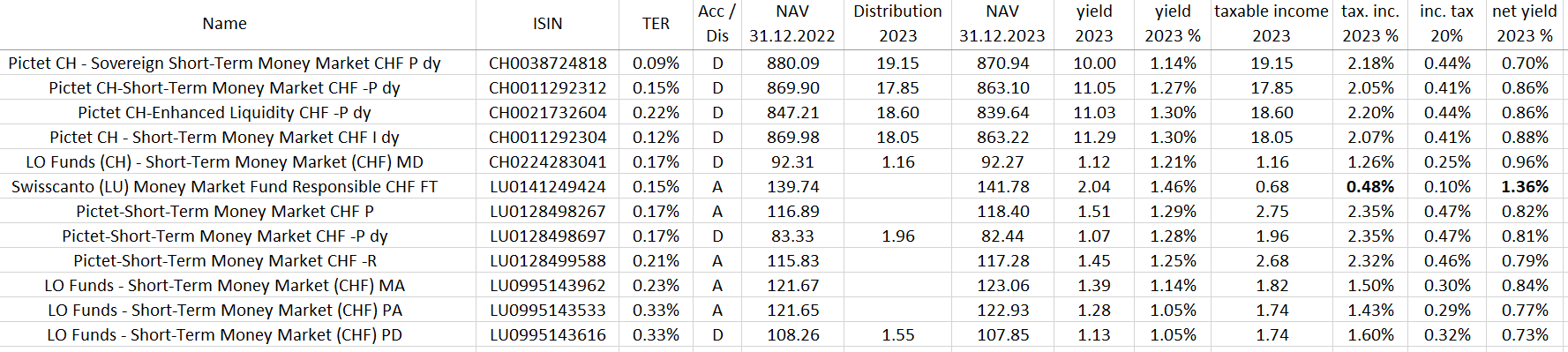

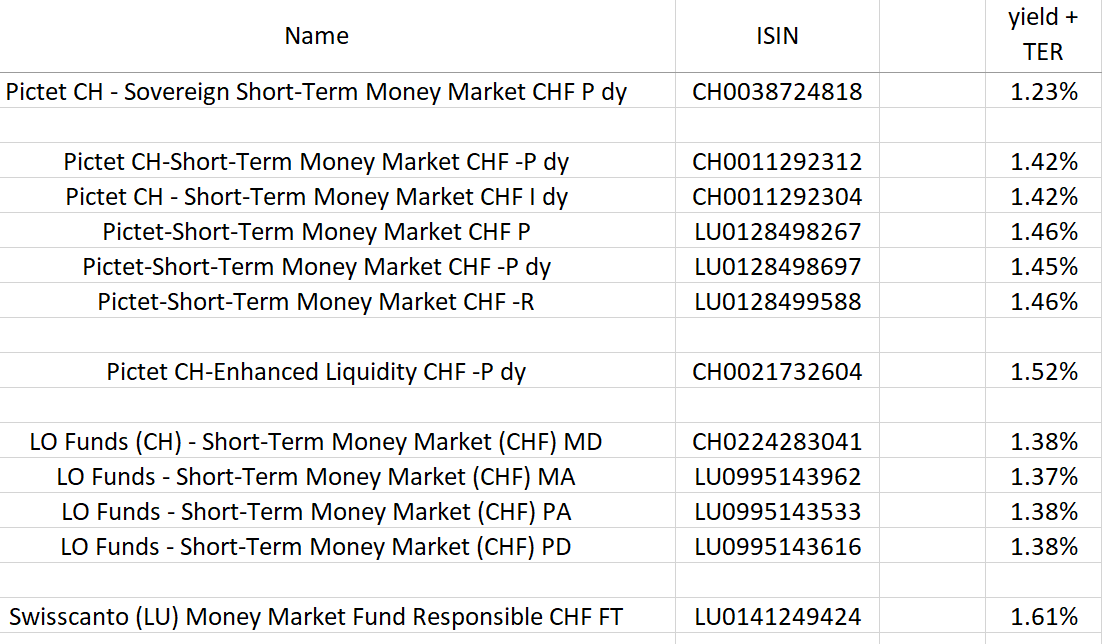

That one seems to be as good as they get. I am formulating like this because I have doubts about MMFs as a class, or at least about their suitability for private investors.

I observed that Finpension’s MM offering uses the PICTET (CH0011292312 ) offering (TER 0.15%)

So perhaps another one to also review.

Tax drag can easily erase any TER benefits.

https://www.ictax.admin.ch/extern/en.html#/security/CH0011292312/20231231

I was wondering why different MM ETFs have different taxable income?

Is it simply related to the ability of fund manager to find best bonds with 1-3 month maturity and lowest coupon?

It looks like that the pre-tax yield is more or less the same for the same level of risk or, which is the same, what kind of instruments they are buying. Yes, MMF also have risks:

Here you can see it well with Pictet funds: “Sovereign Short-Term Money Market”, which I would say carry the lowest risk (95% of holdings are AAA), has the lowest gross yield, mixed but conservative “Short-Term Money Market” is the second, more risky “Enhanced Liquidity” is the second. LO funds are the same as the second level Pictet fund.

I don’t know what exactly Swisscanto is doing, but the investing policy of this fund is different:

Each sub-fund invests 100% of its net assets in instruments within the meaning of the MMFs Regulation, where at least 80% of these are denominated in the currency indicated in the sub-fund’s name.

