Probably because people don’t know the SPI. Same in the US, Dow Jones and Nasdaq instead of S&P 500.

Totally agree with you. I also had some but got rid of it this year. My main reason at that time was that for a Dividend ETF it really does not yield much… Then I better instead just get some Zurich, Addeco, Swisscom and call it a day… No more Swiss bias for me for now.

Here is a funny picture to cheer you up, %USERNAME%.

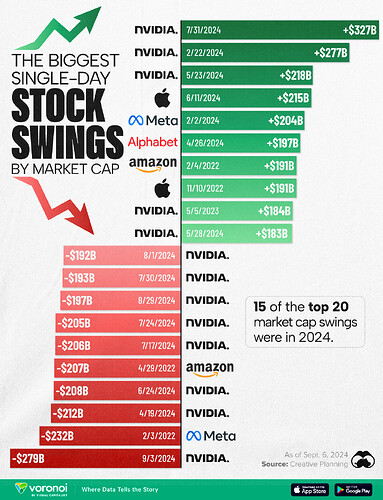

https://www.visualcapitalist.com/ranking-the-biggest-single-day-stock-swings-of-all-time/

And yet the year was super calm in terms of volatility according to data posted above ![]()

Edited for Dr 3.14

They were posted when this thread had half as many posts as now…

The Fed just cut interest rates by 50 basis points.

Money printer warming up… brrrrrrrr

That surprised me. I thought they’d go for 25bp.

The Fed also sent the USD sinking below 0.84 CHF, a new 13-year low.

Wow, same here. That’s…not great news.

They even said in meeting that they were thinking about even more.

I was also surprised. Market did price the chance of 25/50 at pretty much 50% beforehand.

Now the ball is in SNB‘s court. They will certainly cit, but maybe even more than expected.

Rumors telling additional 50 till end of year. But „economy is good“. ![]()

Even though CHF / USD is high today versus last year , I think we all would agree that CHF / USD is destined to grow due to the nature of debt that US carries.

Bull run in US dollar for last decade needs to be over at some point.

I believe that it’s FED doing catchup with SNB rather than other way around. SNB was bolder and did the first cut ![]() and most likely they would continue .

and most likely they would continue .

Not sure if that would control the CHF / USD much though. Would be tough for exporting companies of Switzerland as it would make sales to US more difficult

I don’t claim to understand economics, it’s not a science anyway so why should I bother, but zero interest rates can’t be healthy.

This market has priced in cuts 25 times in a row this year and another 25 last year, now the cut is here and historically it’s supposed to be very bad to have a 50bp cut as the first of a series, associated with crashes and recessions.

Personally I was hoping for a 25bp cut, seems more chill. Let’s see what the psycho Mr Market does with it.

Perhaps rename thread to “Chronicles of yoyo diet years?”

Today was definitely a Yoyo day…

And today looks more like a treadmill ![]() Ok I stop!

Ok I stop!

I bought gold miners on the news yesterday. I always expected the fed to be weak on fighting inflation, but I thought they’d actually try a little bit harder to look like they meant it.

Not sure if I understand what you mean.

You are saying FED is not serious about inflation?

Why is that? The interest rate is still 4.75 % and inflation is less than 2.5%

You mean you bought an gold miner ETF such as GDX.SW or AUCO.SW ?