Do understand what you mean and appreciate it. Our whole system we are running here is based on grow of the economy. Our own strategy here to get FIRE is based on growths of the economy. Once you have this grow - the liberals are happy because they have the flexibility to create something and the more left oriented are happy, because with the grow, they can restribute wealth to the less fortunate people and all is in balance.

But if you have now a really big bump on the street like now with a potential GDP loss of +15% and unemployement with +20-30% in Europe, this peace will not hold for long. In the US the people went demonstrating, only after a few weeks when they can’t make an apointment with the hairdresser. Our system is much more fragile that most people understand. It needs a push to get out of balance. Maybe this push starts with the touristism industry, maybe with a currency war’s, maybe with civil unrest in countries where people struggle to put food on the table.

Don’t get me wrong, I will still stick with the plan to invest money regular to my FIRE goal (there are no really alternatives), but in my opinion this fire goal went up right now several years with a heavy upcoming recession.

Side note:

Singapore was part of Malaysia until it got thrown out (!) and has been going its own way since then, as a tiny country. So much for all that sermon how necessary and vital it is for countries to join or remain in big supranational blocs or unions.

Not necessarily. Equity markets might go down or crash quickly, but provide great opportunities to invest again. They might also go down over a prolonged time and recession.

In any case, there’s always way and investment opportunities to benefit bigly from what’s going to happen. You might just have to time the market right - and/or seek out other alternative investments.

I won’t be advocating anything specific. But since you seem to have a strong conviction of what’s (most probably) going to happen (a big recession), there should be plenty of opportunities for you to counter-act on it.

The funny thing is that it was tragedy for the Singaporeans at the time, but now they outcompete the Malaysians by a mile.

I think it’s a bad advice. The reality is that nobody knows what will happen, it’s one huge known unknown based on milion of factors. So acting on convictions is basically playing a roulette.

We are not speaking about you or me or John Smith.

So you disagree that if one is the CEO of a company in the SMI then you are a public figure & you get paid enough to compensate losing a part of your privacy?

I do actually care, good manager or not, since it’s unethical. Also having a mistress at work causes jealousy, gossip & makes the CEO open to blackmail.

I’m a very small fish in a big multi-national, but when I hear the boss-of-my-boss (who is also still quite a small fish actually) flies in a female colleague literally halfway around the world, business class of course, to a few days “business meetings”, it’s abusing company money & time. Usually it doesn’t stop with that. This guy was later fired for insider trading on a M&A he was in on.

That’s often the thing, unethical usually attracts others to do similar, and then grows and grows.

This harms us small fish, employees & shareholders.

Well, what else would you suggest acting on?

Other than firmly held beliefs (convictions)?

Well, your thinking is a bit too conventional. A more ‘out of the box’ thinking would consider something like citizen A going cannibal on citizen B’s ass, like this dude here ![]()

'Murica ![]()

![]()

Slightly related… what is happening in Poland and Hungary?

Same old populist crap, when it comes to politicis. Or what would you like to know exactly? ![]()

Well I’ve read that Hungary because of covid is creating laws on the fly and started a while ago to make being gay illegal or something like that. Now they are giving more power to the president. It seems they might start not being a democracy anymore and someone said that Poland is following…

Big troubles for Bruxelles…

Can’t say I’m an expert on Poland, have not been following the news. But this weekend, the presidential elections were supposed to take place. Despite coronavirus concerns, the ruling party spearheaded the preparations. They wanted people to vote per post.

Chaos ensued, some candidates suspended their campaigns, it was a real farce. The post offices were supposed to get address details of millions of people. The data was unencrypted, handled in an amateur way. Finally, the ruling party gave up and the elections… will happen, but… nobody will vote. And then they will annul the elections and propose a new date.

In the meantime, the state television propaganda has become so blunt that it puts North Korean tv to shame and some people watch it for the lolz.

Thank you Bibi4 for pushing the most popular thread up!

The problem is that this gentleman does not have any solid argument. Yes the P/E is high and it will probably even get higher. However do not look only the P/E in a crisis for the actual quarter, look what could be the P/E in 24 month for similar shares prices. Then you understand why some fool buy at P/E 21 today.

And I begin to believe that even if the immunologic test show that only ~15% of the population got infected in the most affected areas the epidemic may well be already over. The following publication explains why in an in-homogeneous society the herd immunity is reached faster than one could think.

Happy de-confining to all.

Soo… now the market (in the form of VT) seems to be almost on par to when I started checking it.

The cat wasn’t really dead after all, isn’t it?

We’ll be able to tell only in hindsight. ![]()

Maybe this n-th life of hers is just a tad prolonged. ![]()

This recovery since March 23rd is another example why nobody knows nothing. It made my buy and hold belief even stronger.

I’m glad I didn’t start playing games.

When do we reach the bottom?

We’ll probably be able to tell you as early as next year when the bottom was. Maybe also sometime later.

What’s your strategy these days?

Stick stubbornly to my investment plans which I set up before the crisis.

My portfolio is currently – at this very moment – overall up about 20%. Comparing to the beginning of this year it’s down about 1.5% (though, again comparing to the beginning of this year, it was down as much as 15% or so in March).

The decision to invest or postpone was thus made years ago, and I’m now just following my plan.

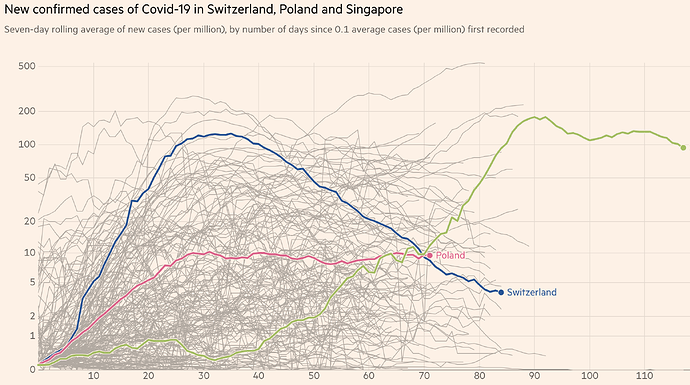

I would like to hear your thoughts on why does the situation look so different in the following countries:

- Switzerland: we’re past week 1 of softened lockdown. Restaurants and shops are open, I’ve been eating out and shopping myself and I saw huge numbers of people queueing up in front of shops in Bahnhofstrasse. But the number of new cases keeps dropping.

- Poland: it never saw such a big spike in cases as Switzerland, but the daily number of new cases has been constant since 40 days, to the point that Poland has now more new cases per capita.

- Singapore: at the beginning of this mess, Singapore has been touted as the positive example, that took the necessary steps to contain the virus. Yet, it had a second outbreak and amassed more cases per capita than Poland and Switzerland.

- Also: why did the countries of the Middle East (Qatar, Bahrain, Kuwait) and South America (Brazil, Peru, Chile) fail to stop the rise of the number of cases, even though they have been in the “race” for a long time?

These differences seem weird to me and I struggle to find good explanations.

The chart comes from this tool by FT.