Yep, also apparently Trump‘s VP is pretty anti big corporations and pro smaller businesses (big in the sense of mega caps).

Did anypne compare VT with VWRL for lets say the last 14-30 days? There shouldnt be many dividens (aka limited tax drag) in this short period. TER Delta / tracking difference is as well small over such short time.

So that would be ideal to see if the Delta in VT‘s ~98% of market cap vs. vWRL‘s ~90% was a material difference… so far, I assume it was not.

Edit: just reviewed FTSE‘s Index performance:

- FTSE all world in 1M: 2.57%

- FTSE Small Cap in 1M: 3.06%

- FTSE Global All Cap: 2.79%

Looks like FTSE Small Cap is somewhat, but not uber relevant. Pitty that we can’t invest into it.

I think better comparison should be VT vs IMID. Both of them have most of the world’s market underneath them.

Maybe that give better insights

Over the 1 month period IMID had a better outcome vs VWCE. 3.37% vs 2.92% (USD terms)

@Dr.PI Are we still in Plus after today? ![]()

![]()

It might be good to have a link to the chart in the OP so we can follow.

I’m on vacation now and was actually up for the day and so it was only now when kids are in bed and I’m seeing in detail what happened in the market that I see what a blood bath it was today.

Still, it is well within the normal bounds of a “pull back within a bull market”.

CHF going up quite a but hurts double today for portfolio value.

Good day for accumulators though ![]()

VTI doing -1.5% is a blood bath? ![]()

(I know I know, you’re talking about individual (tech) stocks, but still a handful of % only, given their pumps in the last 6m)

I don’t know about you, but I am still in ![]()

Small correction → toys maniacally being thrown out the pram.

The perennial optimist in me wants to say that when earnings are actually missed the market will react more rationally than proper bloodbath but the misanthropic side says “humans are cancer, when nvidia misses earnings prepare to see 20-30% drops in everything because humans”.

stop watching the market on a daily basis, start watching on a monthly basis only… we are still green - deep green.

Fun fact, I am on holiday and often away from technology (yes, even my phone) so I don’t watch the market - it’s so liberating - only saw it yesterday because the news made headlines.

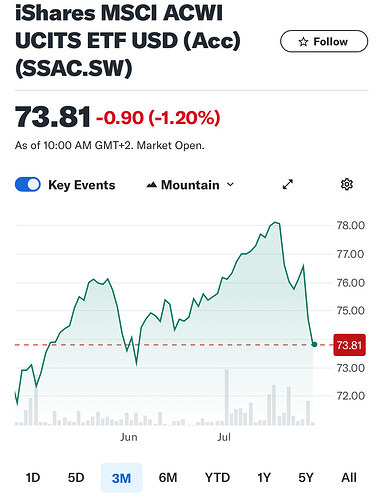

This might be best representation for CHF perspective.

Accumulating all world ETF in CHF (SSAC)

Right now it’s >5% down versus last high.

But it’s still >16% up 2024 YTD.

Agree with your view, like it. Only suggestion - stop reading news that mention anything around Stock Market levels. There’s other news out there. If I didn’t see this post, I wouldn’t have noticed that things had gone up or down…

Wrong asset allocation…

In all seriousnes. Untill it was clear who would hold the bucket on the crowdstrike fuck-up - there may be a prolonged sidewards/down pressure on tech shares. Its not nescecarily crowdstrike that goes belly up, they probably know what they put in their contracts. But some IT/Business service providers that integrated Crowdstrike into their solutions, they may face claims for damages worth a few billions. This all in a weak summer market with low volumes and analyst coverage…

What to do now? Don’t watch the news, don’t buy but as well don’t sell… and see how the situation presents itself by the end of August. What we see now is short term volatility that has no meaning whatsoever.

I‘m not comcerned, was mainly shit talking here for entertainment ![]()

Nothing changes for me, I just keep buying and now it‘s cheaper, so actually a win.

Also I have a very different asset allocation than VT, VT is just the representation for the market to talk about.

what a misleading title, my stonks are worth nothing now, ban pls

Just kidding. Hooray, cheap stocks!

Don’t buy? I surely keep the regular investments continuing also this month and take this dip as an opportunity.

If I don’t watch the news, don’t buy and don’t sell I become Olaf Scholz with his Savingsaccount-Approach. ![]()

I agree, I meant “don’t tactically buy”. Keep proceeding as per your long term strategy but don’t do anything. No buying more than you otherwise would - no selling.

9 posts were merged into an existing topic: Benchmarking The Market

So when do we change the topic title? ![]()