It was misspelt from the beginning and was supposed to say Chronicles of the flat years [2024-2027 Edition] … ![]()

So. Is it time to panic yet?

Nah, just a couple of drops of blood in the streets …

Edit: Oh, and you mean panic buy, right?

Not really panic buy, but I thought yesterday after the VT drop it would be a good moment to add a bit of an extra boost.

1 day later I’m humbled again, and realize that I will never be made to be a day trader. ![]()

![]()

I’m thinking the opposite and wondering whether panic will soon set in and it would be better to sell early.

I’m still overweight my equity allocation (70/30 instead of 60/40).

We have a big double whammy going on as well.

CHF up like crazy +1.5% just today.

+5% over the last month

The small pull back is too shallow for CAOS to be profitable, but my INTC puts and bearish SPX futures have kept me in the green the last few days.

Yeah, annoyingly, I had converted funds into CHF cash but then had a change of heart at exactly the wrong time and moved it into CAOS and bond ETFs.

That’s why I think it’s better to invest in chunks instead of lump sum (a comment I already made for @st.huck the other day on thread Starting Out at 40).

This works for the psychology of my simple mind, at least.*

* Tested as freshly as in the past week or two:

I sold off some Broadcom in early July (it’s dropped since) and some Iron Mountain in late July (it’s gained since). I ended up having mid 5 figures of cash to deploy.

It felt temping to just spend it all right away on my favorite companies on my current shopping list, but I’ve since gradually only deployed maybe about 1/5 to 1/4 of the cash. I feel happy to still have a bunch of dry powder left, especially if @PhilMongoose turns out to be right …

Either way, I’ll just keep buying – BTW, has anyone here read the book? –

either averaging down or averaging up.

And here’s a more serious reply on whether it’s time to panic.

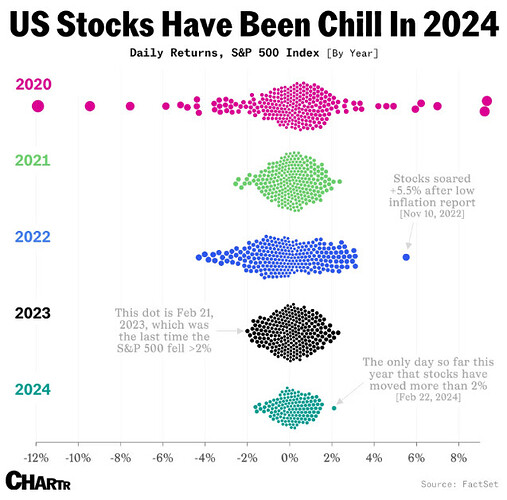

Check out this graph by Chartr (featured by Ben Carlson on his awesome blog here):

We haven’t seen many 2% daily moves in the S&P 500 this year.

Actually, just one up on Feb 22, and perhaps – well, it looks like probably now – one down today.

This of course still doesn’t answer whether it’s time to panic: you could argue for 2024 being statistically (well, ok, big word given the sample size …) abnormally, ahem, chill and today being the start of the correction for more 2% down days to come … or today is just one dot to the left for 2024 to … counter balance the one dot to the right we had earlier this year. ![]()

Dunno, I made a deliberate decision to pause buying back in late May, to build up my emergency cash position. Now I have a few 1000s lying around which I am resisting to do anything with and feel fine about it.

I feel VERY fine that at the same time I made another deliberate decision to switch all my accumulating ETFs to distributing ones, first decent chunk of dirty dividends coming in September, let’s see what the market will be like then.

Still pretty considerably in the green YTD.

UBS seems to think the S&P500 will make 5900 this year, by the way.

Curveball:

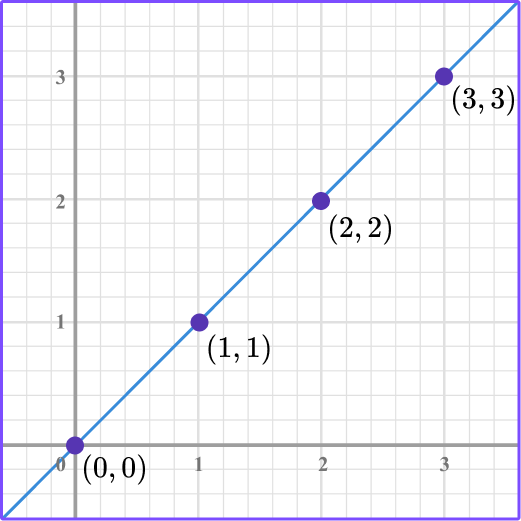

I did a bunch of really complicated and sophisticated statistical analysis on how the number of daily posts in this topic and the VIX are correlated.

You will be surprised to see this surprising yet very interesting result:

(X axis: measure for the market volatility; Y axis: measure for the number of posts in this topic)

I’ll see myself out.

I would say it’s once again time to decide what is right level of volatility we can manage as an investor.

In other words - if such days (1st and 2nd august) make one feel bad, then 100% stocks allocation in „controllable portfolio“ is not right allocation.

I think that in theory, we all understand that these drawdowns are part of the reason why Equities have higher returns than Bonds. However in reality, drawdowns feel very bad to almost everyone.

Such days would always push investors to make a move. And most of the times it would be a wrong move.

I read somewhere in JP Morgan’s article that even though average returns of stock markets were 10%, average return of average investor was 2.9% because average investor doesn’t stick to the strategy. Time period 2001-2020.

Edit -: I am not saying anyone need to reduce their allocation to equities. I was talking more in general that asset allocation should be thought through deeply.

P.S -: I am currently more like <60% EQ because I am relatively new to investing and have been building portfolio slowly. I think maybe 60%-70% is max for me. At least that’s how I feel now. Maybe in few years I would be more bold ![]()

Do you include 2nd pillar in your portfolio ?

if such days (1st and 2nd august) make one feel bad

I’m nearly 100% in equity (except 2nd pillar), and I don’t think I would feel much better if my portfolio drops 3% instead of 5%, because I didn’t go all in.

It feels bad either way, even though in both cases I would still bet it recovers (that’s why I won’t sell now).

Of course if it affects someone very much psychologically this is not the way to go. For me however, talking to others & ocassionally consulting this thread & read posts of likeminded is medicine enough to keep my sanity. ![]()

I would say it’s once again time to decide what is right level of volatility we can manage as an investor.

In other words - if such days (1st and 2nd august) make one feel bad, then 100% stocks allocation in „controllable portfolio“ is not right allocation.

At this moment in time, with 10+ years to my kids being adults and ideally out of higher education my only two feelings are:

- frustration that I don’t have much cash to plug, counterbalanced by feeling confident that making a plan and sticking to it was absolutely the right thing to do

- intense need to keep and remain being good at my job, which allows me to continue buying

X) optimism because of the first two feelings and that I can stomach a 11% drop in two weeks

Y) seeing once more that humans are headless chickens, devoid of any control (including of their bowels), seeing people talk selling equities and going into fixed income NOW - that’s lack of planning/self awareness.

Of course everyone’s mileage can and does vary.

Edit: typos

No. I am only referring to portfolio where I have asset allocation rights. I include 1E plan though which is also part of 2a but there I can decide myself what I want to invest in

I realise that I might have to increase my equity exposure overall. But since I am new investor, I need to learn the emotional game slowly. ![]()

Either way, I’ll just keep buying – BTW, has anyone here read the book? –

No, but I have author’s blog in my RSS aggregator. Very enlightening, although very US-centered.

Not sure how much it is worth reading, though. The main idea can be formulated in few sentences, and he regularly does it in his blog.

I don’t have much cash to plug

Not sure what this means??