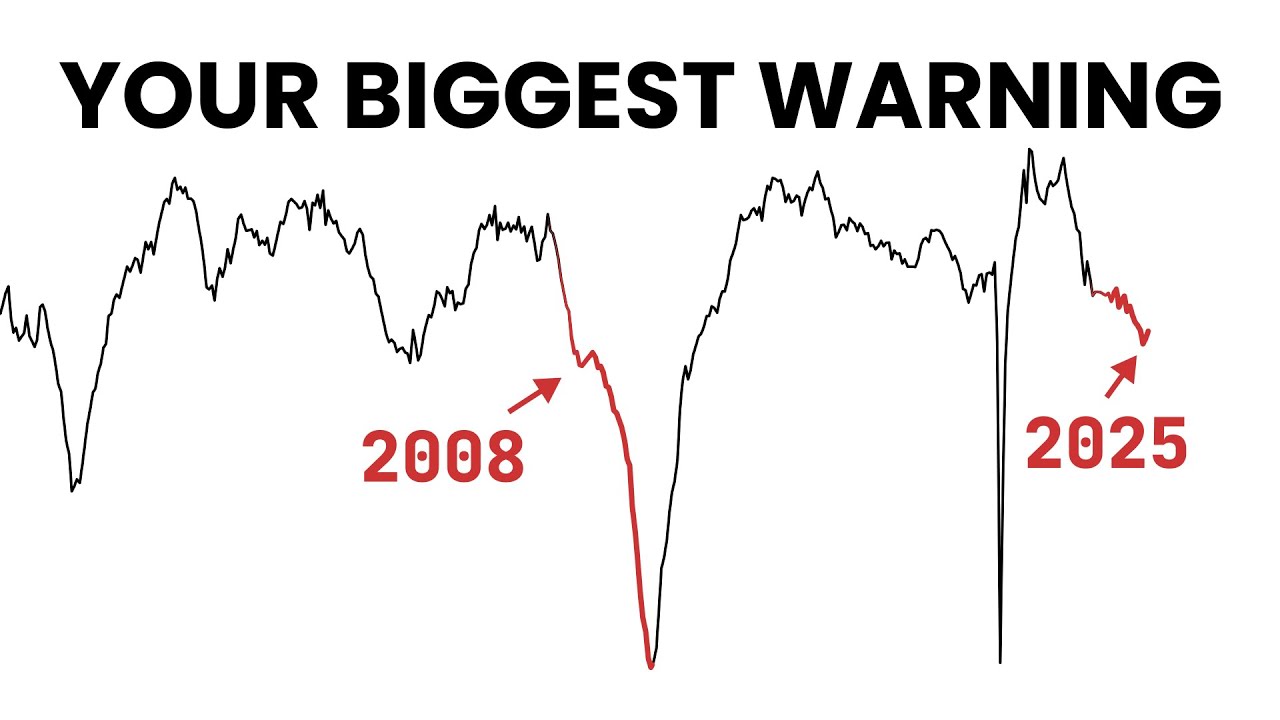

What is this chart showing?

Do I detect a change in the air? A fat winter is now giving way to a nervous spring. US politics is causing volatility. A spate of economic indicators is less favourable than anticipated. The previously over-confident retail investor seems to be getting a little worried… plus Cortana just invested.

Is 2025 going to be the year?

I have to admit, I’m somewhat nervous because my asset allocation has moved away from the target 70/30 stocks/bonds to around 80/20 and 18% of that 20% is going to be sold to put into the pension fund over the next year. So I’m trying to figure out when to sell stocks to fill/replenish the bond portion of the portfolio.

I guess in principle, I could consider the pension part of the bond portfolio, but only 2% liquid doesn’t leave much room for re-balancing.

Ideally, I’d get one more fat year during which I can sell. But hope is not a strategy.

Guilty. But in my defence even the latest Unhedged podcast notes the ‘Vibes shift’:

Bracing for the Cortana effect.

