How I read this is that they welcome china money, but without corresponding voting rights (I don’t think it’s a message to amundi/state street/vanguard clients).

I don’t think US wants to limit the investment by any passive investors or regulate this investor class (where we all fall). IMHO it is good to diversify to spread risk but to change the investment plan based on one’s interpretation of policy might be stretching a bit too far. Again, each one has a different outlook to investing and it is good to take steps that align with an individual’s approach but to have blanket statements on assets getting frozen might be going a bit too far.

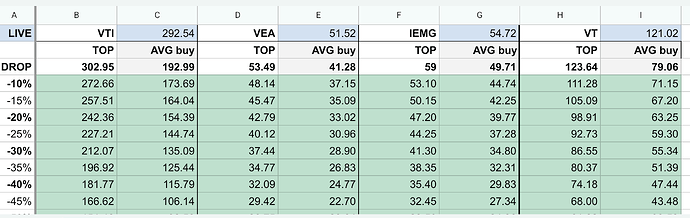

CHDVD up, VTI down.

hmmm

Just pre-empting! I’m tracking 5% drops myself and not moving before 10% ![]()

Can anyone explain to me what exactly this deal is?

50% of future revenue from future unexplored resources from Ukraine would go into the fund. This fund will invest in Ukraine. Agreement doesn’t say how much money would need to be deposited into this investment fund and for how long.

But what I don’t understand is what does US get out of this? How exactly are they getting their money back if the fund invests in Ukraine

Not sure I can explain but my understanding is that the US would have either a controlling stake or at least a high decision stake in the investments the fund would make, gaining an ability to direct it toward US companies (that would invest in Ukraine so the deal would still benefit Ukraine).

As with everything Trump, we’ll have to wait until the deal is signed to know what will actually be in the final version of it.

I see. So it’s kind of a way to control who eventually explore the Ukraine resources.

This might shut out EU & UK and reduce their access to the minerals

Btw - I feel there is too much FUD about rare earth. I wonder who come up with these names

Rare earth is not that rare

Greenland is more icy than Iceland

It’s also not clear what Ukraine gets, right? (there’s no hard commitment).

However, the agreement omits any reference to US security guarantees which Kyiv had originally insisted on in return for agreeing to the deal. It also leaves crucial questions such as the size of the US stake in the fund and the terms of “joint ownership” deals to be hashed out in follow-up agreements

I think what Ukraine gets is economical entanglement with US and also a way out of this continuous „sign the deal“ discussion

Reality is that to put something in fund, some money needs to be made first and that would need some investment too. So most likely US will provide aid which will kickstart this fund

Breaking news

US will sell GOLD Green cards for 5 million USD and will launch it soon.

1 million cards would lead to 5 trillion USD , 10 million cards would be 50 trillion, as per Trump.

He forgot to mention there are only 58 millionaires and 22 million already live in USA ![]()

I’m lost, this sounds like EB-5 visa but more expensive? Why would anybody take it? (OTOH, AFAIU EB-5 processing backlogs are so slow Trump may not be president anymore by the time you get approved, especially since job cuts aren’t going to make this move any faster …)

Yeah it’s a replacement: Trump floats $5 million 'gold card' as a route to US citizenship | Reuters

EB-5 is an investment, Trump wants extra revenue from foreigners (tariffs, taxes, etc)

That is unfortunate. The money was lower, and it being an investment indeed meant you’d likely get your money (or a bunch of it) back eventually. There goes my backup plan if I ever wanted to move to the US (given that the (L1-A/B + ) H1B + PERM path seems like an utter mess too)

Kick them out and force them to pay $5m to be allowed back in ![]()

Atleast they are trying to reduce debt …. I like that . But it also shows how desperate US is getting as there are no simple ways to reduce debt.

I also find reciprocal tariffs very dangerous.

Normally when US applies 25% Tarif on one thing, the other country applies X% tariff on something else to compensate. This is because mostly the trade is not on exact same thing. But the reciprocal tariff means that the new tariff from other country would have a reciprocal effect to the original tariff from US. It sounds like a fair deal but it’s actually very tricky

The plan also calls for $4.5 trillion in tax cuts over the next decade. […] In order to get the budget plan just to this stage, Johnson was forced to concede to a demand from some conservative holdouts for $2 trillion in spending cuts

https://www.npr.org/2025/02/25/nx-s1-5308067/house-republicans-budget-vote-mike-johnson

Don’t think the goal is to reduce the debt, there’s way more tax cut planned that any of this extra revenue.

(But it is Trump’s dream to remove things like income tax and replace it by things like tariffs, nevermind the fact that tariffs would end up being at least partly paid by the end consumers unless US disconnects from global trade)

this won’t do anything that noteworthy for the debt. As per Record-Breaking EB-5 Visa Issuance in FY2024: An In-Depth Analysis of Monthly Consular Processing EB-5 Visa Data Through September about 12000 visa/year were issued, and at a $5 million price tag I’d expect demand to be significantly lower.

Talking new rules, I found this to be interesting: the america first trade policy executive order (Trump executive orders signal a new U.S. frontier for cross-border tax Gide):

Section 891, which has been in place since 1934, permits the President, at his sole discretion after an investigation finding tax discrimination by another country vis a vis the United States, and without Congressional involvement let alone approval, to double the tax rate on citizens and corporations of any such foreign country found to be engaging in discriminatory taxation of U.S. interests. The scope of the taxes covered include income tax and withholding tax.

This seems particularly spicy with Trump targeting digital services taxes (White House announces directive to counter digital service taxes (DSTs)) and … VAT?! (Trump tariff VAT threat raises prospects of hit to UK)

Gotta see what comes out of this, these are only investigations yet and it isn’t necessarily clear to me whether the retaliation would be through tariffs or these other mechanisms, but looks like there is at least potential for it to be spicy. Luckily not too much targeting Switzerland (or Ireland, for those holding UCITS ETFs) yet, but we’ll see if he comes back to Switzerland “manipulating” their currency.

Put 20k USD into VTI and UPRO yesterday. Feeling fine now. Overall leverage of ETF portfolio at 1.33x ![]()