Yep, sorry, seems the u-turn happened quicker than the time I had to write my message…. Nevertheless sorry for the emotional reaction

From the director of Global Macro at Fidelity:

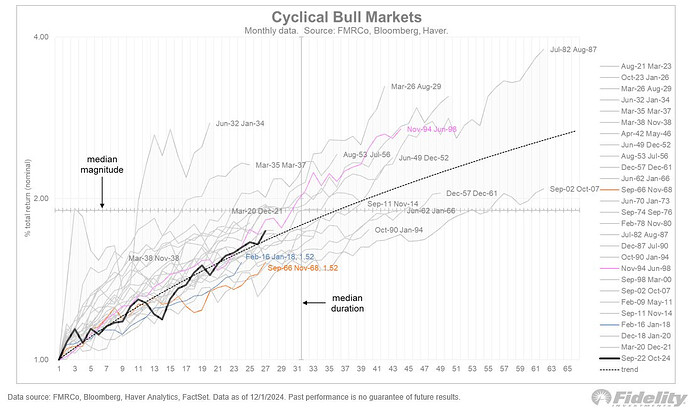

After a newsworthy November, the cyclical bull market for equities is now 26 months old, producing a 73% return for the S&P 500, a 51% return for the equal-weighted index, a 48% return for the Russell 2000, and a 63% return for the MSCI All-Country World index. The median bull market (S&P 500 index cap-weighted) over the past 100 years has produced a 90% gain over 30 months.

(source)

So more gains for another 4 months then!

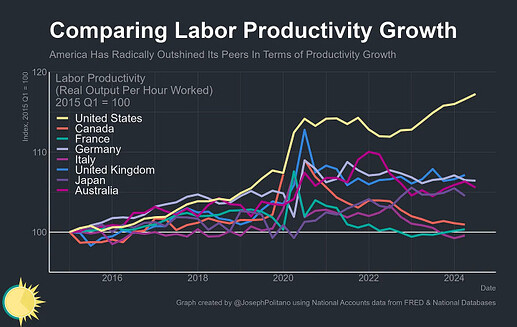

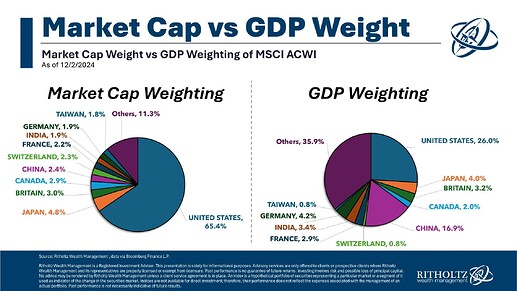

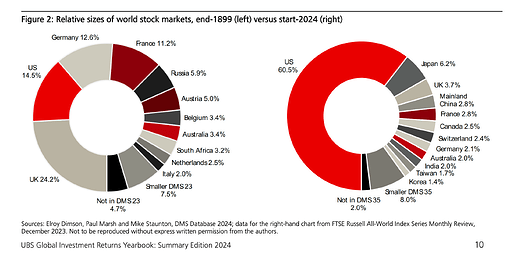

We haven’t discussed the US vs RoW in while, hence I’ll pour in some gasonline from Ben Carlson (@awealthofcs):

Excerpt charts:

There was a piece on CNBC yesterday. Everyone has given up on investing outside of US.

In addition, there is also an interesting discussion with Norges Fund

The real impact of growing budget deficits

I like Ruchir Sharma. Not because he is Indian but he is generally balanced in his views. He praises Switzerland though ![]()

Typical news claptrap. Look, professional gossips (journos) need to talk and write stuff, that’s their job. In the past they wrote about what happened yesterday (as a kid my parents sent me to get the newspapers - and extra thick on Sundays because it was the day of the commentary - a chore I hated), nowadays they write what happened the last second, tick tock, 2 more news pieces, tick, 1 more etc.

Compounded by nowadays’ search/social media engines’ feedback loops and click revenue they need to write catchy stuff all the time. A couple of months ago it was doom and gloom “the black hole is about to open under your butt in the toilet”, “WARREN BUFFETT IS SELLING AND SO SHOULD YOU!”, Goldman Sachs “predicting” low returns for the S&P500 for the next decade, now the topline news I saw this morning said “S&P500 to 7000 by this time next year” (up from 6500 by UBS a couple of weeks or so ago).

All claptrap. There’s wisdom in Bogle’s message about staying the course and tuning down the noise.

I wonder if people still remember “the terrible Halloween sell-off” from 130 messages before.

No, nobody remembers, now we’ve moved on to anticipating the Christmas rally, the future is now, carpe diem, old man.

I wasn’t paying attention, has there been a Thanksgiving rally?

Today’s Bloomberg MarketsDaily newletter knows how to mix the South Korean episode with US outperformance and rubs it in as follows:

“The political chaos spanning Seoul to Paris this week is reinforcing why many investors have chosen to stick to American markets.”

![]()

I think discussion on CNBC should be seen as more of an evidence to not have 100% allocation to US.

This is not the case for VT / VWRL investors anyways. But I think that video would make more sense to S&P 500 only investors and that’s make audience for CNBC.

I agree that we shouldn’t make portfolio changes based on news / noise. But I think there is nothing wrong in understanding the problems that video is talking about.

I didn’t look at the numbers, but to be clear: you’re telling me to buy the dip in SK stock market? ![]()

I do understand it, but for me it’s a non-problem because it’ll eventually be self-correcting and more importantly does not influence any action from my side.

It’s a bit like a problem we’re dealing with right now at work: a manufacturer wants to launch a diagnostic which currently has no direct clinical utility, ie no medical decisions will be made based on the results, so there’s zero appetite for stretched healthcare budgets to pay for it unless it can be shown with hard numbers that it will a) do something good for patients and b) it will materialize some financial benefit for someone, somewhere, at some point.

Should I just go all-in or leverage long all-in?

Either works, but it’s best to time it to the bottom.

OK. Re-mortgaging house now…

True

But if we are being honest, are we really willing to “set & forget” allocation no matter what?

Are we really not making any changes to our monthly contributions or portfolio?

To be honest, I do not think I can do that. But maybe I am still in early years of investing. Once I am a veteran, perhaps I would not do that.

Depends how pedantic you want to be. For the last 2.5 years I really did not make any changes (I had no portfolio before 2021 so…) other than adding more FREEDOM and switching to distributing funds. Contributions, frequency and allocation didn’t change. I’ve currently chosen to build up my emergency reserve, but that’s been very regular and systematic too. When that’s done I’ll switch contributions to KMLM and leftovers to the 3A, but that will also be regular and systematic, so no changes to the core process!

Of course, dreaming, longing, pining, yearning, lusting, coveting…running out of synonyms here…for the day I’ll convert all that crap to dirty dividends, then again nothing will change ![]()

I know a couple of people who really just buy VWRL/VT/VWCE/SSAC every month and do nothing else.

I think the more you can automate the better. I had one setup where cashflows from rental income were swept directly into a fund and I never really looked at or thought about it except to remember to include it in my tax return each year.

My main portfolio is a hassle as it’s always spinning off dividends etc. which need re-investment. I guess I could also automate that to some extent.

Maybe it would even be worth separating out the ‘permanent’ part of my portfolio and sticking it with another broker out of sight could even help.