Aren’t they available on Yahoo Finance? Can you provide an example that is not working in Portfolio Performance? Did you check my guidr linked above regarding price feeds into Portfolio Performance?

Fiddling around with PP/VIAC again and trying to get it running and am currently trying to deal with these tax refund pdfs, but have hit a wall.

How exactly to you handle these tax refunds? Do you just add a dividend entry manually? Or rather a tax refund entry? I presume you will have to manually also make the forex conversion for the date of the tax refund? Thx for any advice on this.

PS: Could be an addition to your very helpful guide.

Hi @skyw4lker

Sorry for my late reply, have been quite busy lately.

It’s actually pretty easy, but annoying to do it manually, especially if you have multiple portfolios and multiple securities within each portfolio.

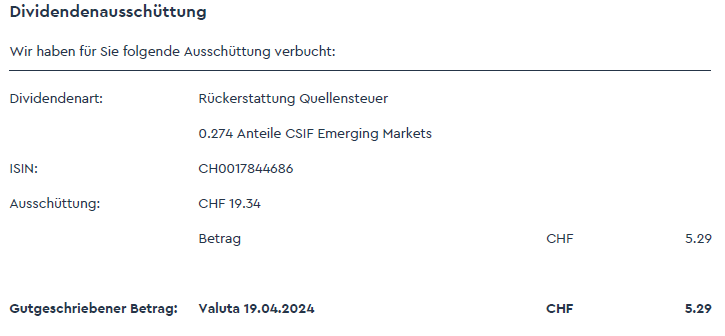

Here’s a tax refund document I received from VIAC:

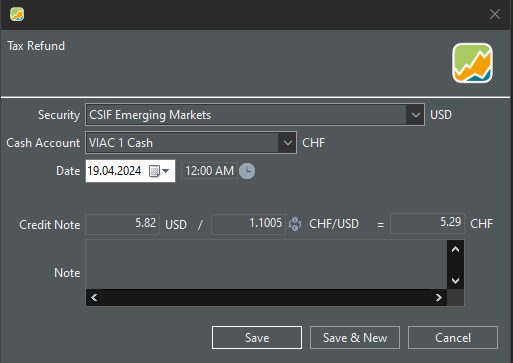

- In Portfolio Performance I right click on the respective cash account and choose “Tax Refund…”

- Choose the respective security, in this case the CSIF Emerging Markets

- Choose the date, in this case 19.04.2024

- Now the annoying part, multiply the CHF amount (5.29 CHF) with the CHF/USD exchange rate (1.1005) to get the USD amount (5.82 USD) and enter it accordingly

Now repeat this process for all tax refunds.

Watch out for the “Dividendenart” in the statements of VIAC, some of them are actual dividends, which should be booked as dividends in Portfolio Performance.

Please let me know if anything should be unclear.

Thx a lot for taking the time to answer; I’ll implement it once I have a bit of free time. Unfortunately been busy myself the last few weeks ![]()

Hello

I have a portfolio of Swiss individual stocks, bonds and SICAV funds in EUR. Currently as a reporting I have end-of-year statements from UBS (in pdf). Please advise which is the best tracker to use? Thanks in advance

Check Portfolio Performance as mentioned above, depending on how much you trade you should not have a lot of maintenance to do.

I’m not aware of any portfolio tracker that let’s you import PDF statements from UBS. I would anyway suggest a different broker as UBS is way too expensive.

It seems like a great tool.

However, I was scared away by the results from virustotal.com when checking the installer. It is likely to be a false positive, and many asked about that in the Portfolio Performance Forum before already.

But the answer they get from the devs in the forum are usually unnecessarily agressive and patronizing. Hope this gets resolved in the future…

You can check the source code, it’s open source.

I think it’s a fantastic piece of software, for FREE.

Yeah but:

-

if I would be skilled enough.

-

To be fair, in that case I would also need to compile it myself, otherwise it’s pointless.

I don’t think they did anything fishy (most likely false positive scan results), but for me this very small risk doesnt outweigh the benefit over my current tools.

And the reluctance of the devs to fix this doesnt make me chance this decision. Sure, they don’t HAVE to do anything, after all its free and they can do what they want. But so can users opting for other solutions.

I recommend getquin (free or premium). It’s the most complete and easy to use tracker I’ve found so far and I’m now sticking to it. I haven’t found any security so far that they don’t cover.

It’s well maintained, the support is reactive, and they keep improving it as their user base grows.

The only downside for me is that one has to enter each transaction manually, except if one’s willing to connect the account to the broker.

Fair enough. I wonder why virustotal marks it as unsafe.

You can link brokers/banks to IBKR and they will then show up under Portfolio Analyst. You can also just create an offline portfolio and add any ticker IBKR can find. I have added my company shares and the ETF I have in my endowment fund there* and my last holding in Saxo, all as offline accounts but it has the trackers so the current price is correct.

But really I do my tracking in Excel because I have full control over it. I can enter exactly the fees paid, I can enter the FX I got so I can accurately track FX gain/loss (I bought a lot of USD and EUR beginning of year which for now was very fortunate) and separate my return by underlying and FX. I have one tab for current positions since start and then a tab for year and one for closed positions. I guess if you have dozens and dozens of positions this may become cumbersome, but for the few I have it’s easy to update whenever I feel like it (I take a snapshot once a week). The IBKR platform does provide nice graphs and so on, but for the real details my Excel is superior.

I ignore pillar 3 for this, I track pillar 2 and 3 in my general Excel not my investing one, and have a separate pension Excel to forecast AGH including various projected retirement dates and pension fund returns. I don’t think it makes sense to include either as part of your actively managed investments. I

Update: I’ve had now the opportunity to implement Burningstones adice and it works perfectly.

Hello. I envisage to use finary but I am a little afraid about permissions transparency when you setup the sync. For example with IBKR, how can you be sure that permissions asked by finary is only readonly ?

A post was merged into an existing topic: Choosing an ETF on Swiss stocks

Hi. Not sure about this app and how it works, but I would never ever share any e-banking login details with an app. Maybe an open source password manager, but even there, I would use some peppering.

It’s safer to put your numbers to an excel sheet once in a while.

If you share your actual login and password there is no read-only mode.

The Amount management App could perform whatever action possible with your credential.

European Open Banking APIs should be the way to go in order to access cash account and other holdings

But PSD2 is limited and a new version should remediate the missed aspect:

https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_3544

Hello. I have the opinion than you to be honnest.

For example, integration with IBKR simply ask you for your standard login credentials. For me it is not acceptable even if the login windows comes effectively from IBKR. The permissions allowed to the generated token will probably be the same as your standard account.

It is different for example for gate.io plateform where the integration ask you for a API token. On gate.io you can configure this token to give access only to specific sections and with correct read only permissions.

Interessting ! thank you for the sharing.

This account management platform must invest a lot of in cybersecurity measures and be top notch in the area. I’m not sure a startup or new player will have enough members in their team to apply best practices and slow down the release of new features.

You do not want a hacker collect all your credentials or even API key to exploit other platform P0.