Sounds very sensible to me!

In other, other words, he’s counting that in the short term the market is a voting machine and in the long term a weighing machine ![]()

He is counting that market is simply a gambling machine. That’s my read watching the video. He is not counting on market to ever go back to drive stocks to their true value

But you can still buy companies which make money and just get rewarded in terms of dividend / buybacks

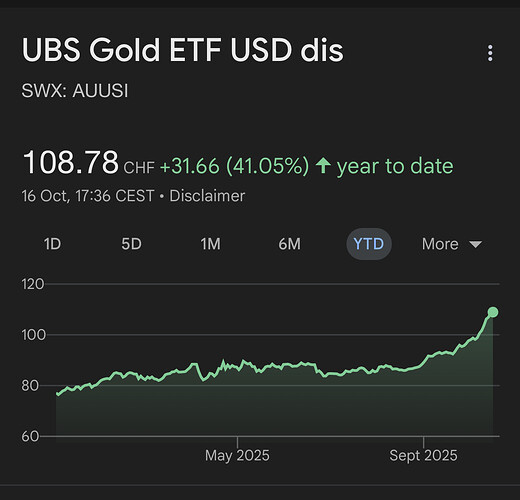

BTW looking at Gold rally, it feels like something very strange / bad is ongoing and we just don’t see it

Gold is up more than 40% this year (in CHF terms) and something which has 25 trillion USD market cap, it’s not a micky mouse move

So basically, in the end, which ETF is safe to buy with these conditions? Is there an anti-passive ETF passive investment? Maybe an inverse market-cap weighted index?

Who knows, maybe we’re all (most, anyway, except those actually living off their investments) blindsided by the “historically line always go up, mkay?”, “diversification is the only free lunch”, “time in the market”, “TINA”, “99.99% of active managers end up in hell” etc axioms.

Oh, and “this time is different” ![]()

Edit: what on earth is the sweat smile?

No. I don’t think it’s possible via ETFs. Most likely investor need to find companies with good balance sheets, earnings growth potential & low PE multiples

Didn’t know there was a product to buy gold with hedging. Seems like it’s a double bet - Gold & CHF

I was half joking with some contradictions, but some ETF have to be chasing these criteria…

Maybe in 25 years there would be a research paper, 99% of passive investors underperformed US bonds ![]()

P.S -: I am also passive investor

Exactly, you read it here first.

Which looks like a safe double bet when looking for safe haven asset class.

I am sure soon we will have a product called

Make your own ETF -: just like make your own pizza

Please stop trolling if that was not a typo.

That is exactly what I do since over a decade.

Care to specify?

I was almost serious. ETF (passive) and active investments only work if they use at least one mechanical element: money and probably position management. What happened to the clients of Peter Lynch: they lost money with a fund that made 28% CAGR over a long period of time by buying high and selling low. They were not passive at the moments that count.

So you meant active approach. Maybe

OK, I see. Sorry for my English, it is a bit rusty. This sentence makes no sense. Probably “… do not make money if they do not use a passive approach when it really counts”.

TBH you have various dividend ETFs, value ETFs, quality ETFs, yield ETFs, ETFs using joint metrics etc.

e.g. Avantis/Dimensional have some well published value+profitability ETFs, and Cambria has a total Yield ETF.

You may not like the mechanism or TER of these but there are definitely mechanical ETFs out there.

Yes there are, thanks for mentioning that. If you use one of those that fulfill your requirements you don’t need to build your own ETF like I do.

But still, you need a “mechanical” approach to position and money management. Otherwise you are in danger of losing a lot due to behavioral errors in key moments (buying high and selling low).