Yes I buy some some more VT today just because I had some money laying around that I wanted to put in about a week ago. This move was absolutely not planned and rather just me being hyper focused on other stuff last week. Hopefully this has played out otherwise I have still some money coming in soon which I need to put into the market. In any case such days are a great way to find out your risk tolerance.

I bought a little bit today.

There seems to be some panic as CAOS briefly touched >+10% today but corrected to +2.5% as I was pondering whether to sell into that.

I usually buy on the 7th trading day of the month. So coming Friday. Hopefully, the markets haven’t rebounded by then.

While markets have fallen the last few days, it has been on the back on months of gains - even with the falls, IMO, there’s still not that much out there that is attractively priced.

My holding in Japan Tobacco fell about 17% and while markets were closed when I checked the portfolio, even if it was open, I’m not sure I would buy even with a 17% discount.

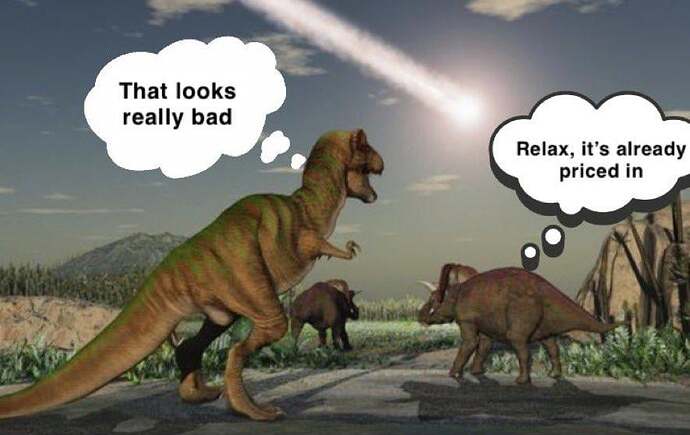

This explains the current market behavior

Extended Cortana effect.

Volatility above capital introduced is easy. Draw a chart where volatility regularly takes you deep into loss territory.

I mainly tried to simulate the impact of corrections and bear markets. The 18 months and 54 months was mentioned in some research.

Idea was to see how long one needs to be doing DCA to avoid net negative returns.

Of course if there is even more volatility then investor would go into negative territory quite a bit. However I am pretty sure somewhere after 5-8 years timeline, the negative territory would be low probability for a global world market ETF.

Otherwise there is no point of investing ![]() eventually people need to be able to count on something.

eventually people need to be able to count on something.

perhaps bootstrap models would be needed to plot typical investor experience. Portfolio visualizer reduced access to data, or else would have been possible.

Edit -: someone actually did such an analysis. He calculated probability of losing money vs years of monthly investing. Link here.

It goes even further. I won‘t be able to invest anything for the rest of the year due to some personal reasons. So I can‘t even buy the dip lol.

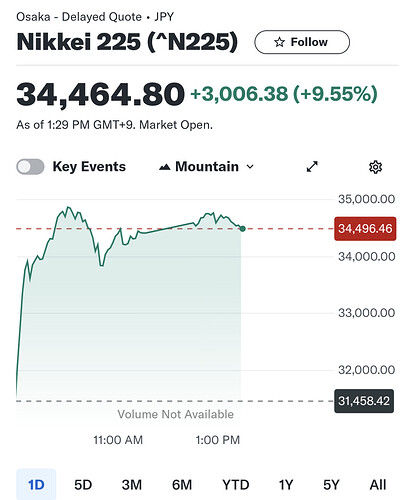

2nd half recovery confirmed!

Here you go: Yuzu Sirup

Taste like lemon, but less acid in my taste of view ![]()

Looking at VIX, I thought a war has started already… 65 was last seen in, huh, March 2020.

Why haven’t you asked him in January?

What year?

Well, any, actually ![]() .

.

Couldn’t help myself, bought more just now.

Though annoyingly, the stocks I really want to buy are not falling much at all.

Because I don’t like to owe people money.

But right now, there’s a correction 1.5 months before I’ll have some cash freed up from a fixed-term deposit, so I could pay back the loan shortly and with certainty.