I btw dumped my ARKK bag and bought 0.5 Bitcoin (at 28k CHF xD) with the rather small pay-out.

more i read on this forum more i have to remind myself that no one has a clue about anything…

Did you break even? Or sold at loss?

The correct question would be: was ARKK/BTC higher when you bought ARKK or when you sold it?

Hefty loss, but I lost my trust and believes in Cathy Woods.

I think you did well, it was a sunk cost and better to move on.

Having said that, ARKK May continue to grow in the short-term as markets get some relief, wasn’t an option to put a sell limit to let it ride and see if you could sell at higher point? And potentially move the sell limit up every further 5% increase? Just trying to figure the physiological element

I have a hard time believing that one would see the light and dump ARKK, just to buy BTC straight after. The internet is full of jokers ![]()

Sure, but probably too much hassle. It did drop another 10% since I’ve sold, so I guess I did ok.

I just believe that BTC will have a higher upside potential than an ETF run by some old lady.

This ARK story reminds me of an article I’ve read 2 years ago about FANG’s future returns:

So what does explain the FAANG stocks’ high realized returns? Their unexpected returns. Things turned out much better for them than investors expected. The companies’ cash flows over the last 10 years were much higher than investors expected 10 years ago and their prospects looking forward from today are almost certainly better than investors expected they would be 10 years ago.

All this unexpected good news produced high unexpected stock returns over the last decade. It would be wrong, however, to expect high unexpected returns to persist. After all, it doesn’t make sense to count on good luck. The expected value of the unexpected returns must be zero.

In short, the past decade of extraordinary realized returns tells us little about the FAANG stocks’ future expected returns. And unfortunately, this is a general result.

https://famafrench.dimensional.com/essays/investing-in-faang-stocks.aspx

Her main holdings Teladoc and Roku are in complete freefall : -20% to -25% in one day.

Luckily, she started cutting her losses on Coinbase.

If the stockpicking of this lady is based on research, is it probably the worst research ever.

Only blind faith can make customers stay with her.

https://www.marketwatch.com/story/teladoc-loses-3-billion-in-three-months-stock-plummets-11658954738

So Cathie bought Coinbase stock with her investors’ money at an average price of $255/share and sold them at $53/share; losing her investors $230m…

The tried and true method of guaranteed losses by buying high during irrational exuberance and selling low once the market panics. Of course she takes a well deserved 0.75% management fee for all the hard work of giving sales pitches to naive investors ![]() .

.

I hope people will remember these charlatans and not fall for the same tricks the next time they come around.

We should maintain a black list over the years of Fund Manager with their worse decision/ performance.

For stock picker, we should do the same with the CEO/Director of companies that diluted their investor.

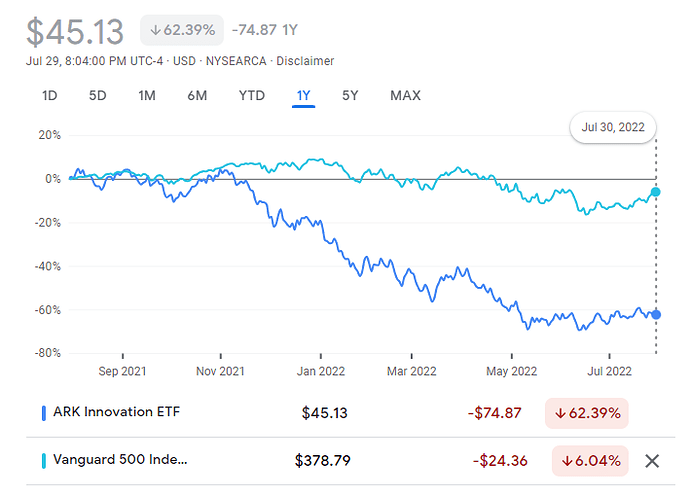

It’s impressive, really. -75% this year.

I stick to a simple portfolio of classic ETFs (my only bias is towards ESG) but if I wasn’t so disciplined, I’d say that shorting her decisions is tempting.

It is a fascinating car crash to watch. I feel as guilty as if I was watching Russian dashcam compilations.

But it could be too late for that. As we know, investors have a certain time horizon. The longer the horizon, the less they discount the returns which lie fair into the future. In times of uncertainty, when the cost of credit goes up, the investment horizon shortens, and investors apply a higher discount to investments which will pay back far into the future. That’s why growth stocks were hit first. Plus, all the covid stocks were also hit. So I guess ARK got hit twice, and their 5y growth is all gone. But I don’t think it’s certain to further go down. Maybe the stocks, with their current reduced prices will see a rebound once we’re done with raising interest rates.

I wasn’t serious, for god’s sake ![]()

Guys, I really think you should just be Mustachians and stick to a classic 3-funds portfolio. Really.

And yes, it implies never, ever touching crypto, active management or whatever snake oil is on offer at the moment.

Doesn’t matter. I was commenting on the general negative sentiment vs ARK. Perhaps all this deep understanding of the disruptors was just a nice story, that didn’t work out. But maybe it’s still too early to tell. Like, imagine laughing at AMZN investors in September 2001, who bought in March 1999. It took many more years until that investment finally paid off.

This is the voice of reason.

But Ark was looking for the next FAANGs, it’ still too early to tell they were wrong.

May I remind you that the latest discussion was sparked by a news that ARKK sold Coinbase shares at 20% of their purchase price (or whatever). So yes, AMZN investors who bought in 1999 and sold in 2001 deserve nothing but laughs and ridicules.