot better for US funds. And they make up a big part of ex-US market cap.

So if the DA-1 refund gets denied e.g. VWRL will be superior compared to VT? So I lose 15% of dividends instead of 9-13%?

If you cant get a refund with da-1, vwrl is better yes.

You have a double tax layer with VT otherwise. (0% L1)15%(L2) on US stocks and ~10% (L1) on ex-US x ANOTHER 15%(L2) only on the ex-US part.

Ooverall probably something like ~20% of the total dividends, compared to ~12% (L1, L2 is 0%) of VWRL (just quick math in my head)

Many thanks for the detailed comparison. I will revisit when it actually gets denied (signed a mortgage contract this year). But considering the estate tax and this double taxation drag I am not that convinced of US domiciled ETFs anymore.

I started investing into VT and CHSPI (80/20%) a couple of months ago (lump sum + monthly payments) after reading everything I could on the topic (but this thread…). Reading the above, I realise with a mortgage it might be problematic to recover the 15% WHT for VT through the DA-1 form because I will already deduct the interests for my taxes or I would only recover the WHT partially.

My question is:

- When taking into consideration the costs difference of VT and VWRL, the dividend gap, the yield, and the fact I invest monthly with Swiss Francs that I need to convert in Dollars on IBKR to buy VT, would I be better off with VWRL or VT ? Would investing in VTI/VXUS change anything with regard to the WHT ? I believe not but that’s not super clear to me.

Or could all this be offset in the year to come due to some parameters changing anyway.

Estate tax is not relevant for most due to the double tax treaty between the US and Switzerland, so it should not be a factor.

Am new to this and trying to wrap my head around all the parameters.

VTI VXUS would change nothing for withholding tax

But you could do VTI + the new EXUS + an emerging markets etf.

VTI without DA-1 is the same withholding tax as an ucits Ireland US etf and EXUS/emerging markets is like the ex-US portion of say VWRL.

That would have a slight TER advantage, as VTI is very cheap.

But also a little complex for not as much benefit.

I would suggest SPYI for total market including small caps (but still not yet full replication)

or FWRA (same index as VWRL, but a little cheaper) or VWRL.

So if you deduct a big mortage go with a ucits fund.

As I‘m forced to use the custody account of my employer, I was forced to fill out RUS for 2023. It actually worked and I got the 15% back this week.

But this is for US domiciled ETF right?

Yes for VTI.

What about the other 15% (the US one)

Did u receive a full reimbursement? Partial due to your mortgage interest ?

Unfortunetaly I was slightly below the CHF 100 threshold (no such limit for RUS). So no DA-1 for 2023. I‘ll be able to claim both RUS and DA-1 for 2024.

VWRL is not better than VT based on my observation over the last 3 years.

I hold both ETF, and I’m comparing the current value and adding up all received payouts to my broker accounts. IBKR for VT and a swiss broker for VWRL. Comparison in CHF.

With payouts I mean the received dividend amounts where withholding tax(es) have already been applied.

So even with no additional payout via DA-1, VT will match VWRL.

Am I missing anything here ?

We can check ictax for that:

VT:

https://www.ictax.admin.ch/extern/de.html#/security/4354003/20231231

1.897/86.59 = 2.19% dividend yield, but with withholding tax → -15% =1.86%

VWRL:

https://www.ictax.admin.ch/extern/de.html#/security/18575459/20231231

1.946/99.97 = 1.95% dividend yield, no fuether withholding taxes

So VWRL nets you 0.09% more when you get nothing back via da-1. Not that much more, but not nothing either.

The difference would be bigger, if VWRL did nit have such a high TER (0.22%) compared, as the TER is paid from the dividends.

VWRL (0.22%) has higher TER, so that’s the reason for the different you see in performance. Plus VT and VWRL don’t have same underlying stocks. VT has small caps too.

WEBG (TER 0.07%) be better alternative to VWRL if similar profile of underlying stocks is needed

As of 1 August , SPDR ACWI will also be close competition (TER 0.12%)

Thanks guys for your input. Yes, the ETFs are not identical in their composition.

TER is already included in the above mentioned values. And as stated VWRL and VT are very close in performance if you include payouts, but no DA-1 claims.

So even if you only get a fraction of the requested DA-1 claim back, you’re better of with VT in my experience.

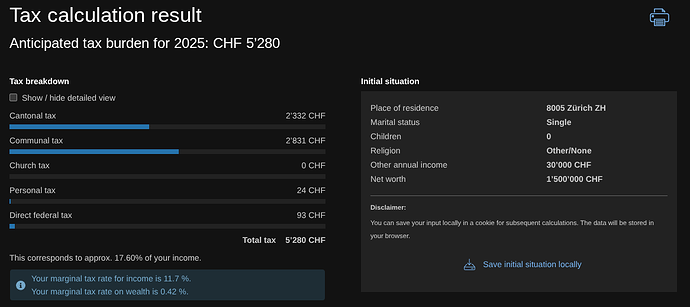

I missed a change from 2020. There is no separate reference tax rate (Anrechnungstarif) for DA-1 anymore. They now use the actual tax rates for the DA-1 calculation: Canton ZH: Changes in the flat-rate tax credit | Tabea Lorenz

Are you sure? I remember that the tax rate increases quite rapidly.

I mean in much of ZH for example, to reach a 15% average tax rate, you need an income of like 150K.

Not that many acchieve that during their peak working life, and during retirment this will be a lot lower.

Romandie probabaly half though lol.

In Zurich city a taxable income of 90k is enough for a 15% tax rate. That’s not easy to reach if you only hold VT, though, without any other income (and pillars 2/3a are irrelevant while you still have them). With 2M in VT, you might have a taxable income of 30k after wealth management deduction, and with that your tax rate would be only 6.5% (+ 0.3% wealth tax but that doesn’t count for DA-1).

If you only retire partially or have pension income (and/or invest in high dividend stocks), it would be less difficult to be at least close to a 15% tax rate, though.