Right. To share among all customers are 150 million worth of coverage.

Ohh, now I get it. Is this a joke? If their AUM is over 100 billion and the insurance covers 150 million, then I don’t see another reason for its existence than to mislead people. Like how does it work that the insurance covers 30 million per client, but 150 for all clients? This is maybe per case?

And the SIPC? You think our stocks are held under custody of IB LLC or IB UK? I read somewhere that it can actually take years until all the lawyers have done their job and they pay out this insurance.

Does this apply to US brokers as well?

And finally: what’s the best approach then? This particular broker going bust while committing fraud is a “black swan” event, but it could be pretty devastating for your life. How much is safe to be kept at a single broker? At which point should you start splitting your portfolio and over how many brokers? I guess 3 brokers should be enough? If one goes bust, you still have 2/3 of your wealth, and you should be able to recover the most of the last 1/3.

One reason for having a Swiss broker is that it may be easier to pledge your etf in exchange for a loan/less cash upfront for mortgages. That means you won’t have to sell stocks. I think a typical scenario is that you have 100k stock and they can be used as 30-40k equivalent own cash for a home purchase. You could pledge stock for an emergency loan, if you don’t want to have an emergency fund sitting somewhere idle.

As far as i know with IB you cannot do that. But again it is a very particular case.

up to $30 million (including up to $1 million for cash)

I don’t get it. Aren’t shares under our names already? Why would we need insurance in that case? Is it in case they aren’t really under our names or they’re stolen somehow? Or maybe in case the broker sells them without our consent?

BTW, any idea what the procedure is to get your shares transferred from a fail broker?

(mods, maybe we need to split this topic…)

I got my answers, thank you all for your help.

Conclusions:

- IB is a “qualified intermediary” so you pay only half the tax of the dividends (15% instead of 30%)

- All other criterias are not a game changer for me

- Having different broker accounts to manage the risk of loss through broker fail seems a good idea.

For now I will setup the CT account with the dollar-account to avoid USD-CHF conversion costs for VT dividends. In the future I will add an IB account and split the shares over this two brokers.

Under IB LLC is what they’re telling

Yes, segregation is also of course required in the US. And there’s the SIPC insurance, a concept most countries don’t have

No, under broker’s - in the electronic records in the computers of a central depository like DTCC or SIX, and then broker has its own electronic records that you’re the ultimate owner, that’s how it works

Unless you’re rich enough to afford to buy yourself a small bank and deal with a CSD directly…

(Or another alternative for cash strapped and truly paranoid is DTC’s Direct Registration System)

Eggzactly

Well, I personally consider the forex (0.5+% savings) and lack of stamp duty (0.15%, times 2 for when you sell) to be also quite big advantages of IB. Let’s say you want to be investing 100k every year - you’re looking at spending 800+ Fr in these two charges alone at swiss brokers. On top of already draconian broker fees

Eh, don’t get your hopes up. The bank would tell you to move the stocks over to them for custody and probably bill you around 0.3-0.4% for safekeeping. You can loan the money also from IB on margin.

Ok, good point - but I don’t understand it thoroughly:

- Forex (0.5+ savings), what you mean by that, higher exchange fees with swiss brokers?

- stamp duty is a swiss thing, but don’t you have to pay it at one point anyway? Is this legal with IB?

@hedgehog - thanks for all the good inputs!

Yes, exchanges rates are pretty much universally marked up by 0.5-2% or even more at the banks. You’re getting robbed when you exchange currency without even knowing it.

IB gives you access to fair interbank rates for a very modest commission. For some people I know this alone is worth it to pay 120 Fr/year for an account at IB.

Perfectly legal, it’s what the law pretty much explicitly says - only domestic brokers have to pay it.

I think that’s where the combination with corner bank could be an advantage for CT. You can already deposit gold on corner bank and use it as collateral for ct. I imagine you can work out a deal with corner trader and corner bank for mortgages and pledging etf

dammit - read the Switching form CT to IB and the Interactive Brokers for dummies Thread and I am really considering switching the whole thing to IB. Starting from scratch

But according to the table by MP Best broker with cheapest fees for an ETF portfolio as a Swiss investor CornerTrader is cheaper than IB (80 vs 126.4/year) or slightly more expensive (max. 72 vs 40/year). Am I missing something?

And, with the Brexit chaos an account in England, doesn’t make you feel uncomfortable?

100k initial deposit

IB is hands down the best retail broker on the market.

For the cash strapped, there’s also lynx, captrader and some other IB resellers who’ll onboard you starting from some lousy 10k

Also only 1 transaction per quarter. If you trade more, CT becomes more expensive

Regarding Brexit - I am not sure but somehow it makes me feel even more comfortable

has anyone done a USD transfer from IB to CT? IIUC 1 cash transfer on IB per month is free - so the question would be, how much would it still cost for ‘in-between’ banks and on the CT-incoming side…

Being interested in a cheap swiss online-brokerage, i started inquiring about CT. Obviously, the whole Cornèr Banc financial soundness shebang sounds quite enticing.

As far as I understood though, CT does NOT have too much to do with CB when it comes to the relevant aspects of online broking. Not only has CT whitelabelled the Saxo platform (which really is a good thing!), but ALL transactions seem to run through Saxo. After reading their Terms, I even come to the conclusion that the bank account you open there is NOT with CB, but with Saxo (even though they don’t mention Saxo by name) and that your assets are held in the name of Saxo and NOT CT/CB.

I am not saying that this would result in a total no-go, not at all (they’re cheaper than Saxo - for now at least; Saxo is still a bank in CH; saxo is still a reputable international broker). But one should inquire about the real background of CT and not get blinded by how it is advertized as a part of CB, when in effect it doesn’t seem to be.

If someone has information to the contrary and can shed some light on this issue, i’d be glad to hear/read it!

Hi Folks,

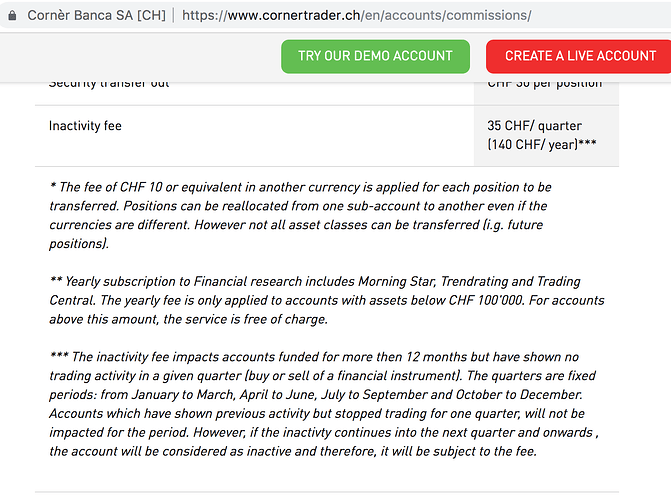

Do I understand CornerTrade website right? If I buy and Hold and do no trade for 2 consecutive quarters I will be charged an Inactivity fee of 35 CHF/Quarter.

looks like yes. Or put in other words: first inactive quarter is free, thereafter 35 CHF

Thanks for this! I didn’t know it. I stopped trading on CT some time ago, just kept my current holdings. I will have to rethink what I do with this account.

I got the notification today in my inbox. Not too happy about that as I have some funds there from my early beginnings… Is the answer all-in on IB? Or transfer the stocks to PostFinance and live with the 90 CHF/a depot costs? Meh ![]()