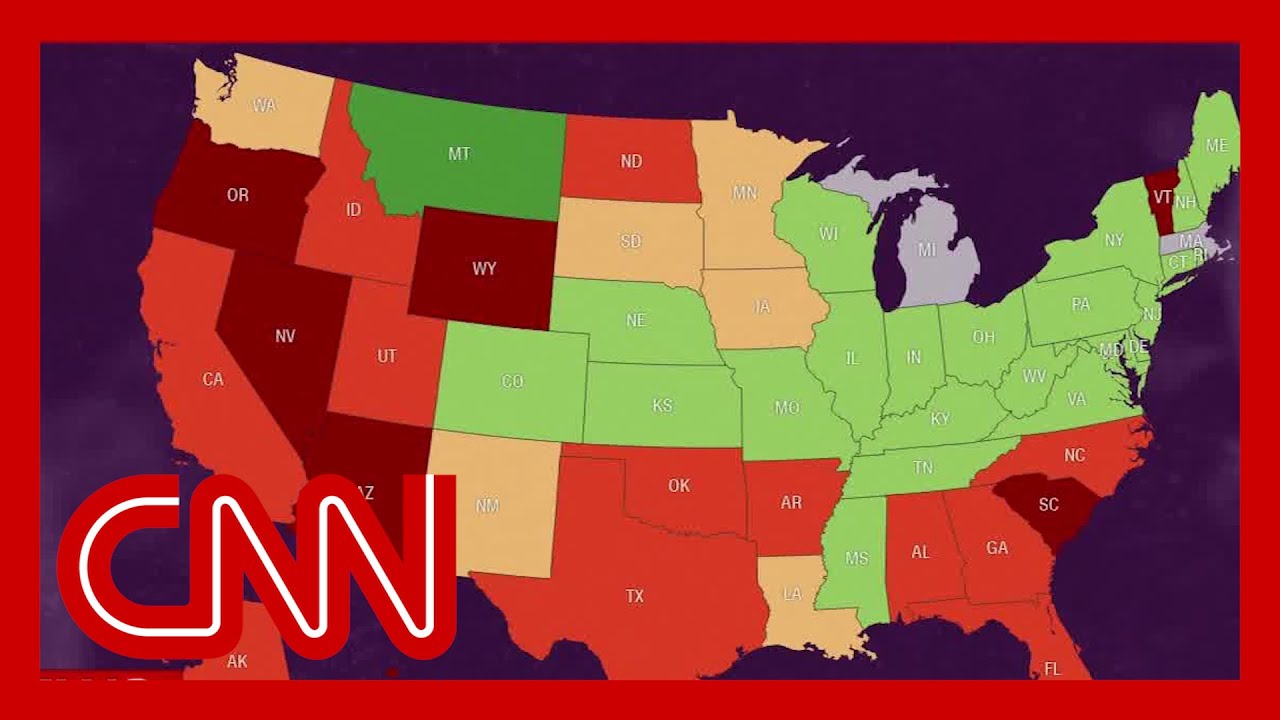

And the South and West of the USA haven’t reached their peak yet:

Sure if you are willing to accept that 0.5% of the population dies. I much prefer the test, trace isolate and quarantine approach.

Nouriel Roubini "does expect things to get better before they get worse: He foresees a slow, lackluster (i.e., “U-shaped”) economic rebound in the pandemic’s immediate aftermath. But he insists that this recovery will quickly collapse beneath the weight of the global economy’s accumulated debts"

Reading the news lately I was wondering if VT & Co are fast enough to rebalance against the US. It seems to me that they are in a very steep downwart trajectory as a country/culture. Or again the news are polarized against the idiots that lives there.

Actually I just heard in one podcast the other day that S&P500, and then subsequently ETF providers (such as State Street) were skipping/delaying the (March) rebalancing until next quarter (June), because volatility.

I guess it will be happening soon/now.

Edit: Source: Quarterly Shake-Up for World’s Biggest ETF Delayed Until June - Bloomberg

In other news - WFH ETF ![]()

https://www.bloomberg.com/news/articles/2020-04-08/-work-from-home-etf-from-direxion-will-track-world-s-new-normal

too many bloomberg’s links ![]()

IMHO the big news this week is the pledge by the Fed to support financial markets at their current levels. Even though those levels are not explicit, it sets clearly the “Fed put” at 3000 points for the S&P 500. The money flows globally, so you can also mark the levels of SMI or Euro Stoxx as new floors - IMHO again. This move is unusual in the sense that in other crises (including the Covid crash this year) they tend to set the “put level” to stop a free fall, not when indices are close to their tops (or at record levels like the Nasdaq 100). But… don’t fight the Fed.

Probably someone heard the old joke about what KPMG stands for ![]() (in German) ?

(in German) ?

interesting. offtopic though.

It’s also not given (yet) that you can’t catch it a second time, and it seems to leave quite some scars on people’s bodies, after they recover.

Swiss Covid app is out.

You might be confused by the location sharing requirement (on Android) as I was too, although they swear they don’t use it.

But here is the apparent reason why it will ask you for this “feature” of Android ![]()

https://www.bag.admin.ch/bag/en/home/krankheiten/ausbrueche-epidemien-pandemien/aktuelle-ausbrueche-epidemien/novel-cov/faq-kontakte-downloads/haeufig-gestellte-fragen.html?faq-url=/en/swisscovid-app-privacy-and-data-protection/why-does-app-android-devices-require-access-my-location-0

I thought they were using the new API which wouldn’t require accessing Bluetooth directly.

I think it’s sad that newspapers are now reporting stuff like this…

I imagine if they really want to do it seriously, then they will force Android and iOS to integrate contact tracing into their core and then everybody will have it, non-optional. All for our safety ![]()

With cases increasing dramatically in the USA, countries where it was down it goes back up (Italy Spain UK…) I think we’re in for another round. Yesterday we had a global record of new cases, record-level deaths. I think we hit the 10m mark on Sunday.

Moreover, with the summer and lifted measures, my take is that it will be much worse.

I know I shouldn’t time the market, but I will reduce my positions. We’ll see soon if I was foolish ![]()

If you know all of this, shouldn’t the market too?

The Fed has set its “put” quite high now. That what matters.

As always you have a short good answer. You got me.

I think the markets are very counter-intuitive. You see bad stuff around the corner and think you can get out in time. But in reality all of this is already accounted for in the current prices. We all know that the US is doing pretty badly compared to Europe. The question is: will it get worse than expected?

Even if you know what will happen in the future from an ecomincal standpoint, you still wouldn’t know what the markets will do. Economical facts are about the past and the present, the stock market is about the future. And nobody knows the future. So don’t try to act on it. At least that’s what I’m doing. John Bogle already said it: Don’t just do something, stand there!

If you pull out now, do you know what the worst outcome would be? Being right! This will lead to thinking that you have a good gut feeling or that you know more than others. Sometime in the future you will make the same decision and the markets will just keep rising. You’ll stay stubborn and wait to re-enter at the right price…which you might never see again in your lifetime.