I’m in a similar situation.

But I don’t want to buy more.

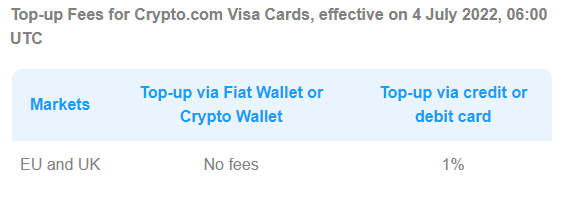

Oh gosh. They have introduced a new fee. Starting from now. ![]()

Someone is topping it up in the next days? I don’t get their language.

It’s free if you top up via Fiat Wallet but you pay if you use a CC.

I thought I topped up my Fiat Wallet with CC, so am I using both method at the same time or they really mean that the 1% applies only if you topup the card directly?

So, you are paying 1% to top up, to get 1% cashback after you stake 350€?

This just sounds like another crypto company that was offering great rewards to lure in customers but had an unsustainable business model.

Seems like sticking with the Cashback cards would have been easier and cheaper

Ok the card is definitely dead. I use revolut to top up in EUR.

Yeah pretty shitty where they went now… Funnily enough the app doesn’t work anymore on my phone since I’ve upgraded to Android 13 beta…

Anyway if someone top it up… Their language is shaky really.

Also f… them to alert us right on the day of the change.

Never been so happy to not have another Credit Card… lol

you can always use a bank transfer, but it really sucks. I guess that I will transfer some funds to my wallet and use it for the last time except to pay spottily.

Even to pay spotify/netflix etc. I will soon run out of money. It cost me 30cts p/m because of exchange rates.

How do you top up? Do you put your CC number in crypto.com? I top up with Revolut but I use it as a normal bank. You should do the same, 0 costs, but it takes 1-2 days.

Edit: I just realised this. I should have thought about it when I first post the screenshot of the email (it was pre coffee, sorry)

Bank transfer from revolut still works and is free yes. I was using the revolut CC which was also free.

Edit: unstaked and converted to btc

You can transfer EUR from Revolut using SEPA (takes few minutes for me) to the fiat account. No need for the CC.

To be honest, from all the changes, the last one is the most sensible. They get charged from credit cards, so it’s fair to ask something back.

I can confirm that revolut->crypto.com via bank transfer takes ~30min.

Back on Revolut as well. Was fun when it lasted, still a positive return for me, and still have a big bag of free CRO that I will sold when the price move up. Maybe with the World Cup. We’ll see.

Their exchange is still in good position so far compare to the overall market and bloodbath we observe, we’ll see how it play on the long run.

For anyone still in the looks fro a Crypto CC, KuCoin is offering a “Free” Credit Card with KCS rewards.

The status is “coming soon” what ever that means, might worth a shot?

Omg, now they’re going after the Netflix and Spotify discounts. Everything lower than the icy white / rose gold tier will no longer get the services for free starting January 2023. I wonder if they don’t realize that these were their unique selling points which they are killing here.

KuCard is currently supported in Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Iceland, Liechtenstein, Norway, and United Kingdom.

It seems we’ll have to wait for it here in Switzerland. Binance doesn’t offer its card to Switzerland either.

Only crypto.com that I am aware of.

Ok. It is now clear that I’ve lost 3.5k eur now.

I think I will leave the cro there and wait another 100years until I might have the whole amount back.

On a side note: someone stole my CC and I surely won’t pay them 50eur for a new one.

Shit. You had 3.5k staked in CRO to get one of the cards with netflix+spotify etc?

Keep in mind we are in a bear market now, it is supposed to go up again in some time. And contrary to most altcoins, crypto.com at least gives something. A product you can actually use. So CRO might go up again at least to recover part of those 3.5k

Yes, that is why I will leave it like this.

But:

- No Netflix

- No rebates

- No CC use (got stolen)

So I’m in a situation where I can only wait for the CRO to get up.

I suppose the platform might grow beacuse of the other shittier coins, but the CC offer is really down the drain now. I paid 0.8 I think, it is now 0.13