Actually i think you are looking at “Current price / ATH” and I am looking at “ATH/Current price” ..right?

Hah, yes, but also absolute (personal) portfolio value.

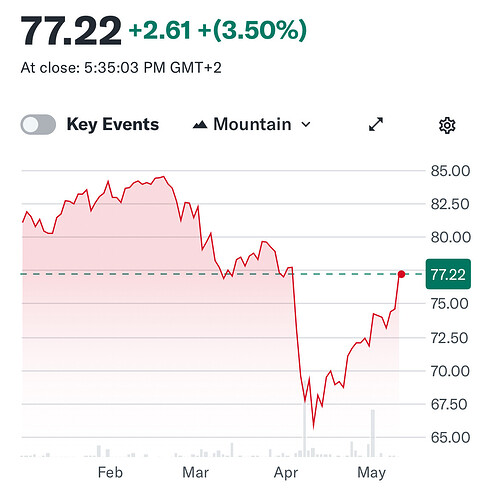

Hm, seems I was down max about 16% and now only 3% (tracking in euro).

Measured in CHF, I went from >+6% to <-6% due to liberation day. Right now, I’m back to around -1%.

Pathetic, only +2.5% ![]()

I think these quotes are undeniably good, though, even if it’s all in the space of no more than 2 months. I’ll take a recovery in the real world as more valuable than paper exercises for academics.

That said…never buying on massive green ![]()

Stress when the market goes down, stress when it recovers, stress when .* (regex ![]() )

)

So folks, are we done with the “bear market” then? ![]()

![]()

![]()

![]()

-1.27% down YTD (in CHF)

Is this the definition? Isn’t a common notion that bear market starts when market drops 20% from ATH and its over when it goes up 20% from the dip (arguably also stays there for a while).

But you don’t need to end up at ATH again.

E.g. if we declare 65.5 as dip bottom here, 1.2x65=78.6, so very close to ‘bear market over’.

Doesn’t change the fact that we still miss ~10% from ATH of course.

Oh I didn’t know

I always assumed bear market is over when ATH are achieved again

Interesting to know

Bear market already over?

They don’t make bear markets the way they used to be.

“I see no hope for the future of our people if they are dependent on frivolous youth of today, for certainly all youth are reckless beyond words… When I was young, we were taught to be discreet and respectful of elders, but the present youth are exceedingly disrespectful and impatient of restraint”. (Hesiod, 8th century BC).

They even buy all the dips before they can really dip. Those darn impatient youth of today!

Depends, you planning on buying anything soon? ![]()

Yep, for me the bear market is over. Today the SP500 reached over 95% of its last high, that is one of my measurements. Normal operation resumes…

10 year Treasury yields are up to almost the level when Trump folded last.

/party poop mode

Can we pause for a sec and mull over the fact a POTUS told the world to buy stocks days/hours before a rip up, twice?! Is this some hare brained “strategy” to absolve from liability in the future?

I don’t think that’s bad, if anything it shows he’s aware of the gimp with the big stick (bond market).

Same POTUS launched a crypto and would have rugged-pulled it if we didn’t have to assume anybody buying anything from him at this point is doing so willingly.

I don’t think giving insider stock advice even registers on the scale of his financial grifts anymore.