The autist in me wants to say “priced FOR (evergreen) perfection”, as “to perfection” would mean that they were priced at “Goldilocks just right” levels. I can see myself out.

Edit: and yes, on the hiccups, it’s what I’ve been writing here for a while about people throwing their toys out the pram. More seriously though, Bogle’s (and Vanguard’s, Blackrock’s etc) glide paths and Target Date Funds make perfect sense in my opinion, especially in times like now. I’d made a post here, pasting a table from reddit where someone collected and summarized the stock/bond recommended allocations by all the big asset managers, I can’t find it now but can link it much later in the evening. What’s mildly irritating me is that all the optimizers out there totally miss the HUMAN element in all of this. Kids 20 years old saying “yeaholol all in in TQQQ, I’m good for 40 years from now”, I want to tell them “hey, kid, there’s great chance you won’t be the same person at 25, 30, 35, 40, 50, 60 so have some humility and accept your ignorance about life, and listen more, talk less”.

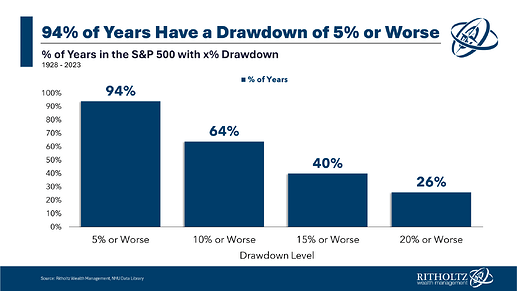

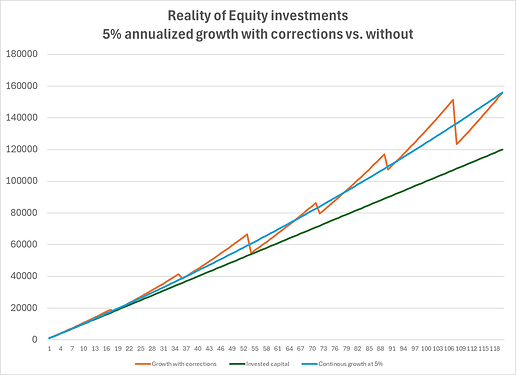

Again, the latest data (eg shown here, in Ramin Nakisa’s excellent channel) claim that in theory 100% stocks are “the best” at any and all times, yet theory on the screen is different when it comes to us humans behind the screen ![]()

I am very puzzled by all the selling talk on fora and reddit though (not here), enforces my thinking that most people aren’t cut out for this, didn’t do the due diligence, lack critical thinking, didn’t think it through… Selling locks in any loss, why on earth sell now unless one has no money to pay for food? And if they don’t then it’s clear they didn’t plan ahead/think it through.

Reddit seems awash with questions about MMFs, bonds etc fixed income - and, yes, dividends - I’d want to go in and type “if you have to ask the question now it’s already too late”, but I won’t because being a smartass when someone’s scared of hurting is not on in my book.