From the articles I saw, it doesn’t look like QE, but providing liquidity to the repo market (to make sure things keep flowing if banks stop lending to each other).

Live conference of tomorrow. I expect closure of all borders by Monday next week and forced home office for everyone.

Can it possibly be worse than today? SMI -9.48% ![]()

I don’t wanna be mean but I think there’s a realistic chance that on of the big two won’t be surviving this year. I hope you don’t lose your job.

Already quit my job there by end of next month, moving to a smaller bank.

I now have a 2nd confirmation that tomorrow they will announce a state of emergency. Holy…SMI will get destroyed.

Did i read this right, is the conference tonight at 12:00?

Yes it‘s at midnight!

Just noticed my post got ‘banned’, and wanted to say I am sorry if I offended someone.

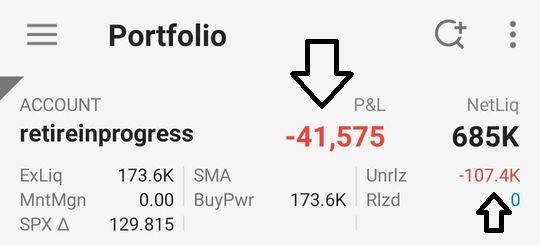

Keep strong! I am -25k in my minor IB account…UBS is better I don’t look at ![]()

![]()

I’m rebalancing my cash to stay below the esisuisse guarantee…

I am almost 100K down since the beginning of this thing ![]() at least I did not yet invest my little cash on VIAC

at least I did not yet invest my little cash on VIAC ![]()

Another day, another -10k, oh well, let’s hope this virus will be eventually over at some point before we get broke :-p

Ok. 13th pay is gone. Together with a couple of month wages…or more. I don’t want to calculate.

It’s time to buy a bit probably.

I’m too scared to check, but I think it could be a similar number for me… Often in this forum we argue about saving 10 CHF here or 50 CHF there, and then poof, comes an event like this. And I bought a big chunk right before it happened.

I think it’s important now to invest a bit to lower the overall cost and to stay in the “game”. If you know/believe it’s going down (I think everyone here believes it will go down) you might decide to wait. But until when? You might risk to see all rises as bounces and then miss your best occasion.

I am going to invest probably tomorrow or try to set a buy limit. Is it possible in the web client?

ouch. you might sell that beer instead of drinking it.

(joking next beer’s on me ![]() )

)

Also I thought you didn’t want to check your account…

I’m really almost flushed out of cash at the moment. I would be afraid to go to 100%. I bought at a really really shitty moment. And every day it looks even more terrible. I was afraid to buy before the bubble pops, and in the end that’s exactly what I did…

Just resist the feeling to sell now. We all “know” is going down again, don’t we? Maybe it’s not. Or maybe it’s going up to go back down on monday.

Really really annoying.

Uh you made me check now, 6 digits loss in a day…

I think this a perfect time to test your “risk level”

- Think long term

- Stay in the course, don’t sell, buy if possible

- This situation is good to show that a worldwide portfolio makes sense

I think the market is a bit irrational. I don’t think that 1 or 2 quarters of losses is equal to a 30% discount on the value of the company.

It can always be worse, just think of people using leverage ETF or margin