Like… back where we were 3 months ago?

A post was merged into an existing topic: Benchmarking The Market

What’s happening today? I know the LifeProTip not to look at the market but what can I do, I check my phone and see >2% gains? Something something futures something.

These days it’s always mix of following

- direction of Japanese Yen

- Forecast of US recession

- balance of inflation - reflation - deflation

- AI stocks are in bubble vs it’s just the beginning

For last 24 hours the story for these topics was considered positive.

The market is like Hotel California ![]()

You can check out any time you like, but you can never leave?

Is anything happening?

Just normal Mr. Market environment.*

“Mr. Market’s job is to provide you with prices; your job is to decide whether it is to your advantage to act on them. You don’t have to trade with him just because he constantly begs you to.”**

– Benjamin Graham

** I would be eager to provide a longer and better explanation here, but I now need to have a close look at my watch list and the market now and see whether these intraday fluctuations provide me with a great short-term buying opportunity.

--Yours Truly (a long term investor)

![]()

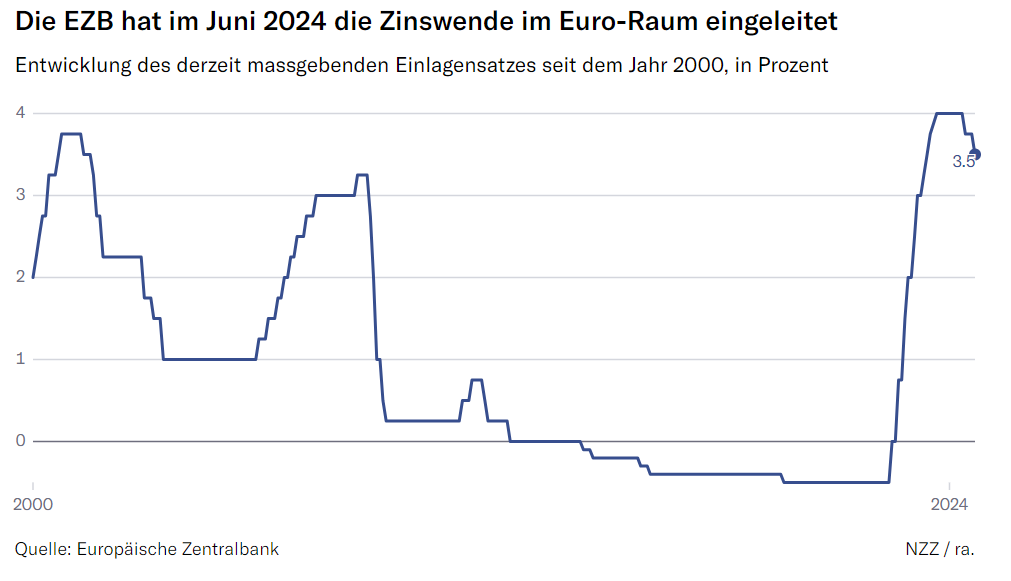

This is also happening:

EZB senkt Zinsen um 0,25 Prozentpunkte

Die Europäische Zentralbank verringert den Leitzins auf 3,5 Prozent. Dies war erwartet worden.

(Tagi)

(NZZ)

(NZZ)

Anyone buying anything?

Nothing interesting seems to be marked down these days … ![]()

I might have to turn to songwriting if the market keeps going up (Yes, this is a personal threat to you, Mr. Market!):

No dip today, my love has gone away

Red prices stand for lorn, a symbol of the dawn

No dip today, it seems just going up

But people passing by don’t know the reason whyHow could they know just what this message means?

The end of my hopes, the end of all my dreams

How could they know the crashes there had been

Behind the door where my love reigned as in the green

Feel free to sing along now: No Dip Today (an earlier recording where I hadn’t yet gotten the final lyrics right).

Market down -: @Your_Full_Name is buying the dip

Market up -: @Your_Full_Name is looking to buy the rip

Says cash is on the sidelines to be invested,

It’s not tough to keep him interested

Touché!

Edit: Just for the record, though, I don't buy rips.Nah.

Bought VT two days ago.

Just kept buying™

I plan to increase my DVD collection. chdvd.

The concentration in that fund is crazy.

The top 5 are 70% of the fund.

At that point I‘d just buy the single stocks if you think those companies are worth to buy.

I’m more amazed how much cash they hold, e.g. in CHF they’re sitting on 1.25% cash (and that they also seem to hold GBP?).

Well, that’s the same with some other dividend “aristocrats”.

I did compare chdvd with chspi and somehow the former performs always better.

I also always wondered why the news talk always about smi and not spi…