User Pekotski is silenced for aggressive behavior and direct insults.

To be fair, even with the pause there’s still a global 10% tariff, that’s still a fairly big change (imagine if you had a 10% VAT added overnight).

(that’s the thing with doing something outrageous and rolling back, where you end up is still very different from where you started).

So Trump blinked. I guess China gave him a way out - he can still look tough while walking back nearly all the reciprocal tariffs.

I think in the end some agreement will be reached, but I think the stock market may have suffered some permanent damage as investors have been rattled and are unlikely to be as enthusiastic as before… then again, we are known to have short memories…

I’ve been waiting for a blow off top for years now and I think the successful resolution of the Trump tariffs (including China) could finally be it.

Yep, the goldfish on reddit are rejoicing like it’s all fine. This is not even a dead cat bounce, there’s ways down left, my estimate remains 4000-4200 for the S&P500, as do my buy targets.

@PhilMongoose how did Trump blink when he hiked tariffs for China?

If countries don’t learn a lesson now, then they should not complain when they get bullied next time around.

What happened today is the proof that people forget very easily… All this thing about loosing confidence may make sense for leaders and geopolitics but for the stockmarket is another story.

Let’s generously assume there is a plan; implementation is still amateurish at best and a disaster at worst for nobody bothering to do their homework.

Indiscriminate DOGE cuts may end up costing more than they saved.

Abrupt tariff moves spook markets and lastingly destroy credibility in the US as a whole. People like Navarro spouting obvious BS on TV will not help. Naming the tariffs ‚reciprocal’ if they are anything but doesn’t help either. And what are they about - additional government revenue, or clawing back blue collar jobs - both at the same time won’t work, right? Those $1t in interest may actually grow if treasuries continue to sell off.

I have seen declines like that, but I have never seen a daily rise like that. My momentum portfolio with 38 positions is up a stunning 15.45%.

I don’t understand and never will understand the market participants… and I am one of 'em.

There are new players that can manipulate markets without fear of punishment. But only because the market participants (we) let them…

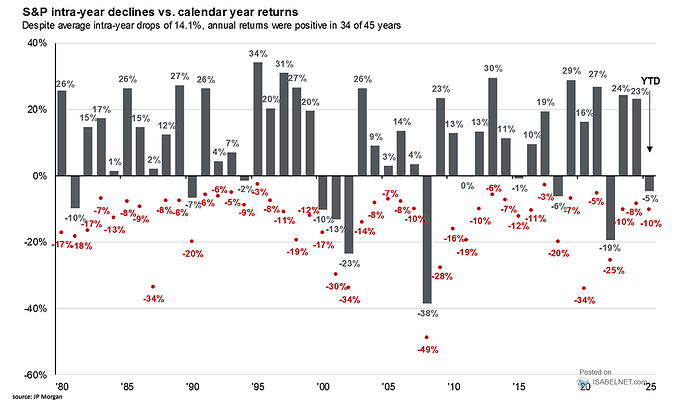

This vid has an expanded explanation of this graph: https://www.youtube.com/watch?v=3PxqwZcTpc0&pp=ygULamFtZXMgc2hhY2s%3D

I don’t know if this pause is caused from position of strength (many countries offering concessions or from position of weakness (due to US30Y & US10Y spikes & stock market crash).

But the plan was already defined by Stephen Miran in details. It is exactly what they are doing. Putting countries in buckets of green, red & yellow.

Next step could be Debt restructuring & USD devaluation as US got most countries scared to death.

You are too emotional. Judging by your post history you hate the man personally and nothing will change that.

It may look amateurish (the “formula”… 0.24*4) when Trump talks about it, but you have to stop listening to him. Look at the people behind him, like Scott Bessent. You think they don’t have a plan, seriously?

Care to elaborate? Do you know how much the federal government spends? How do you plan on cutting it? Put some politicians in charge and check back in 4 years? We can also take the European Union way, where we propose something and create more regulation to cut other regulation sometimes soon. It’s better to do something, than doing nothing and you can hate it as much as you want, but we both know that DOGE are right.

I totally agree with you - but it’s the Trump way and he literally said that he is going to do it.

If he gets through with his tax cuts (making them permanent) and can lower the corporate tax rate to 15% I am positive that he can get both. There is far less bureaucracy in the United States for doing business and lower taxes, which both are important for businesses.

If you want access to the United States, either pay a 10% tariff, or move your business here where you have much lower taxes and regulations than in your country.

I might sound like a Trump fan, but and I can assure you I’m not. I’m a fan of government that’s actually pro-business and low-taxes. Here in Europe everything they talk about is more regulation and higher taxes, because it’s not like we are already getting taxed to death (income tax, wealth tax, consumption tax, mineral oil tax, inheritance tax, electricity tax, emission tax on equity increases) and what’s the solution? MORE TAXES! /rant

I am glad that Trump blinked. Otherwise, we wouldd tomorrow be in a very difficult scenario.

The key question now is what Mr Market thinks of 10% tarrif and the China situation. I wouldnt be surprised if turbulence comes back after the weekend.

Strange times it is…

I think this Reddit post is related

What I don’t quite understand is with such a high inequality in US, how come US is larger market than EU.

Most wealth stays with top 10% of people in US but their per capita consumption is still very high.

It seems either US lives beyond their means or Europe is more focussed on saving than spending

I think a small global tariff plus stronger ones on China is where we are likely to land so already close to this. Best case, US China hammer out a deal too.

But I don’t think this is the end. Europe isn’t out of the woods yet. For sure, I think Trump has one more plot twist left in him so would not be surprised if these some of the higher tariffs are brought up again.

If the world gets 10%, I think everybody is already resigned to that and can live with it.

Isn’t it well recognized? (I think it’s acknowledged as a source of trade deficit for the US the fact that there is little saving and a lot more consumption, and then you have countries like Germany that are probably the opposite ![]() )

)

I think more harmful than the tariffs at this point is the uncertainty. Companies still don’t know where they have to build their next factory.

They do live more on credit, but also have more money to spend, because they don’t have to pay so many taxes. Mind you that lots of US states have none to low sales taxes, or even income taxes (+federal). Most people also invest in the stock market where their wealth grows (including pension funds) that also is not taxed very much compared to the rest of the world.

Ignoring all what I said above, I just think they have a different mentality and risk appetite, which I can’t comprehend.