We need a clown emoji! On a Tesla.

I think there should be a policy (in any country) that anyone taking office is not allowed to manage their social media accounts / any PR by themselves. ![]()

In the meantime

“Starting next month, May, my time allocation to DOGE will drop significantly,” Musk said during a Tesla earnings call. Tesla stock rallies on this news

Elon lost more money personally than he would save for US via DOGE work. Now that’s what we call national service

Well, I’m a social democrat, centrist, I think it’s the best of both worlds. Free market with some measured oversight and sufficient economic and social safety nets to protect people from total disaster and dehumanization (and the rest of us from crime) and hopefully allow them a bit more space to do something good with their lives. It’s far more efficient, too, and the RoI on state-funded healthcare and education is galactic.

My point was more than Musk losing money (which he had on paper) is nobody’s gain whatsoever and that’s a waste I’d love to see mitigated somehow. I also find it unreasonable that it’s even possible for a single person to control hundreds of billions. There’s nothing, nothing they can’t buy - except time, as Bill Gates has said - so after a point the question becomes “what’s the point”? My drivers aren’t political, they’re about efficiency.

I don’t know the data, you could well be right. I think the underlying thread of creating great wealth is finding a problem, an unmet need, and solving it or meeting the need. I doubt that taxing JD Rockefeller, Henry Ford, or Berkshire Hathaway (largest tax bill in human history in 2024) stopped them from creating value ![]()

It depends on how much tax. Not sure what the number is but there is a sweet spot for taxes above which people don’t feel like working harder. And sometimes governments can go crazy and it’s very damaging.

The first income tax rate in newly independent India was as high as 97.75% with 11 tax slabs. Reducing this sky-high tax rate was a major challenge for the country. Over time, India witnessed a significant decline in tax rates, from 97.75% with 11 slabs to 30% with just three slabs. The country has come a long way in its taxation journey.

Is that doublespeak for ‘communist’?

![]()

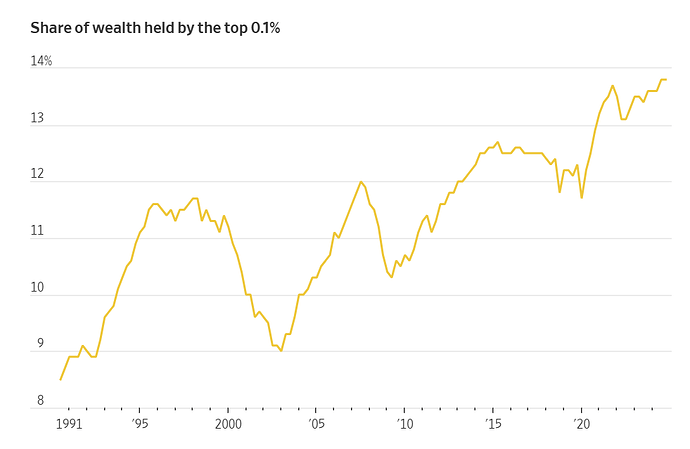

From today’s WSJ, the share of wealth held by the top 0.1% (in the US):

(Source)

They should also have a plot for how much of world‘s wealth in controlled by 5 people in the world (leaders of big superpowers)

They can literally destroy half of it with stroke of pen

Seems a little too political to discuss, maybe.

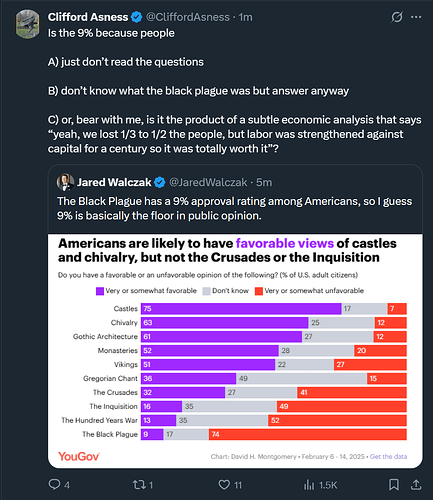

Let’s turn to … surveys.

(Source)

Just love Clifford Asness' repost/answer here.

Sure, for some Americans ![]()

We have home Bias. I had mine related to Switzerland. In the end i chose this year to go away before the dip because it was capturing less benefits, but the same dips

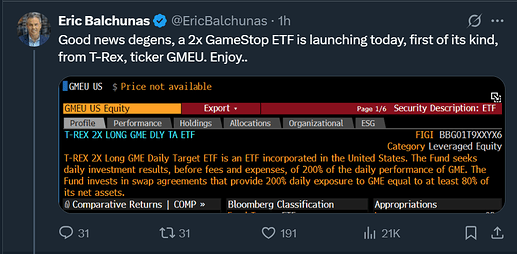

A leveraged ETF for a single stock? Lol?

There are even 3x leveraged ones for Nvidia/Tsla/ Apple and more.

Just another company having Bitcoin on its balance sheet. Nothing to laugh here…

There’s BRKU, a 2x leveraged BRK.B, I am seriously considering getting some ![]()

There are lots of leveraged products in CH with same mechanism, they are called factor or constant leverage certificates and belong to structured products. Do you want 12x daily leverage on novartis, well your luck is in. UBS even issues these products, certainly an easy way to loose money fast ![]()

KKS and Parmelin met with Bessent today. Apparently, the US has defined a group of 15 countries they want to make deals with quickly. CH is part of that group, and US and CH plan on signing a letter of intent defining the areas that would be part of a deal.

Tough job for smaller countries like Switzerland. I hope the deal will be fair and not just squeezing cash from CH to US

It seems CH is having discussions with the three major economies simultaneously

I’d wish our politicians were tougher negociators than I expect them to be but my guess is that Bessent is after ways to offer Trump an off ramp that saves face. In that context, having a deal quickly would be more important for them than having a deal that is actually very good for the US.

There may be room to make a positive or mostly neutral deal for us, though I wonder how the EU and China would react to us playing the three sides at once (basically being Switzerland). From a pure investing perspective, this reassures me toward a CH home bia: we’re a small country with a small market but we’re very mercenary in our dealings and our politicians will support our economy in trying to deflect all end-of-the-economic-world scenarios.

Things being the way they are, what gives us confidence that any ‚deal‘ will be adhered to for longer than the ink underneath it needs to dry? Wouldn’t it be better to stand back?