It was the local bottom ![]()

Looks like it, congrats! At what point does a local bottom become…regional?

The evolution of local → regional is exactly what I discuss in my new Geopolitics Explained! substack.

Subscribe for a small fee to learn more!

I will need an affiliate link, the content will not change but the blog will earn a small commission to sock away, and I sincerely thank you for it!

I guess once the local bottom starts selling Substack subscriptions, we’ve officially reached the local top. ![]()

I was wondering what happened

But just saw now we have a Israel - Iran war

Can’t understand the world we live in

I saw the new on Iran, but didn’t look at the financial markets yet. I guess it means I’m not going to get a good price on the oil and gas stocks I’ve been meaning to buy.

They have kind of been at war since, like, 1979 through indirect conflicts and proxies (Hamas, Houthies).

Not today ![]()

I don’t pretend to understand but one piece of the puzzle is that we have authoritarians who use/need wars/conflicts to stay in power. I wish we’d figured out how to work around that but we don’t have a satisfactory answer as of now.

Portfolio up, but my hedges are really a drag on performance.

Insurance is expensive.

In the U.S. I could fill out a “statement of self insurance” for my car and did not need any insurance. In Europe I always do the bare mandatory minimum insurance. The price difference over my lifetime bought me 2-3 new cars…

Up 3.67% on my divi portfolio and 8.01% on my momentum/growth portfolio YTD.

Indices YTD: SP500 +2.73%, Dow +0.12%, Nasdaq +4.48% and the Russell2000 is at -4.77%(!).

In CHF? Nice. ![]()

No, always in USD as I trade only US markets. I think in CHF it would be a loss YTD as the greenback lost more than 10%. Lucky I don’t spend too much in CHF.

I don’t care for the currency fluctuations. Since I started my second portfolio in 2020 the dollar lost 16.61% in total against the CHF but my portfolio made me 26.61%… every year (XIRR).

Even in my boring dividend portfolio I can mostly ignore currency fluctuations. Since 2014 that I started with it, the Dollar lost 11.14% against the CHF and my dividend portfolio made me that about every year (10.17% XIRR).

I think the CHF will feel upwards pressure until the presidency of Trump is over. But I don’t trade what I think and every stock is its own currency.

Ah sure then, VT is also 7.5% up YTD… in USD (without dividends)

-3.5% in CHF ![]()

Nice.

I have no way to beat any index all the times, no illusion about that. But middle to long term (>5 years) I try hard to beat index investing by measurement of XIRR with my mechanical momentum strategy. Otherwise it would not be worth the effort and the additional risk. What is the long term XIRR of VT?

15.38% per year in past 5y, 8.9% over 10y.

Many thanks, just what I thought. I cannot beat it every year, but over time I can and do.

Momentum strategy only 5.5 years, 26.79% per year

Dividend strategy past 5.5years 12.55% per year, 10.18% per year since inception in 2014. XIRR numbers, interest (and interest of interest) deducted.

5 years that I run my momentum strategy is nothing and the high risk there can (and will) cause big losses and big volatility. Performance alone does not say much. I am willing to stomach the risk. And there is the scaling problem, soon I will hit position size limits and that will hurt the performance.

But then 26.79% compounding 5.5 years brings in piles of cash, I live off that strategy since this year as it did overtake the dividend portfolio in value.

I personally don’t think you need to worry about benchmarks because you are running your own strategy of trading stocks

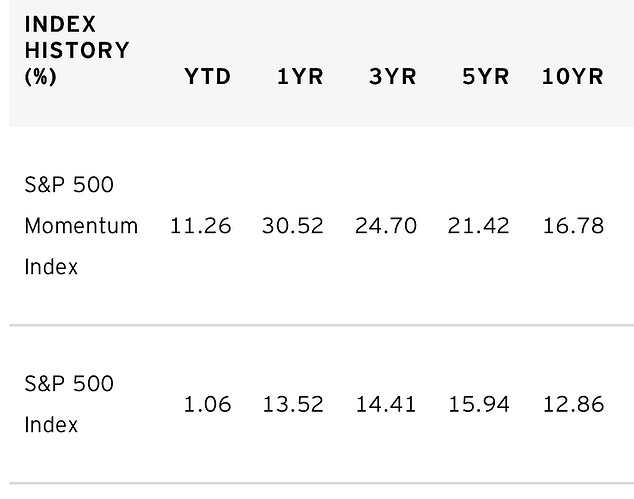

But if you were looking for one. Following would be the best one (S&P 500 momentum index) because you only invest in US stocks and your strategy is momentum.

US46138E3392

Thanks, interesting. Although I do invest quiet often in non U.S. stocks and ADRs and mostly in non SP500 stocks.

But looks nice. I suppose this ETF has the needed numbers: