This is slightly off topic for the original poster, IMO, but here we go:

Surely, you’re joking, Mr @Tony1337 (and everyone who is clapping along).

Obviously, express your opinions as you see fit, but …

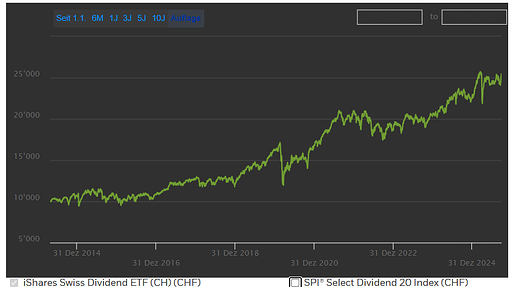

While the CHDVD did not exist in 2000 to 2014, you could look at their current top holdings and estimate how their holdings and dividend payments held up compared to “the market” or those “safe” bonds at the time …

There’s actually a reason why dividend paying companies (and actively selected ones as in CHDVD) will continue paying dividends even when your regularly scheduled recession or market crisis occurs.

Roche, currently at 15.58% of CHDVD: no dividend cuts during the GFC.

If you look at Roche during the dot com bubble, things won’t look different.

Novartis, currently at 14.95% of CHDVD: see above.

Nestle, currently at 14.66% of CHDVD: see above.

Zurich Insurance, currently at 14.62% of CHDVD: yes, they cut the dividend. Exactly once after the GFC.

We’re now at about 60% of CHDVD.

Anyway, I didn’t and will not pass judgement on other suggestions in this topic, but I’ll stand by mine.

It’s what I would do, and in a way it is what I am doing with my retirement portfolio as I am retiring, albeit slighty more complicated, so I kind of feel I am not armchair advising like perhaps others advising here many years away from retirement might be enticed to.

If I were in the OP’s mothers situation I’d just do what I recommended.