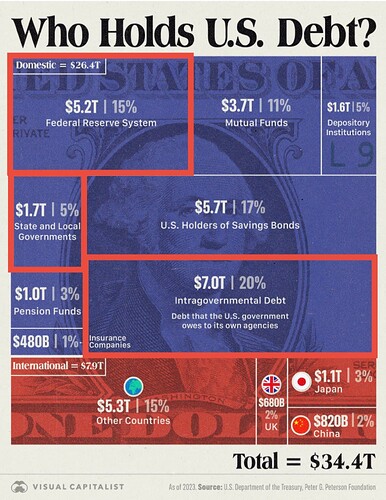

For me the main point of the infographic (even if the boxes aren’t exactly proportial to the values stated): I was amazed how much US debt was held domestically versus internationally and how little debt is held by, say China.

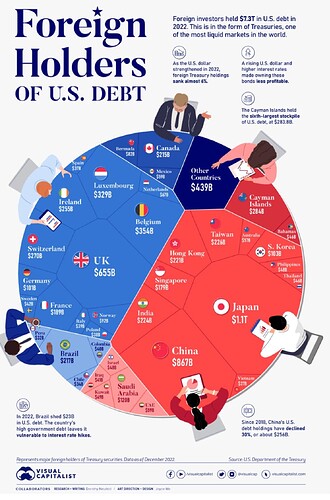

Incidentally, after a bit more doomscrolling on Twitter I came across this infographic of Foreign Holders of U.S. Debt in 2022:

(Source)

But since you asked whether the first infographic was really exact: I asked a couple of AIs “are the boxes proportional to the values in this infographic that I would like to upload”

Chat-GPT failed at analyzing this and gave me pseudocode on how to check this myself.

DeepSeek said that it can’t analyze images directly, but that if I provided the area sizes and repective numbers, it would be able to tell me if they were proportional. Duh.

Gemini says in short: no. In length see below.

(If you question the exact proportions of the second infographic, you’ll have to do the measuring yourself – or ask you favorite AI yourself  )

)

Gemini’s long answer:

Let’s analyze the infographic “Who Holds U.S. Debt?” you’ve uploaded.

Are the boxes proportional to the values?

No, not in a straightforward, visually consistent way. Here’s why:

- Area vs. Linear Dimension: The boxes seem to be attempting to represent the values by area, but it’s not done accurately. Ideally, if a value is twice as big, the box’s area should be twice as big. This doesn’t appear to be consistently followed.

- Inconsistent Scaling: Look at the “Federal Reserve System” box ($5.2T, 15%) and compare it to the “Mutual Funds” box ($3.7T, 11%). The Federal Reserve’s value is significantly larger, but the box area doesn’t reflect that proportionally. Similarly, the “Intragovernmental Debt” ($7.0T, 20%) box looks far too small for its value compared to the others.

- Focus on Percentage, Not Absolute Value: The infographic seems to prioritize showing the percentage of total debt held by each category rather than the absolute value ($Trillion). While the percentages are helpful for context, the visual representation of the boxes should still reflect the actual values they represent.

What the infographic does well:

- Clear Categories and Labels: The categories of debt holders (Federal Reserve, Mutual Funds, etc.) are clearly labeled, making the information easy to understand.

- Percentage Breakdown: Providing the percentage of total debt held by each category gives a good sense of the relative distribution.

- Total Debt Figure: Including the total U.S. debt figure ($34.4T) provides context for the individual values.

Suggestions for Improvement:

- Consistent Area Scaling: If the intent is to use area to represent the values, the boxes should be scaled accurately based on the absolute values ($Trillion).

- Alternative Visual Representation: A horizontal bar chart might be a clearer way to represent these values, as bar length is easily compared.

- Clarify Visual Method: If area is intentionally not proportional, the infographic should explicitly state how the boxes are scaled (e.g., “boxes are for visual categorization only and do not represent exact proportions”).

In conclusion, while the infographic provides useful information, the visual representation of the values is not proportionally accurate and could be misleading. It’s crucial for data visualizations to accurately reflect the underlying data to avoid misinterpretations.