Thanks a lot for the Inyova tip ! It is much more adaptative than the ETF, indeed.

Why do you write that I would have more tax in comparison with ETF? Is it not the same principle than with a distributive ETF ?

An ETF may be able to reclaim withholding tax on certain dividends that may be refundable to you in principle - but where in practice it’s more expensive if not financially unviable for you to do.

For starters, assume you have a small stock position (1/30 of your portfolio) in a German or French stock - and then look into how to file for refund of French or German withholding tax and what documents you need to provide (and how much these tax vouchers costs).

Bitcoin - as the biggest and most well-known cryptocurrency - is burning (the equivalent of) the energy consumption of entire countries, blowing much of it from fossil fuels into the world‘s atmosphere. For lolz and speculation.

Likewise, have you looked into the ecological footprint of gold mining? And 90% or so of Gold in the world is used for jewellery and investments (says Wikipedia), with only a small part used in useful industrial applications.

Meanwhile, Nestlé is nourishing hundreds of millions of people around the world with safe food and clean drinking water.

I agree with you on the gold and bitcoin, I just wanted to have your investment opinion.

Concerning Nestlé, I don’t know if nourishing is the best word to describe the company, since they admit themselves that 60% of their product are unhealthy. Note also that Nestlé former CEO explicitely said that having access to clean water should not be a right.

Anyway, here is the list of the reasons.

- paying doctors ad nurses to encourage mothers to use milk powder instead of milk, including in areas where there is no tap water.

- extracting water from drought-prone areas, exacerbating water scarcity issues in communities where Nestlé operates, accusations of selling tap water.

- highly contributing to plastic in the oceans

- highly contributing to deforestation

- has been lawsuited for child labor (for cacao and oil palm extraction)

- selling milk with melanin instead of protein, which caused 50’000+ hiospitalisation in China

- participating in price-fixing cartels, impacting fair competition in the market.

Not saying Nestlé is worse than crypto or any other company of its size, just I don’t want to invest in it.

I was purposely mentioning Nestlé for contrast. While I’m sure they’re no saints, I honestly do believe that they taking food safety very seriously (well, it’d also hurt the brand if they didn’t) though - and that they’re providing safe food in markets where food safety isn’t taken so seriously.

Apart from the fact that it was melamine (not melanin), you’re conflating information and unfairly blaming Nestlé. It wasn’t Nestlé, it was a company called Sanlu Group that sold contaminated baby formula.

To my knowledge, there’s no base to the claim that Nestlé was willing (or condoning) to sell contaminated milk or baby formula as a means to increase profit.

As the use of melamine in the Chinese dairy seems to not have been restricted to this particular incident products industry though, other companies - such as Nestlé - were unwittingly dragged into the scandal due to their local supply chains. In Nestlé’s case, small traces - not considered harmful - were detected by the Taiwanese authorities - so were they in, for example, Cadbury chocolate.

So, the MSCI GICS (Global Industry Classification Standard) puts them squarely into sector “Consumer Staples” and (sub-category) industry “Food Products”.

Can’t speak to most of your claims about how “bad” Nestlé is, and I can’t even refute your claim that they make water scarcity issues worse, but apparently (according to one of their former CEOs) their “water busines” makes up 0.0009% of the world’s water supply. Whatever that means, but big picture they don’t seem to matter in water overall, given humanity overall.*

I don’t agree with your investment view, but I applaud you for making that concious decision for yourself. I think that’s how one should approach “responsible” investing: exclude businesses that you are personally not comfortable investing in.

(For once, I’m not being sarcastic, I mean this honestly.)

Even old Warren and Charlie, who both aren’t eager on ESG, don’t invest in tobacco companies for ethical reasons. (Me personally, I’m fine with investing in tobacco)

However, I already know you’re just gonna love this: Bloomberg — the most expensive and best regarded service on financial data — on Nestlé, through an ESG lens:

“Leading” in most categories, “Above Median” in two, “Lagging” in one.

Whatever the exact numbers may be, I guarantee you, any ESG fund that benchmarks to an index including Nestlé will overweight Nestlé relative to the index.

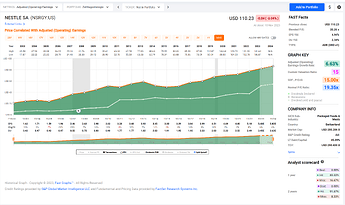

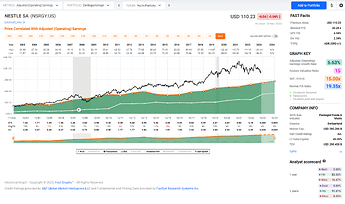

Disclaimer: I’m not invested in Nestlé, except (most likely) via broad index funds in tax shielded accounts. But I would personally buy Nestlé when they’re attractively valued: they look like a great business to me, growing their earnings at an almost 7% rate over the course of decades, increasing their dividend steadily, stellar S&P credit rating of AA-, acceptable debt. Checks most boxes for me:

Unfortunately, the current price is still too high for me:

I’d prefer to buy them below $90 when they would be closer to my preferred measure of being fairly valued given their growth rate.

* Of course, I don’t know shit about this at all, but then again I would also want to know how exactly the claims about Nestlé exacerbating water scarcity can be materially substantiated.

I know this is an old post. Did you eventually find a solution that aligns with your original goals to invest as per this post? I am also looking for similar solution.

Thanks

I finally invested most of my money in standard ETF (VT) and I give a certain percentage of my earnings to associations.

For third pilar, I worked with Inyova for three years and now I am opening a second account in VIAC.

Overall, my feeling is that you cannot do anything really ethical if you want to be profitable. If you know a company you can invest directly in it., like you do with Inyova but I feel that no big companies will not make the world better.

On the other hand, I invest in small projects through platforms that have a high risk but can have a positive impact (Litaa and la Nef for example). It does not represent a lot of money and I am not super frestrated to lose it.

Maybe you and I would differ about what is ethical, but that said:

YMMV, but here is how I think about this, from the perspective of working for an asset manger who has re-branded all of their funds to be ESG friendly just a couple of years ago (sub-percentage differences to index allocations ensued, aka completely laughable).

And which is now trying to pivot away from the ESG label as it has become now an unfashionable term in investing since the new US administration has been in place.

ESG is just a way for the asset manager to justify sub-par performance and extract more fees from their clients (as long as their clients feel like they have to buy “ESG friendly” assets)

Period.

Even the most senior asset managers in the company I work for will admit to this (in fact, they’re the source for my quote for extracting more fees).

Back to your original quote of not being able to to anything ethical: Maybe make a educated guess and then judge for yourself when putting down money in the market? Nobody else is going to do the homework, and those who claim they are doing the homework, they’re just pursuing their own agenda.

@Gabz Gabz Thanks for your response. I have been researching for such a one stop solution ex an ETF for a few weeks with no luck. I agree with you regarding being unable to make our “investments” behave ethically and still be profitable. It is not just the big companies, sadly capitalism eats ethics for lunch at any level.

I like your approach of subtracting the “unethical” part of profits from “VT” by donating that part to good causes.

Interesting company, didn’t know them before. Are you happy with them?

I agree, this will probably have an actual effect for the cost. We also have this thread

An attempt was made to find impactful strategies. My favorite is using ownership to influence business decisions of companies (preferably the most brown ones). There are even a some ETFs (for a fee).