I was hoping they would quarantine me for having spent time in the region in Italy affected by the virus, but they didn’t ![]()

Relax, you mix up infection rate with mortality rate. Normal influenca infects and kills every year Millions of people. The mortality rate for Europe is still not confirmed - I read/heard it seems to be lower than in China and approaches values of the normal influenca.

MSCI world is down just above 10%. if it drops 40% from all time high, i go switch to QPRO, 3x leveraged SP500 xD

it just tanked 13% yesterday alone^^

Lol will do the same. UPRO will save us all, maybe even going with TQQQ.

Oh no! Now I have learned of a new dangerous thing I should hold myself from using: leveraged ETFs!

All events with >1000 people are now forbidden in Switzerland. Europe is going into lockdown mode.

My portfolio has been so lucky.

I’ve been unintentionally timing the market. Last week I sold my individual stocks in my depot at the bank and transferred them to IB in order to buy. I’ve invested around 30% of my funds so far because the other deposit took a while. Although those 30% were invested literally at the top.

I’m currently not sure how I should go about investing the other 70%… maybe DCA over a few weeks? I know that lump sum investing works out better. But I’m not really comfortable doing that in this market.

Same with my 3a cash. I had that at a bank, transferred it to Viac a few weeks ago so it’s still not invested.

I’ve been really lucky with this. And I’m extremely glad for it.

It’s quite an experiment seeing your freshly invested money going down so quickly but I’m excited to put my monthly savings rate in at discounted prices.

Luck is your best partner. Congrats on doing the right decision that were necessary to earn that luck ![]()

Damn, I did the same… Had a bad feeling but thought market timing is not good, bought at the very summit… But ready to buy more in a couple of days ![]()

my minus 40% “hope” does not look like very promising…

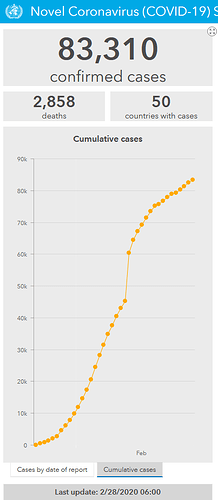

here the UN official numbers of cases lost their exponential growth already:

source Experience

Isn’t that the best thing that could happen? A solid crash at the beggining of your investing career only means you’ll be buying cheaper.

With company leverage as high as it is now, a grain of sand can make the machine stop. If a company doesn’t have debt, or better, if it has cash reserves, it can just wait out: lower income for a while, maybe no profit for 2 quarters, big deal. I mean the stock price will be impacted but it will just be a blip 10 years from now. But if you have to service debt and were counting not only on your current revenue but also future growing revenues to pay it back, these 2 quarters can litteraly kill you.

I can’t wait for Berkshire to offer 15% loans to distressed companies ![]()

Nasdaq 100 futures already 170pts up (2%) since the bottom an hour ago.

My VOO on IB shows another big fat minus in after-hour trading…

Word on the street is the official numbers are severely understated, based on side evidence like crematorium activity.

This is a bit fringy, but still:

https://www.ccn.com/billionaire-whistleblower-wuhan-coronavirus-death-toll-is-over-50000/

Unfortunately the statistic is infected by Chinese numbers, that are as reliable as their economic numbers. So the first thing to do would be to clean the data (I think I saw a few “World ex-China” charts).

Where are the long-term, rational investors hiding ![]() ?

?

I strongly believe we should stay away from unreliable sources in this discussion. We will not know the full truth anyway, so best to stay with credible sources and knowing of their potential weakness/bias.

Overall a very interesting discussion though, currently still wondering about catching the falling knife (great meme in this situation) myself.

Plus it’s an incentive to learn about valuation (of stocks or other investments).

Better to learn about what you are buying. Take your time. Read books (you can begin with the Intelligent Investor), look at various metrics (price/earnings, price/sales, dividend yield and plenty others). You find everything on the Web, with charts.