Is this really possible? Can you buy VWRL in CHF and sell it in USD/EUR/GBP?

Yes, you can request to change “listing” of your ETF from SIX (in CHF) to London (USD or GBP) or Xetra (in EUR). This is not free and I am just mentioning it as an example how fund units bought in different currencies are equivalent.

Do you know how that would be possible in Interactive Broker? I haven’t found any good material on how to do this

For which security you want to change listing? Best is to ask support. I and I think others would be interested to know what would they reply.

At the moment it is just a curiosity.

I buy VWRL on SIX in CHF for simplicity and peace of mind (it helps to think that my main investment is in CHF even though everything discussed above explains that there is no difference), however in the very far future I might be interest to sell it in EUR.

I was just wondering how difficult it would be to do it from an operational point of view.

I don’t think it is much different with IB.

This is a very informative thread:

https://www.bogleheads.org/forum/viewtopic.php?t=290937

For example, Degiro offers “stock exchange conversion” for a fee. IB probably have something similar. In fact, the other day IB service desk were assuring me that I could buy ETF position on one exchange and sell on another - I’m not sure I believe that yet.

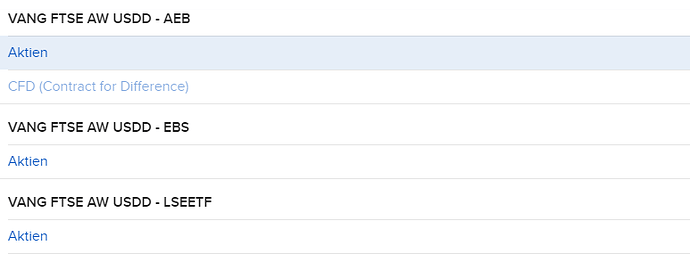

actually pretty easy, when you type VWRL into the search bar, you see it for LSE, AES, and EBS (London, Amsterdam, Six)

And I guess in the TWS, you might even have more options to buy (VWRL is also listed on XETRA for instance, not sure why it is not appearing here).

In the bogleheads thread linked above some people say that IB has “multi-exchange positions”. I.e. with TWS you send buy order to one exchange and pay in respective currency, then send a sell order to another exchange where this security is traded, and sell in another currency. And your position is being debited.

Searching for IE00B3RBWM25, I find it at IBIS2 (Xetra) and GETTEX2 (a certain additional German exchange, lower fees than Xetra). Don’t go for FWB2 and SWB2, they are significantly more expensive.

My guess is that you are overpaying, the question is how much and if it is worth bother to exchange CHF to EUR and buy at Xetra. What fee you pay per purchase transaction?

I might try this for fun with just 1 share and see how it works, I’ll read the bogleheads thread you have mentioned and give it a try in the next days.

Every month I buy 3300 CHF and pay a commission of 3.8 CHF. I have checked other months with other orders and it is always around 0.12%-0.14%. I have paid 0.08% when I have made an order of 13k, otherwise the fees are always in the range I have mentioned.

Well, European stock exchanges are “more expensive” than US ones anyway. Considering the FX conversion fee, all in all it would probably be very similar if you would convert and buy in EUR.

I have two basic questions about ISINs and Exchanges.

Question 1 -: Is it possible to buy shares of a particular ISIN on one exchange and sell it on another exchange? For example -: If I buy 100 shares of VEVE (IE00BKX55T58) on LSE or XETRA , can i sell them on SIX? If yes, which currency would i actually get after selling?

Another question -: To make it more complex, is it possible to buy IE00BKX55T58 on LSE at IB and sell them at SIX (via Swissquote) after transfering them

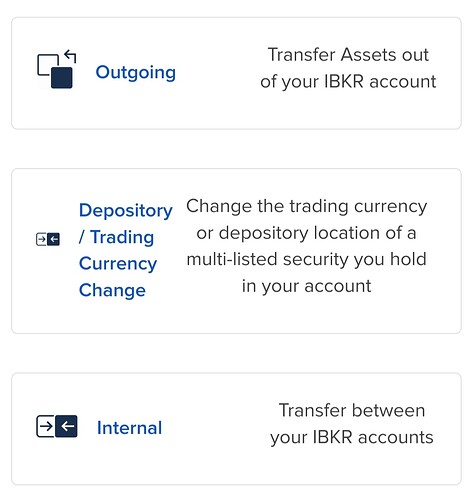

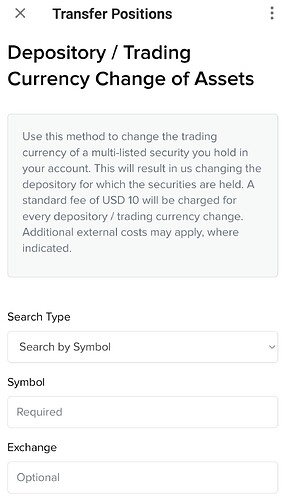

Yes but you might have to pay a fee for changing the listing.

https://forum.mustachianpost.com/t/interactive-brokers-q-a-2023/9780/119

The one it is traded in under the given ticket at the given exchange.

You will have to pay to either one. SQ must be more expensive than IB.

Thanks.

Changing the listing refers to changing the exchange where product can be traded. Right?

Not only. The same security can be traded at the same exchange in different currencies, under different tickers. Typically for large ETFs you see listings at LSEETF in USD and British pounds (or pences).

Ahh … so change of listing means

Change of “exchange and currency combination” ?