Never forget, the big crash from 4.8.24-4.8.24.

I for one am hoping for a couple more dips as I still have cash to deploy.

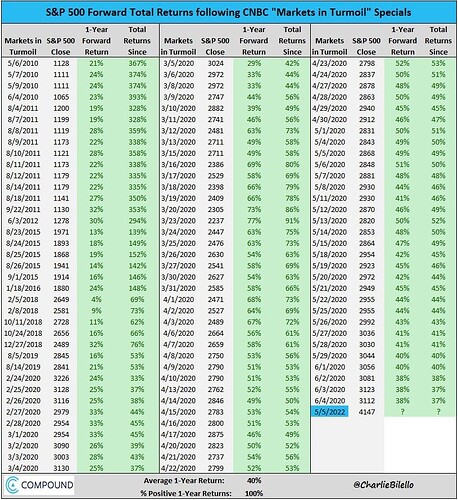

Also, these discount entry points tend to work out well:

12% drop in one day and 10% surge the next is not normal. This would shake the confidence of investors and people would be vary to invest in Japanese markets until dust settles. The end of carry trade will take time and it’s not clear how long it would take.

Who knows tomorrow you wake up and Nikkei is 25% down. This is something no one likes and wants. I wouldn’t be surprised that Nikkei would be choppy for few months.

Of course this is about Japan. For rest of the world, there were multiple issues at play (recession, war, Japan), so let’s see how it goes

In my view the main learnings from last few days drama is

- Equity investors need to be able to live with volatility. Gains made in 6 months can be wiped out in 2 days. So diversification is very important

- Bitcoin is not a store of value at all because whenever things go bad, people sell their bitcoin. So the narrative of “store of value” is only really believed by some. Examples -: Covid, 2022 bear market, Japan meltdown

- Gold still holds the fort for defence. When things go bad, Gold is preferred asset for many. I don’t intend to say it’s good to bad. It is what I notice.

- Swiss Franc maintains its confidence amongst global investors even after Credit Suisse fiasco

- Investors should be clear about their asset allocation strategy and its expected return & volatility profile.

- Mega tech in US is very vulnerable because it’s priced for perfection.

Good summary and I would agree on all points.

I should have bought yesterday, but that would have been timing the market. So I’ve decided to hold off until my usual trading day of the month, which is also timing the market.

If it’s still up by then, I’ve timed the market unsuccessfully, but it’s not my fault, because I’m not timing the market, it’s my usual trading day of the month you know. If it’s down by then, I’ve timed the market successfully but I can pretend I haven’t timed the market, because it’s my usual trading day of the month you know.

Goofy-GPT, turn above statement into finance-pro language:

– The present value of future cash flows from Japanese companies is not changing by 10% a day.

Buttt… it must have. Efficient market theory doesn’t allow for any other explanation, no? ![]()

People’s assessment of it may have changed by more than 10% as new information came in.

The global market participants’ assessment may then have changed in the other direction as more time to process the information became available and more people got access to the information.

The efficient market hypothesis doesn’t posit that the current price of an asset is right, just that it is the best collective assessment of its value at any given time. Emotions and shock reactions are a part of it (which means that, yes, the market can be beaten. Good luck doing it consistently, though).

A … friend with cash on the sidelines asked me to post this:

Please report any sightings first here in this forum topic.

Let’s wait for the dead cat to finish moving first… ![]()

So is the cat now rolling down the stairs or not?

Kinda.

just did a Markt-to-market of my Portfolio. The effective, final drop is peanuts. What matters now is how things continue. IF Iran goes balistic, we might see a major drop. But at the Moment, looks likey they are fairly sensible (actually mores ensible than Israel?). Anyways, thats politics. Unless something crazy happens in Japan / with Banks that have large JPY book / Israel and Iran… i don’t think that we will have super scary Investment times ahead.

Clearly… it bugs me a bit as I just re-balanced end of July and (due to a calculation and Markt-to-market error) slightly over-balanced my equity portion. But in the bigger scheme, that probably costed me something like 0.05% of performance, so … so what we are good and Investment live goes on.

Wake me up again when a real crash happens ![]()

You mean like the epic crash last Monday?

![]()