Okay.

Then I think IMID is only real alternate for a one ETF solution

That’s the magic of ETFs, compared to mutual fund they avoid internal capital gains since they only do in-kind transfers with the AP.

(that’s why vanguard mutual funds are often preferred in the US since they have the patent for structuring the mutual fund based on the ETF, patent is expiring soon tho)

So we are back to the fact that there is no good one-ticker solution to VT on the UCITS side.

Taxation of events occurring within ETFs is magic indeed.

Only @nabalzbhf or @Dr.PI can handle this.

However CGT even for us as investor is only when we sell the ETF.

If you want all components of VT , then yes. There isn’t one to one alternate

Following can come close to it.

WRDUSY + EIMI + WSML

So not so simple ![]() (that’s the thing I also don’t know, UCITS are more expensive, might want to split US vs. not and get a synthetic US one, etc.)

(that’s the thing I also don’t know, UCITS are more expensive, might want to split US vs. not and get a synthetic US one, etc.)

Also some people have 7 digits portfolio split across brokers (some brokers I don’t want to trade with because the cost would be really high, so need to also transfer back to IB. So not so trivial and might need to plan ahead ![]()

Yes, and would stay that way as it’s the country of our domicile which decides that. I was more worried about internal costs being miracled to mirror a CGTs but will look up what @nabalzbhf mentioned. In fact I saw something about the Vanguard patent on reddit today but didn’t have time to check it.

I think about similar combination, but using state street:

SPPW+EIMI+WSML.

Just don’t understand why SPPW (most liquid large caps) still do some sampling for a fund of 11 bln Euro.

Or on FTSE Vanguard side VHVE (FTSE developed)+VFEM (FTSE emerging)+WSML. I like Vanguard, but this combination would require an ugly mix of FTSE and MSCI indices.

Well.

It’s not so simple. Today we don’t see CGT because of the treaty DTAA.

Even with ETF route, if US wants to tax foreign investors for CGT in US, then we as investors would incur a tax too but this most likely would only happen when ETF itself redeems the units. And hence it would move the NAV of ETF up and down.

This is quite visible in ETFs tracking India. They continuously need to „provision“ for capital gains tax that can incur because you never know when they need to sell the underlying units.

I agree, it is also not so easy to replicate VT on the UCITS side.

And we’ll have time.

If they introduce capital flow restrictions overnight, it would be another story.

I was just promoting European provider ![]()

This is my personal goal for 2025 to support European ETF providers as much as possible

SPDR route can be ** SPDR ACWI + WSML**

You might be too much worried about sampling. If you look at SPDR ACWI stock list, it’s too many stocks. I don’t really think that the ones they exclude really are material ones. They might just add to cost and not much to returns.

If that happens, there wouldn’t be much to move around. Market would be down 50% if foreign capital is frozen because it would simply mean no more foreign money gets in

SPYI has now 3 705 stocks while the index has 8 600.Taht’s quite a sampling; tracking error is 0,52%. No thanks (this is likely an autistic index purity pursuit on my part ![]()

Actually I was referring to SPDR ACWI which has 2277 stocks and index has 2645

I had the same thought ages ago. While VT having “everything” (in fact VTI+VXUS have about 3000 more) I’m personally not worried that VWRL’s sampling will miss some crazy hidden diamond stock from Lesotho which will become the new Microsoft. If it is in line to become a new Microsoft it’ll be picked up soon enough. Fun fact, as an ignorant white guy I looked up Lesotho’s stock market. There isn’t one, HOWEVER Lesotho companies can be listed in South Africa’s stock market which has, apparently, beaten the S&P500 on a 100-year basis (along with Australia). That said, I understand someone wanting to sleep better knowing they truly bought the haystack.

So it may not be so simple but it’s also not unthinkable, and there’s precedent and mechanism to do it.

For 269.45$ and 69.83$ each and 0.881 USD/CHF ![]()

Omg I can‘t believe I got lucky once xD

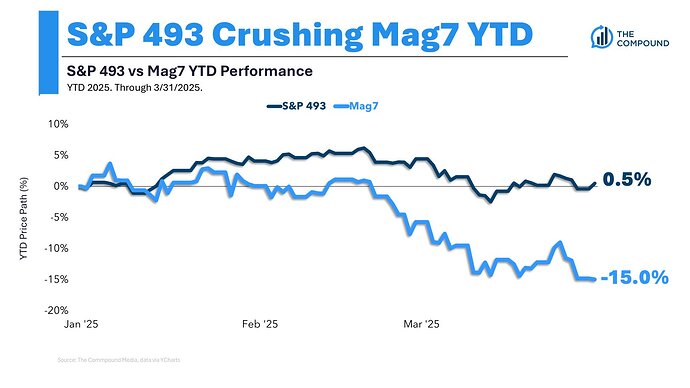

What in the market anomalies is this! ![]()

We truly live in unprecedented times.

New long-term trend just dropped: The end of American exceptionalism

So according to the Trump administration, Switzerland charges the US 61% tariffs, so the US will now charge Swiss imports with 31% tariffs.

Anyone know how they got to 61%?