Is that a rhetoric question? What’d be wrong with that?

Nothing wrong

I am guilty myself

But @Mirager was making a point that investors can be better off ignoring the noise, staying the course and relax.

I don’t read all this content from influencers or youtubers posted, but based on the chart, does this one cover in depths how the labor productivity development across countries compares across sectors of the economy.

I’ve picked up somewhere that the US recently did better, even accounted for the hours worked, but it’s focussed on single sectors (and those that matter).

I haven’t gone done this nor the next obvious rabbit hole, myself, but wonder to what extend this shouldn’t be priced in, already in the stock markets (to the extend it matters)?

Ok, then I got it wrong. ![]() I do some side bets, but for the serious part, it’s one transaction per a month. No noise, just takes a few minutes and works well since over a decade. Can fully recommend.

I do some side bets, but for the serious part, it’s one transaction per a month. No noise, just takes a few minutes and works well since over a decade. Can fully recommend.

Of course, with some annual adjustment on what’s available to invest based on the circumstances, and reviews on the individual products and their allocation to match market cap again, (if not having a single ETF) even less frequently, but that’s about it.

I don’t like the markets being so expensive, as I am still accumulating. But what can you do? The market was approximately as expensive as it is now in November 2021. But if you quit then, you would have missed some 20% return over the 3 years. So do nothing.

Another thing is if the market continues to rally. At a CAPE of 40+ and if the Euro (my currency) looses to the dollar, probably there would be a moment when paying off the mortgage instead of buying can make more sense. Still not now.

What, if anything, do we think about what just happened in France?

That democracies are stronger than we may believe, as parliaments don’t take budgets being passed by the executive branch, bypassing their consent, without striking back and doing so efficiently (South Korea is also about the legislative making sure their prerogatives stay theirs and don’t get appropriated by the executive)?

We live in interesting times but I’m pretty optimistic about the future (the same goes for my stance on investing and investments).

Few days ago saw a headline that 10 year government bond yields were trading higher in France than Greece. Either France doesn’t have much trust with investors, Greece has really done its homework or both.

I mean we’re literally talking about a basis point for a few minutes, but yes with the turmoil in the French govt currently it makes some sense. I think it says more about France being in crisis than Greece being particularly good.

There’s at least 8 more months of instability in France, what happened was expected.

(Could be longer if the next elections still doesn’t bring a coalition tho)

That it takes time to realise that affordability is not permanent. But kicking the can down the road always helps ![]()

I was talking to a French friend today and he told me that a lot of people there work for govt and don’t want to give up their rights/benefits but also know that there is no easy way to afford it. Only a miracle can fix this situation.

But he also said that the role of opposition in france is to just oppose everything that is proposed.

Bit OT:

News stopped being the news, by the time they started broadcasting 24h.

There’s a fairly good book by a fellow Swiss author:

Stop Reading the News: A Manifesto for a Happier, Calmer and Wiser Life by Rolf Dobelli | Goodreads

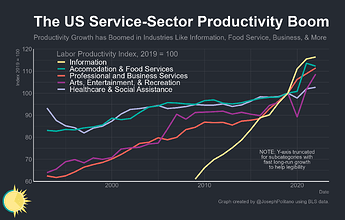

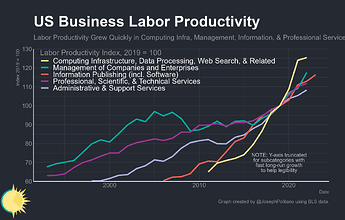

The original author claims that the labor productivity gain in the US stems “almost entirely from the service sector”. In particular, he cites the sub-sectors depicted below, and if I’m holding this right, most of the productivity gains come from “Information” as a service

which seems to translate mostly to

what I would label as “big IT”.

The author does not go into comparing sectors across countries.

If you’d like to explore the details the original charts were posted here: America’s Productivity Boom - by Joseph Politano

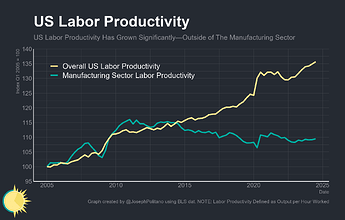

Also, as far as I can tell from reading this post, productivity did grow overall except for the manufacturing sector. Here’s the corresponding chart:

He explains this as follows:

Historically, spurts of productivity growth are most concentrated in the manufacturing sector and manifest only slowly in services—in the classic example, it is hard for barbers to get faster at giving haircuts even as razor manufacturers rapidly get more productive. However, the endemic problems with American industry has meant that manufacturing productivity remains stagnant even amidst heavy government emphasis on industrial policy over the last four years. Thus, the nation’s recent productivity boom comes almost entirely from the service sector—cooks, programmers, drivers, nurses, bankers, teachers, cleaners, managers, caregivers, and more have all gotten significantly more efficient at their jobs over the last four years, with the gains in some subsectors being historically unprecedented in both speed and scale.

Hope this helps.

I’ll go out on a limb: it’s 100% priced in?

(maybe even a little above 100%? ![]() )

)

Dont overthink…keep accumulating.

Just because the markets are expensive doesnt mean they will drop.

If the money printing continues, you need real assets.

Cash and bonds will kill your performance, especially for long term investors

I would add an asterisk for short term (US Treasury) bonds, as these probably won’t kill your performance, but in general, yes …

Just Keep Buying™.

I don’t think that’s necessarily true for Switzerland. It might be true for EU or US

On a side note -: I am astonished and also impressed by folks who can manage a 100% Stocks / Crypto portfolios. That requires very different mindset

The set it and try to forget it (while building) works.

It’s like the gym, no pain no gain, and the gain can work for you for decades to come.

There is a limit to how much the snb will allow the swiss franc to appreciate.

So we are kind of pegged to the depreciation of the euro albeit at a slower pace.

Those two things are quite different,

One are shares of companies that produce goods, make money, own real estate etc.

The other is a mass psychosis. ![]()

Well, no.

(I did read your answer and eventually the links, thanks for the effort. ![]() )

)

And yes. Now it comes to it, I don’t feel like parting with my asset allocation.