Fair point! Good reminder. So, did Ark provide any explanation?

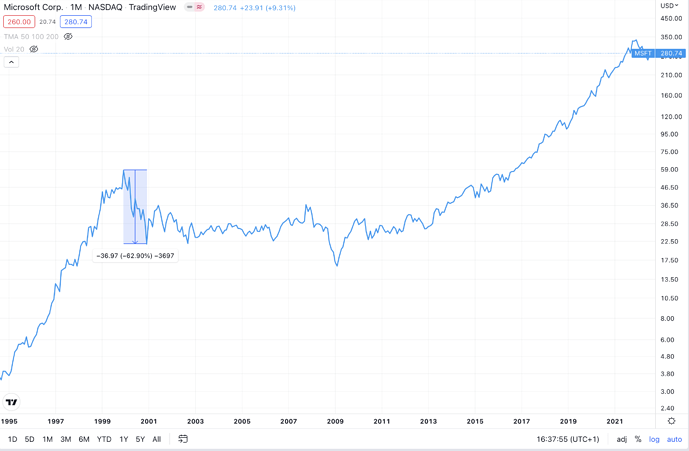

The lessons run true back to the dot com bubble of 2000.

Even though eventually some companies delivered (e.g. Microsoft), if you bought during irrational exuberance at ridiculous valuations you had a long ride to recovery.

And of course, if you pull an ARKK and are quick to abandon the lies of your long term horizons then you are sure to lose.

Exactly. Not only her decisions look pretty random (she was buying Coinbase until 3 weeks ago) but she fails to explain why the majority of her top picks are in freefall, even compared to similar companies.

This.

Either Jesus told her to sell, the SEC investigation about Coinbase scared her, or maybe it is because of the arrival of the new competitor that crushed Coinbase in the NFT-trading activity

History may not repeat itself - but it rhymes. Here’s the thing: many of the dot-com bubble‘s hottest stocks failed. Some survived - and a few of them turned out to be exceptionally great long-term investments.

Do I believe ARK Investment has any competitive advantage over other investors or other funds in identifying these „winners“? I don‘t. And the reason is simple: their economic analysis smells as convincing as a steaming pile of horseshit (see their „analysis“ on TSLA or Bitcoin that was discussed here).

As a side note, Google, Facebook and Netflix, so half of the „FAANGs“ didn’t even go public before 2002, so they weren’t even around (as investable listed securities) when the dotcom bubble busted.

You‘ll may very well fare better doing your research and invest in a couple of stocks according to your oen research instead of paying these imbeciles to blow your money (in fact, that’s exactly what you did with your equine balls of steel).

Had to look up what equine means. I know “equestrian”. The thought in the back of my head was: Ark are one of the well known TSLA bulls. If their research on Roku, Coinbase or Teladoc is poor quality, does it also apply to Tesla? Or was it just a fluke on their part to bet on the right horse for once? Ark are praised for their understanding of Tesla and bold price targets. It could also be that you’re right in one area, and wrong in another.

I‘d like to qualify that and say: They are renowned for correctly betting on that horse. We‘ve seen their 2‘500 USD price target „analysis“ for TSLA that they released. And it‘s quite a bit horseshit (yeah, the puns just keep coming).

What they correctly called: Tesla becoming popular as a stock during the pandemic and the ramping up of the electric automotive market.

I think that ARK’s research made public is poor in general, and is not worthy of 75 bps. It looks like an excuse for bets, for faith.

Let me tell a bit about my life, just to get a more relaxed vibe here ![]()

My dad is impressed by Tesla cars, by seeing a doctor online via an app, by seeing friends via Zoom, and by watching TV on a Roku stick. He sees all this as innovation, as the future. But he is old, even older than this lady. What my dad and this lady see as the future, I see as yesterday’s future.

Old people can be gullible, and too easy to impress.

I bought him a Roku from Amazon DE, so cheap that there is no way anyone is making money out of it. And he is certainly unable and unwilling to subscribe to any of their paid services.

Don’t buy shares of companies you like for the wrong reasons.

I don’t think it has to do with age. Gullibility ok maybe, as we know how old people get tricked into buying magic pots from “gypsies” walking door to door. But being impressed by technology depends on the individual, not (mainly) on their age, I think.

I think that if you are not used to a technology, and discover it rather late, you are more likely to understand it only partially.

Many old people discovered videoconferencing during the pandemic. For them, videoconferencing = Zoom. This service was successful precisely because it was free and didn’t require to set up an app. Who didn’t go crazy trying to remotely assist his parents with technology use during the pandemic?

But younger workers (as opposed to retirees) are used to work with MS Teams or Webex and are unlikely to consider Zoom as an innovation.

So yes, in my opinion, it is very much related to age.

Coinbase share price doubled since she sold ![]()

Better than Nostradamus ![]()

Cathie Wood’s Ark has named a Chief Futurist. I kid you not.

Futurist as a management function is (almost) a classical buzzword.

It’s since 2016 in the Corporate Bullshit Generator:

![]()

I take it as a sign that crypto can go lower. To many people still excited to buy this stuff means we have more pain ahead.

@Bojack I hope you were just interested in the fund and didn‘t put real money into it. Actively managed funds are all the same in the end.

Gotta love Ben Felix keeping it real. Ramin Nakisa noted above too.

Oh boy this thread is reading like a car crash before it happened ![]()

#MarkMyWords ![]()

At least I got this one correctly…