I guess the inflation could be balanced out by recession.

Most likely suppliers have not raised prices yet because they didn’t know what will happen in certainty. We cannot blame them as tariffs change on daily basis

I think prices will raise slowly to compensate 10% tariffs. But this might take some time.

Why should there be recession?

Unemployment isn’t high. Tariffs won’t cause job loss because 10% is not enough.

I do think we can have a technical recession without significant unemployment if the workforce shrinks significantly. And Trump’s deportation policies have some potential there. Not only considering the actual deportation but also ending the protected status of large groups of people (like 500k Haitians) would likely cause a significant number of them to leave voluntarily.

Now whether that is enough to cause a recession, who knows. But if we have crazy policies, I wouldn’t be so sure about assuming normal correlations.

Well it’s possible but not probable.

Deportations might impact growth rate but I doubt it can push US into recession

The main reason for recession would have been an all out trade war which would have shutdown production

However it seems most countries are willing to accept tariffs from USA and move on with their life. US will have some inflation , they will pay back in terms of tax cuts and life goes on. Other countries will form other ties with other countries to reduce dependence on US. That’s about it.

Personally I think the bigger threat is debt issues and de-dollarisation which would continue to hang over the head

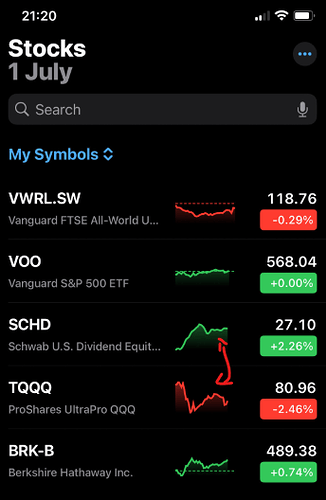

What a funky day: S&P500 flat, VWRL nearly flat, TQQQ and SCHD diametrically opposed.

I agree that these are not jokes. In Greece we say “The US catches a cold and the rest of the world gets pneumonia”. However no-one lives forever, I’m more worried about my job than my investments, if I keep my job I’ll continue plugging, eventually the pile will become big enough to be self-feeding.

Join the dark side of the Force, use UCITS World ex-US funds. No US, no China. Let them play together whatever game they want, sit on the sideline, eat popcorn. ![]()

Disclaimer: you may not outperform. That’s part of the deal.

Edit: RE: Tariffs. My understanding is that we’re going for round 2. The US will, I quote, “send letters” to countries saying for example, still quoting, “Dear Mr. Japan, here’s the story. You’re going to pay a 25% tariff on your cars.”

Apparently, Japan and the EU would end up with more than 10% tariffs. China probably too. We’ll see how it pans out.

On a different note, since the Senate has passed the Big Bill, it just has to pass the House once again and they’ll have raised their debt ceiling and avoided default for now.

Life was easy when global investing was not a thing ![]()

Everyone was investing in local companies and was happy.

The chart is quite impressive (and reflects what I see in my IBKR account… ![]() )

)

The assumption has always been that a world ETF of stocks is exposed to USD not through the trading currency but through the currency in which the underlying companies conduct their business.

Therefore, I personally wasn’t expecting such a significant divergence over a relatively short timeframe—and it leads me to wonder whether any mitigation action could/should be taken, considering that my spending is (and will likely remain) in CHF…

I think CHF appreciation is not new. CHF is gaining versus most major currencies. You can plot long term chart of CHF/EUR, CHF/JPY, CHF/GBP, CHF/USD. All of them have been devaluing since long time

The new thing is that USD/CHF was stable for a decade during the zero interest regime. This might have given a false impression that currency exposure doesn’t matter. And the steep fall in last 12 months have woken up the currency discussion

It’s really not possible to avoid currency issues when investing abroad. The only logical thing to think about would be re-evaluating currency exposure of the total portfolio and consider higher home/regional bias

This article is interesting. Note that it is from the period of zero interest rates. They are basically saying hedging is cheap when difference in interest rate is low, so it makes sense to e.g. hedge JPY, but not USD:

Why can’t you people just stop spreading misinformation? There is no way a global company like Nestle has much to do with the CHF.

Hedging the CHF can make sense to correct for CHF movement, but it has nothing to do with your actual allocation (that is not a cash equivalent). It certainly never has to do anything with the currency used to quote an asset. That means you would use the same currency hedge for Novartis and Pfizer.