The -X% thresholds hit will/would turn corresponding cells red. ![]()

(Relative to ATH and my own avg price)

((Some ATH might not be fully up to date))

Sadly, I have no rules ![]()

I am no big fan of bonds. In the past one could make some “Shannon’s Demon” money by rebalancing, but I think this is over because of correlation. And it wasn’t much anyhow.

However, all the professional money managers tell you that you have to hold bonds. That alone would be a reason for me not to hold bonds.

Bonds are money and cash is trash. It is actually the only good with a state guarantee to lose value.

Don’t get me wrong, I like debt. But I prefer to owe to someone than someone owing to me. It is just a question of who has to run for his money… and debt is cash and cash has a state guarantee to lose value.

It’s funny because the “vibes” are mostly read online. Which is exactly the place where influencers (the real ones, not the insta-fad people) do their job.

I can see the army of chatgpt enabled bots filling the virtual air of the web with people wondering how to move to european etfs ..

Apart from that there are real reasons to be nervous (as usual?)

In a deflationary crash this will still work really well. Inflationary bear markets like recently, are pretty uncommon.

I think you current view is pretty recency biased by 22/23.

2000, 2008, 2020 were all good for bonds and having bonds on hand to rebalance.

They still absolutely have a place to dampen volatility of your portfolio.

I hate debt. The saying goes “When they owe you money, you have a problem, when you owe money, they have a problem” ![]()

Lots of thoughts on your suggestion of the Chronicles of the Lean Years, but I feel none (of mine) are interesting … or at best as interesting as market macro considerations (read: smart sounding but useless).

Off topic:

Anywho, your little quote still caught my eye:

This was Ben Treynor’s – Google’s VP of Site Reliability Engineering* – favorite quote when summarizing his team’s strategy. Of course, he still spearheaded many many outages, but folklore often trumps track record and people grew fond of quoting him for saying this.

Anyway, I wanted to talk about a different anecdote: Ben, being a relatively early Googler and an early on exec, made a bunch of money from Google stock and spent a fair bit on his car collection. Not only did he own those cars, he posted about them in car enthusiast forums … until forum members questioned whether he really did own all those expensive cars.

Ben responded by asking fellow forum member what kind of pastry he should place on the bonnet of expensive car X, and then posted a picture of car X with the pastry demanded on the car forum.

E.g. Italian bread on a Ferrari 458 or crumpets on a McLaren 12C.

Probably my kind of humor if I had that kind of money and reached that level of decadence.

In person, I never really liked Ben as he always struck me as hypocritical, where standards for him were different than standards for others.

Maybe that’s why he is still at Google and I am not.

Or I am just jealous. ![]()

* SRE (Site Reliability Engineering) was or probably still is Google’s elitist term for a system administrator (of course on steroids), making sure Google never goes down [the Wikipedia page is a little short on earlier outages, including the one where a datacenter burnt down, prompting Google to have at least two data centers …]).

Lol what a dude ![]() gotta like his IDGAFness at least

gotta like his IDGAFness at least

https://www.autoevolution.com/news/google-vp-benjamin-sloss-treynor-gets-ferrari-fxx-k-for-his-wife-races-her-in-his-599xx-99281.html

They (with his partner) are proper race car fans, it’s not just to show off their collection, they actually have track-only cars and use them ![]()

Chaos is only a problem when it presents itself as order.

Those indicators work perfectly… after the fact.

It‘s coming.

You bloody clockwork ![]()

And this time even nicely prenoticed months ago, yet we all hoping it must be coincidence every time anew.

Good man, can you time it so that the bottom is in June? Just to align with my saving plan please.

Seriously though, why do you lever up and all in US right now, doesn’t seem prudent.

More seriously, I expected nVidia’s earnings effect, we’ve seen the same what, three times in a row already?

Anyway we’re back where we were a month ago.