Finally. Then we can stop talking about the longest bull market in history.

Aaand limit order at 67 executed.

Instructing limit order for 100 VT shares at 66 USD per share…

They say that when the stock market drops by more than 20%, many funds treat it as a sign to sell, which can trigger even bigger drops… I waited for over a year, why didn’t I wait just a week longer…

Because don’t time the market ![]()

I’m looking forward to another 10% drop. I’m already massively underwater but the rebound will be epic when this is over!

I lost 20% of my assets in 3 weeks. I invested my bonus (1/3 of everything I saved till then) on February 20th, right at the top. It’s hard, but it’s like it is. There is no premium without the risk.

If I invested now instead of when I did, buying the same stuff, I would still have 25k to spare… ![]()

Since I made the same ‘mistake’ as you, here is what I learnt and plan for future. Next time I have a large enough pool of money and markets start to go down: start drip feed investment of 5-10% every single day. I would have 10-20 days of ‘average’ price - whatever that may be.

It might keep going down for months. I am allowing myself to catch falling knives with a few thousands a week.

Now I am wondering: the CHF has been going up recently, as usual in these downturns; what will happen though if Switzerland becomes the new Italy and infected people/deaths spike up? Would it be a good idea to sell some CHF now to buy EUR/USD? What do your crystal balls say? I might buy a few EUR.

I waited 10 years because I was too afraid I’d put in my money right at the top. Then I really started to invest in February. Glad that I didn’t go all in, but went the DCA route. Still, average price at which I bought VT is 76.87 USD. A good 10 USD more than it’d be today, but at least about 5 USD cheaper than at my first investment.

But I am not complaining, could have been far worse for me. I still have most of my savings to invest. Only question now, how much to put in at which point…

A bit more fact and data-driven reporting, with quite detailed descriptions of the analysis, if anyone interested.

Plus, stock analysts will revise their “strong buy” ratings, redraw their trend lines and invent a new story about the new target price. And a bit later pensions funds will begin to “de-risk” their portfolios by selling stocks.

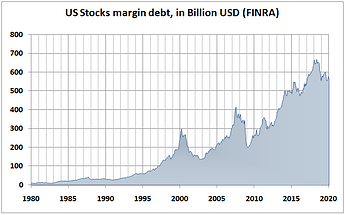

It’s strange that we haven’t seen anybody proposing to start buying on margin considering where this thread is going…

On a larger scale, it will be interesting to see how the margin debt is evolving in the next months…

![]() In fact we have:

In fact we have:

I am not convinced, that the rebound will necessarily be epic. Here is an enlightening Fintool video analyzing duration of the last few stock market crashes. In short, we may need to prepare to going downhill for 3 years, followed by 5-7 recovery years ![]()

Thanks for the plot. Could you additionally draw the growth rate (i.e. Infected[n]/Infected[n-1]) for those countries? Humans are pretty bad at estimating the slopes ![]()

Kind of amateurish, this video, if you ask me. Why are these fear-mongering prophecies always showing index graphs and not total return graphs (incl. dividends?). Why always assume we buy at the very peak and do not keep on buying as it gets cheaper?

That’s longer than the 2000 and 2008 crashes took. What is also possible is that the drops will be stopped with inflation. So nominally the indexes will go sideways for the next 10 years, but inflation will eat devalue them. This already happened in the 70s. It’s a way for the governments to melt their enormous debts.

That was my idea as well, but the data for single countries is very shaky, visually it looks like a trend, but it jumps up and down a lot. So it would need some kind of smoothing.

Those factors were omitted for the sake of simplicity, I guess. The concept of that channel is to present bite-sized 4-minute videos on a single topic. “Investments for beginners”, if you wish.

It would be interesting to see a comparison with the TR index including regular in-payments. Do you have an example, by chance?