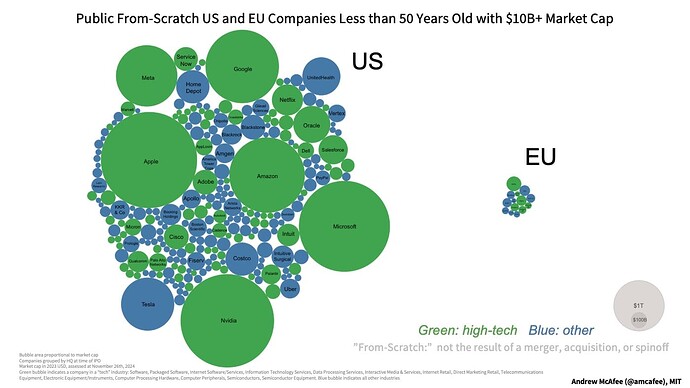

Which makes sense since Big Tech (FAANG/MAG7) are global enterprises, often with a tiny headcount footprint and with the magic of near-zero marginal cost of revenue.

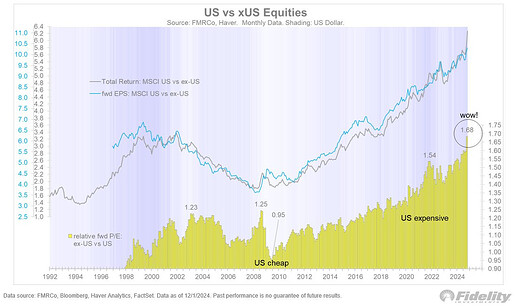

Another US vs xUS comment from Jurien Timmer, the director of Global Macro at Fidelity:

Wow. Price follows earnings, and relative price follows relative earnings. Valuations matter, but they are unlikely to be a catalyst in the absence of a change in fundamentals. This has helped me resist the temptation to play the mean reversion game in the global equity markets. But it’s possible that valuations can get so stretched that it doesn’t take much of a shift in earnings revisions to start the mean reversion. In that regard, the latest monthly datapoint in the chart below gives me pause.

The P/E premium between the MSCI US index and ACWI ex-US index jumped markedly in November (now at 68%), with the relative return vastly outpacing relative earnings. I know better than to call a top, but this chart got my attention.

(source)

Some of you might like this:

(source)

I had also read the quoted WSJ article and also felt as wise afterwards as before.

Actually, I felt a little more stupid, as already from the headline you can conclude with Morgan Housel’s summary instead of reading the article.

Next time they can just leave the Lorem Ipsum text and save some bucks.

This got a bit quiet. Bull again today for the S&P500 ![]()

Gold? What gold? The only gold thing I have is my wedding ring and some 5g 99.999999999% gold slivers my kids were given. They have probably increased in value dramatically ![]()

Edit: got something I haven’t felt in a while last night: FOMO. I’d bought some TQQQ and UPRO last year, exited in good % profit this year (few k) because I was getting twitchy; ran some numbers and hodling to today would have met a goal I have for the end of this year while allowing me to not change anything else in spending or saving. Of course in a raging bull leveraged ETFs can make miracles, but that cemented my opinion that while leverage is scary, it should have a small part in any portfolio. Perhaps will plug some money into these again in the future after a good correction.

Definitely something is wrong here. ASML should be comparable in size with the second dozen of top US companies.

Did something happen?

I have no opinion, but came across this blog post this morning. It argues that the market in the EU is healthier because the USA only has large companies because it often has a monopoly.

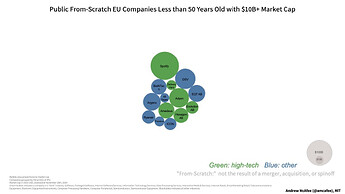

Here’s the blown-up version of the EU cluster. ASML indeed seems to be missing.

I researched a bit and found the original post on this on Twitter. Of course, someone else already pointed out that ASML is missing but the author responds as follows:

ASML is the result of a merger. It is thus not a “from scratch” company as defined by Draghi, repeated in my thread, and included in the legend of both visualizations.

The original data is on a Google sheet in text form.

Looks like the guy actually did his homework …

The over-representation by Sweden is quite amazing!

Interestingly enough, Sweden has a strong stock market. According to this article, it is a combination of strong domestic, institutional investor demand, retail investors and investment culture. It seems that financial literacy is promoted, also in schools.

US media was already enough but now Goofy media is also helping US stocks vs rest of world ![]()

Sir, excuse me, I don’t do media … my work is called propaganda!

Maybe you should also do some propaganda for EU and CH stock market ![]()

It would definitely help most of us who are not 100% VOO

Shur. Vor ey smol feee I vil efen promott ze Roossian stock market.

Here iz my beetcoin address: 1Fak3BTC4LaughsP1easeSendDogeCoinIns7ead

You decided to tilt away from the US and unhappy with the media, as your tilt is not working as expected. Well, don’t tilt, or make it a conscious decision, where long term you will win or lose.

I am not unhappy with my portfolio. And as I already mentioned I know my returns would be low because of my choice. Comment above was just a joke.

The comment about media is not about its impact on returns but it’s impact on perception of markets in general. US media always paints everywhere else as non investible & if Europeans start consuming only such discussions then it can make choices very biased.

As per US media , US is exceptional but they don’t focus a lot on pension crisis, housing crisis, debt crisis, health crisis, etc. All they talk about is how great US stocks are and why people should pay 24 times PE for those stocks. They don’t talk about how Stock market is completely locked in the pension funds and if stocks fall for long time, the pension system will collapse.

Did you ever hear so much publicity about Swiss stock market outperforming the world for almost 30 years? I know since covid things changed but I never heard about all this in media ever.

I think media in Europe is generally not that positive about home markets. They tend to focus on everything that’s bad. All news stories are about things that don’t work.

P.S -: my portfolio so far actually have better returns than VT since inception (only 4 year history), most likely because I used to be stock ninja, then ETF ninja in beginning and perhaps I was more exposed to US in past. Reason is as explained above all I heard about ever was US market. In beginning I didn’t even know about VT. I knew VOO & VTI ![]()

When I say I expect lower returns, I mean for future.

Horosho

If only I had any beet