TL;DR for @Gabz (who possibly isn’t interested in wading through the toxic waste in these ESG sewers that I map out below):

Just buy your plain vanilla standard (non ESG) ETF most tailored to your beliefs, ideally with low fees. Then move on.

If you’re - on the other end of the spectrum - absolutist pure hearted about investing money conciously, take the time and put together your own portfolio of companies you can live with.

Reading your latest posts on this thread it sounds like you have already realized that ESG does not mean much. I would recommend to you to double down on that.

For the die-hards (be prepared to get a little dirty yourself as you are going to wrestle with an ESG pig):

Just echoing what @Koreba and @Barto already said, although they’re being nice (no offence, fellas  ). I won’t mince my words:

). I won’t mince my words:

ESG is a scam, almost* any which way you approach it.

In the words of my gray haired several decades seasoned professional portfolio manager colleague: “ESG is just way to extract more fees out of customers. You don’t even have to force it onto customers, they demand it themselves and are willing to pay extra.”

Not to pick on @TeaGhost, but the simplistic view of excluding entire sectors (coal and petrol were mentioned)

(a) doesn’t work,

(b) is not what ETF providers do, and

(c) leads to the market and companies just adapting in terms of what is a public company versus a private holding:

-

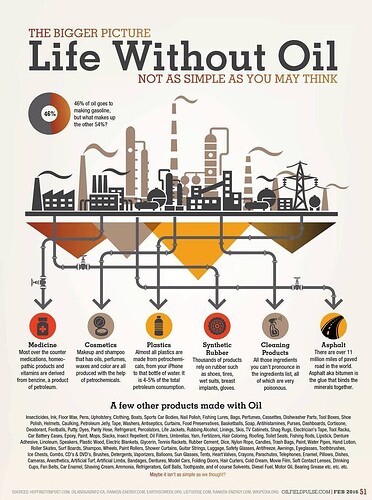

e.g. shunning petrol means letting go of (or making more expensive) a bunch of other stuff. Here’s a bigger picture infograph for what life without oil looks like:

If you feel you can defend shunning petrol, I’m … curious, I guess?

-

shunning coal strikes me as particularly sarcastic given our German neighbors just had to re-activate coal power stations as a result of their brilliant move (ok, I’m definitely also sarcastic) to shut down their nuclear reactors (which by the way also rate low on ESG scores …)

-

ETF providers pick an index they benchmark to (and that they usually hug more or less intensely, i.e. stay within defined limits of how far they stray away from the pure benchmark), and ESG index providers do the same, but they add to it a little secret ESG sauce (which costs dear money).

Check this out:

(i) The largest ESG fund (measured by AUM [Assets Under Management]) is the iShares ESG Aware MSCI USA ETF (NASDAQ:ESGU). See their top holdings below (courtesy Bloomberg):

(ii) The largest ETF overall** is State Streets SPDR S&P 500 ETF Trust, modeled after the S&P 500 index. Here’s their top holdings:

Indeed, there’s differences. You don’t need a microscope, but a magnifying glass is probably helpful. Like …

… let’s pick supposedly “bad apple” Exxon Mobil, weighted at .8% in the ESG fund while being weighted a whopping 1.13% in the S&P 500.

That makes a huge difference, doesn’t it.

Holy moly.

(No!).

… or let’s pick my personal pet peeve, Meta Platforms. 1.67% versus 1.12%.

What?!? META is evil, folks! It should be at 0% at the ESG ETF! Instead, it’s overweight?

… or let’s pick Tesla, surely the North Star in terms of Enviroment, Social, and Governance (sorry, sarcasm again): 1.65% versus .95%

Are you even paying attention?

…

Just in general, across all hodlings: the allocation differences are minuscule! And you’re paying extra for this?

I mean, c’mon!

-

Lastly (well, I could go on forever, but I feel I am stretching your patience already), companies will and have already just split off the negative-ESG creating parts of their companies and taken them private so the remaining public companies score higher ESG ratings (the private, split-off companies are of course not ESG rated).

This shouldn’t come as a surprise to anyone believing in the “show me the incentives, I’ll show you the outcome” (attributed to Charlie Munger, who, BTW, also is not an ESG fan, just like Warren, his buddy).

So, summing things up: stay away from ESG, it’s a virtue signaling but return diminishing vehicle that benefits professional investors only.

* Ok, there may be one way to approach it: pick your stocks and leave out the ones you’re uncomfortable with. In my investment universe, for example, $META is a company I’ve shunned despite their prospect returns and return prospects.

** In fact, the top 4 ETFs with AUM topping a trillion dollars all index after the S&P 500.