The problem with other funds that they invest in debt in other currencies and then hedge it. So they “earn” more in taxable coupons but lose on non-tax-deductible loses in FX swaps. This is what I suspected, @nabalzbhf

As Swisscanto invest mostly in Swiss debt, maybe there are just less defaults?

All in all, I again think that MMF in CHF is not a good investment for individuals and one would do better with savings account up to 100k limit. I mean, their goal is not to get the best yield for retail investors. MMFs is a liquidity management tool for institutions, they were buying them when the yield was -0.75% and they didn’t care.

Kinda depends on people I guess. I find the liquidity of savings accounts pretty limiting (and if you’re above 100k it’s not like you gain much risk-wise).

What would be the incentive in terms of financial stability? Systemically important banks have access to the SNB deposit facilities if needed (and there’s a discount applied if they try to deposit too much, so that there’s an incentive to try to lend the money rather than just deposit it).

edit: actually there are SNB bills available as well ![]() tho wouldn’t be surprised if retail can’t trade them realistically.

tho wouldn’t be surprised if retail can’t trade them realistically.

First of all, thank you for all the valuable knowledge you are sharing here.

I was following this thread and I would like to understand better. I do have 40k in Cash on True Wealth in my Pillar 3a earning me 1.25% in interest. As I now learned in this forum it is better to be invested, and that finpension is better than true wealth. but I kinda fear putting the whole amount in as a lump sum and I would prefer to DCA into the market over the next 10-12 months.

But when I would transfer the money from true wealth to finpension I would need to put it into a MMF like this one here (https://finpension.ch/app/uploads/factsheets/CH0031419960_fact-sheet_de.pdf).

My Questions:

- Wouldn’t the investment into the MMF be affected as well when the market crashes?

- Would you invest the whole amount right now as a lump sum? (I have 25-30 years until retirement)

- Would you wait for a correction or a crash and invest the lump sum within the next 1-2 years?

I regularly buy on IBKR every months outside of my pillar 3a and I also have some dry powder there to invest into the market but I just fear as I read it is very inflated at the moment.

I appreciate your experiences and expertise.

Money market funds do not invest in the stock market, they invest in low-risk, short-term debt instruments, cash, and cash equivalents.

I personally would invest the whole amount. Set and forget. And then just transfer 588 CHF every month (588*12=7’056 yearly limit) and buy. What advantage will DCA give you for a year if your investment horizon is >25y?

I’d appreciate it if you told me when, so I can sell before the crash /s. The markets are mostly at an all-time high, so you can’t predict it. The market could go up for the next 1-2 years, or it could crash, nobody knows…

And obviously, you don’t need to have a 100% stock allocation in your 3a portfolio, you could do bonds or other things, or like currently, simply the risk-free yield. You can configure a lot of things to your linkings in FinPension/TrueWealth.

Whether it is “better” for your case is not clear, but it is better for average returns. But when you read “invested” here, it is basically never meant to be a MMF, but equity (better on average; higher risk) or bonds (not as good on average but lower risk).

What I read between the lines of your questions, is that you do not seem comfortable with the risk that the market crash might come up (which likely, but not surely is going to go up again later). Therefore you might want to take a conservative approach on Truewealth/Finpension which contains lots of lower risk/lower returns parts than equity.

Which ISIN?

@nabalzbhf

I remember seeing a comment from you that you hold MMF from PICTET. CH0011292312

However you were not happy that it is not very tax efficient and the taxable income was more than actual yield (most likely because of higher coupon payments)

I wanted to ask if it is still the issue? And have you figured out why is it like this?

I’m not sure why there’s such a difference, but taxable yield is the reason I use the Swisscanto one now.

Just to be sure

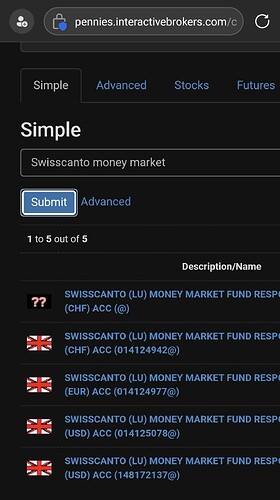

You mean the Swisscanto LU fund right (LU0141249424) ? Can you help me understand what is the issue with unrecoverable WHT tax for this fund? How much of the yield is lost due to LU taking WHT?

I tried finding the Swisscanto CH version both on Swissquote and IBKR and cannot find it anywhere. Most likely the CH version is only offered via ZKB customer accounts. It’s a pity because it seems to be better in terms of taxable income.

I could find it on IBKR using the valor number 014124942, as well as using the ISIN and then tapping on the message « Tap here or search to search by symbol » at the bottom of the result window (mobile on iOS, if it matters).

Haven’t looked in details, but the net yield looked decent to me.

Actually I meant the CH version I could not find on IBKR

ISIN -: CH1220495068

You mean you can find it?

It looks like only the LU versions are available on IBKR.

I heard, you can contact the service desk and they might add it.

I would check

I found the CH1220495068 a bit more interesting because it doesn’t have any taxable income as per ICTAX.

I would rather be cautious. Either there is an error or the share class just started or something else. In any case, there could be some bad surprises.