Amen

![]()

Basically to prove a point you picked the example which supports the point

First of all we are talking here about CHF/ USD. So we need to consider companies which don’t have underlying USD exposure

I agree Neslte doesn’t fit the bill. But what about Swiss mid & small caps? What about Swiss real estate companies ? What about Swiss real estate funds? And Swiss hospitality & tourism?

Are all Swiss companies have such a high USD exposure that investing in CH is equivalent to invest in US from currency exposure perspective? I don’t think so. You might. But that’s okay

In summary -: there are ways, it is not SMI ETF perhaps. I typically use Swiss RE funds if my main concern is FX as it is a clean cut. Having said that FX is not my concern

P.S -: there are more reasons (other than currency) for home bias . But this discussion was triggered by FX, so I try to stick to that

Yeah, if we define investing in the SMI as investing abroad. But normally people do not have that definition. Probably because there is more than currency to “abroad vs. home-bias”. Notably, jurisdiction.

If we invest in a small local bakery, we might actually have a relatively high exposure to the local currency (still, it is a business and not cash). This is of course a spectrum. Unfortunately, the more local the less investable.

I’m nearly certain, you yourself did not think this through and redefined your “abroad” and “home-bias” to fit your argument. This distinction is vital and must be mentioned to remove this widespread misconception (e.g. to prevent finance “experts” from confusing themselves and others to charge higher fees for it).

The point I was making was that when investing abroad , one need to take fx risk. It’s not easy to avoid it. I think we both agree on this point

So my suggestion is that if someone want to avoid FX risk, they need to invest more locally.

Are you fundamentally disagreeing with this statement? Or you are disagreeing with the framing of this statement as I should have been more specific?

If you think investing locally is not an option then what is the option? Because I only saw you think investing in Switzerland doesn’t help and you labelled it as misinformation . But I didn’t see any suggestion

I think, I mostly disagree on the framing and the wrong conclusions that follow from it. Here again, the problem is not foreign exchange → the USD or the EUR move adversely against the CHF. A currency that you do not hold plays next to no role in this. The problem is that the value of CHF is moving adversely against everything else.1

That leads people to think about quoting currencies and that they need to hedge them. But they got it all backwards.

It is possible that one can buy a diversified local equity basket, maybe even in ETF form. One would have to check how much that increases correlation with the local currency and how much side-effects (return, risk) that has.

The other option is to hedge the local currency against a diversified currency basket. I suspect currency hedged global equity funds do this somewhat acceptably for the wrong reasons. They take the quoting currencies of their equity basket and hedge that. This unintentionally is a somewhat diversified currency basket. I would argue though, that the USD is overweight and GDP weighting would make more sense. But there probably is a better answer built on empirical data out there.

And the third option is to accept that not everything is hedgeable. If living costs in Switzerland do increase (e.g. CHF value increases, but consumption prices don’t fall), why would the market pay that for you? Only unexpected temporary ripples can be hedged.

Footnotes

1: In fact, one likely does not even care about the CHF but about their future consumption in Switzerland which does have a somewhat high, but not that high, correlation to the CHF. If we talk about consumption more than 30 years in the future, I don’t think FX hedging will help much.

Thanks for detailed response. Makes sense to me

Probably true, but you have fx risk in everything, absolutely everything. There are very little things in the world that can be calculated without fx risk.

That being so, just ignore it. Every company is its own currency. Everything you look at currently has some parts in it that carry fx risk. It is very unsane trying to avoid absolutely every risk. In case of currency it is nonsense, it is either very expensive or adds risk.

Many beginners are afraid of currency risks on stocks. As I showed in a chart comparing the Dollar index to the SP500, this risk can be ignored… stocks move by factors of thousands compared to Forex. If you can’t stand the forex risk better don’t buy stocks… or anything really.

Of course everybody is whining about the bad performance of the Dollar… now. Everybody is whining about anything that goes down, even if it is only temporary. Wonder what will happen if the real estate or crypto bubbles pop…

Now that Beautiful Bill is passed and tariffs situation is also becoming clear. It appears that average tariffs of 10-20% would be applied across the board in one way or another. US will be sending letters as they realise deals are tough to achieve. This represents perhaps an effective tariff increase of 12-15% versus 2024

What’s your view on the impact on US Stocks and also ex-US stocks. All priced in ?

From my perspective on Apr 2 there was a big drama but the eventual outcome is still quite significant in terms of tariffs. But now it doesn’t seem to be impacting stocks . Why?