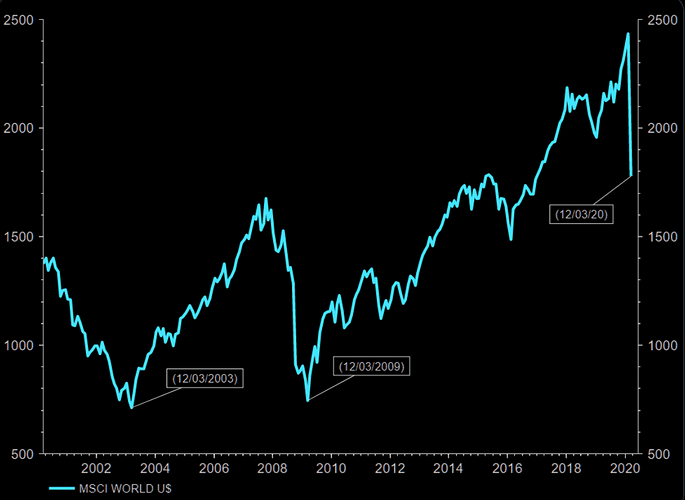

this would be the shortest bear cycle if the markets remain green next week.

This guy earns thousands of dollars at home after learning this one weird trick. Click here to find out!

Also, I guess the rest of March and April will look like this:

To answer to the title of the thread. Maybe the bottom was yesterday. Friday 13 is a lucky day.

That would be the fastest bear market in history… I mean, we are the smartphone generation, short attention span, no patience, it’s only logical that things happen faster ![]()

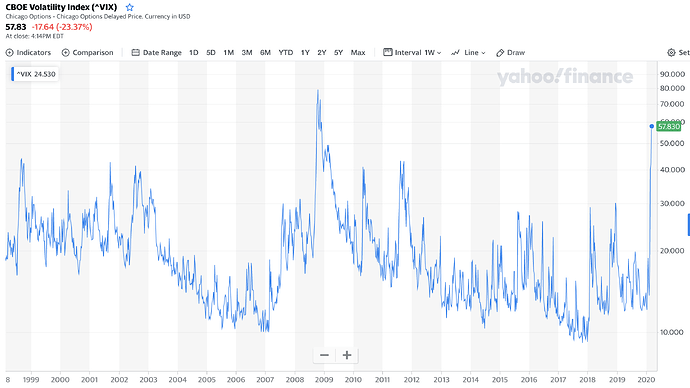

I think I’ll stay away from the market until VIX goes back under 15…

If you had shown this graph yesterday I would have gone all in ![]()

Why weren’t you all in to start with?!

I had to go deep on margin, paid off.

Ah, thanks. This is what my 74 year old father needs, who still goes to the grocery store every day to buy, like, one potato and two tomatoes that he just realized he needs really urgently.

It really is EXACTLY what he needs. Can’t you do the shopping?

Was also thinking about waiting for less volatility. But then I looked at 2008, and it took a really long time to go back to 20…

VIX dropped below 20 in January 2010, which was a good moment to get back, you wouldn’t miss out on too much of the returns.

I live in another city, I’d be in the car all the time. My brother lives close to our parents and does the shopping and leaves the groceries in front of the door, however.

It’s all excuses and self-deception. As long as he can follow his daily routine, everything is fine. Human psychology… of elderly people… ![]()

His sister recently went into full lockdown mode, though. That seems to have impressed him!

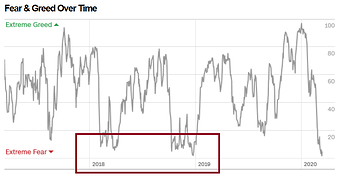

Speaking of VIX, what do you think of the CNN Fear and Greed Index?

Current situation: extreme fear!

I was just planning to buy a few shares of Adobe (ADBE) soon. Talk about bad timing - the stock soared 17% in one day today. ![]()

Otherwise the question remains though how other metropolises around the world are going to cope - and what their answer and measures will be (and of course the effect on equity markets). As this article put it:

“For those lucky enough not to be living through the Italian lockdown, pay attention: What’s happening in Milan, Florence and Rome offers a likely preview of what’s coming to New York, London or Paris in a week or two.”

It seems to jump back and forth from greed to fear. Current fear doesnt even look that special, compared to the 2-year chart

I’ve been able to buy 123 stocks of VT at price 61.99, a local minimum for the day ![]()

Stolen for my next post (credited the author) ![]()

The problem with that index’ calibration is that it bumps too easily on the “Extreme Fear” value, even on minor corrections.

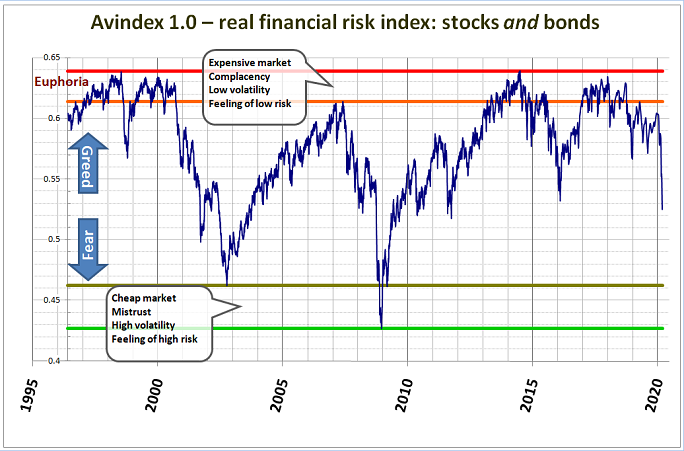

This index is better IMHO ![]() :

:

Folks I think we are still far from the bottom. Major carriers arent flying international anymore and almost all economic activities stops… And winter for the Southern hemisphere is only starting.

Keep cash - you might need it to help friends and family when their companies close etc. Plus protect your grand parents above all.

Germany already announced a bailout for any company struggling because of the virus. Same for the US, cheap credit lines for all cash strapped businesses. Switzerland pledged 1B CHF. A very soft cushon is waiting at the bottom… wherever the bottom may be.

Of course we will yet see the worst of this outbreak when it comes to our daily lives, but it doesn’t mean that the worst is still coming to the stock market. The discounts on some companies are ridiculous. This is an event which will be a thing of the past in 3-6 months time. I thought we are investing for a lifetime? How is a 3-6 month drop in sales reflected in 50%+ stock market drops for some companies?

This is panic and mispricing at its best. You don’t panic sell your shorts and flip-flops at the end of every summer because the winter is approachimg, do you?