Dip Coated Appetizers always good for a party

Good posts on buying the dips. The key assumption missing, in my opinion, from these analyses is whether an investor who diligently plugs money into the market at set intervals (ie not DCAing, if we want to get pedantic) manages to miracle some money up to buy dips OR is keeping “dry powder” in order to buy dips. I guess the variables are too many to do this properly.

Keeping “dry powder” we know well that is a losing game, in Peter Lynch’s words “more money has been lost waiting for corrections than in corrections”.

By “miracle some money up” I mean for example raiding their emergency cash reserves and/or dedicating to eat baked beans for 3 months, or eating the family cat instead of chicken, or other wholesome practices like that. In my own greengrocer-level mental accounting I have kept track of the “chunks” that were used to buy dips - last example is 27 October 2023 - and indeed they have done measurably better. The rub is that my own liquidity is not substantial enough for gains to make any meaningful difference, meaning that if buying a dip would net me a couple of hundred franks more than not doing it then the only reason to do it is psychological.

In other news, I can’t shake the thought for months now that Buffett is preparing for the bull run to end in a bang where he (or his successors) can swoop in and eat up businesses like a blue whale eats krill (edit: please don’t get pedantic, I know BRK isn’t interested in krill-level business, you get the analogy!), either one last hurrah, or setting up his successors for…success. I never intend to stop adding to my BRK.B position.

Another easier way is to tweak asset allocations. If you have, say, 70/30 stocks/bond, then this automatically buys the dips if you re-balance on a dip. Or you can buy the dip by shifting the allocation 75/25 etc.

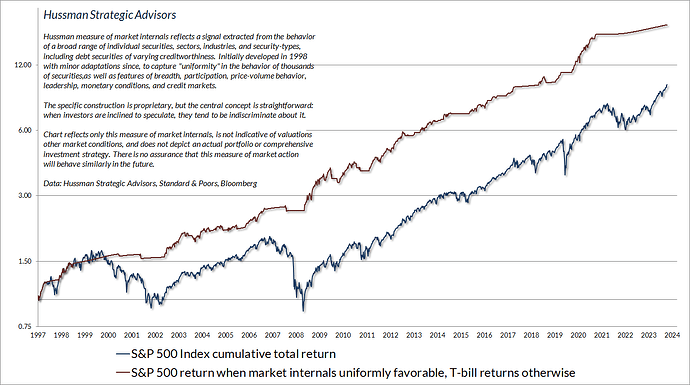

Hussman’s analysis hypothetical swapping between stocks and T-bills based on market internals:

As far as I understand, T-Bills had negative returns in 2021 - Q1 2022. How do they manage to have their returns stay flat?

Edit: Nevermind, it’s probably a matter of scale. The returns of T-Bills during that period were around -0.1% / -0.2%.

Edit 2: As it happens, while T-bills don’t distribute interests, T-bills funds may distribute dividends, which explains much of the decline I had noted.

Your wish was granted:

Turns out this strategy is basically identical to the baseline scenario. Here a possible explanation from my side:

So, to sum up: It doesnt make sense split your investments during the month and try to time the day. But you might get a slight boost if you are willing to work harder to invest a bit more after a dip and

This of course would be different in a prolonged bear market, where you would save more money if you would keep this additional “miracle money” in a savings account. But to be fair, in this case you would save the most money if you would withdraw at the start of the bear run completely (but no one knows when, whether and how long that would take).

So, it was both a matter of scale and of me using a T-Bills fund ($BIL) assuming there would not be dividends while, actually, there were (distributed from the fund)…

Don’t mind my ramblings and carry on.

Thanks for the calculations… Happy to hear, boring is still cool ![]()

This analysis is golden!

https://seekingalpha.com/article/4708365-the-bull-market-topping-process

I wasn’t able to read without logging in recently, so you might need an account. But some articles completely worth it.

My Japan Tobacco shares fell 16% overnight ![]()

Yeah, come on, baby!

I would challenge white coat investors to do something different, though (here comes the neurological mumbo jumbo). Every time you see the market go up, start cursing. Seriously! Cursing is usually associated with negative things in our lives, and the pathways involving the amygdala (fear center) and prefrontal/insular cortex (anger) will be activated and you will learn that every time the market goes up, it is bad. Also, while you curse, think of yourself eating Alpo in retirement and your kids going to community college despite a Harvard acceptance because you are too poor. Silly imagery, yes, but it will teach your brain that the market going up when you are nowhere near retirement is a BAD thing using System 1.

And then when the market goes down, say “Sweet!” and think of your kids (assuming you love your kids), wife, and family. Usually I do this when I see on my iPhone the market is down. I yell “SWEET!” and then scroll through photos of my family and kids. I am activating the limbic system and nucleus accumbens, the happiness and reward centers of our brains, in response to the market falling. So, you are adapting your System 1 to fear the market going up and to feel happy and want to invest when the market is going down.

Hey, guys. I think it might be time to panic.

Can someone send me a PM when we’ve reached the bottom of the dip, so I know when to get back in, OKthanksbye

!remind me in 5 years.

Well. 4 weeks ago I convinced my brother to cancel his 3a life insurance and to transfer everything to Finpension (losing around 6k of the 18k he paid in so far). Damn it.

It’s a bit strange that market sell off is so intense. Is it all driven by one bad job reports in US or it’s because of potential Iran - Israel war?

Whatever it is, it feels very strong . Almost like COVID times.

P.S -: FINRA margin debt is almost as same level as beginning of 2022. so the leverage in the market is quite high. Sharp sell offs can trigger margin calls.

How is it possible? Markets didn’t go down 30% yet.

Dunno if to say “I wish”, to spare prolonged pain, or “hope not” given I’m far from retirement. Also need to spare a thought for those who are in or near retirement.

Surrender value ate that up.

I was/am expecting bigger more extended drops. The share prices are so high in some sectors that there is a long way down to fall before they reach sensible prices and that’s before any ‘over-reaction’ brings it even lower. It just needed a spark to trigger it.