To be clear, after having spent some time with their Github spreadsheet, I can confirm that the rest of ARK’s forecast is the same bullsh*t as their insurance analysis.

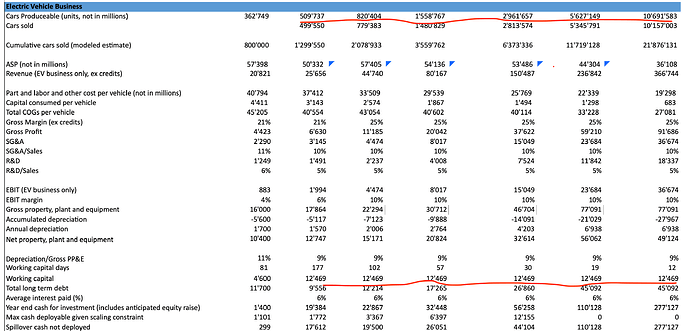

Example with the electric vehicle business. ARK forecasts 10 million vehicle sold per year by 2025. This is 20 times what the company delivered in 2020. Auto-manufacturing is not known to be asset light, and TSLA does not escape the rule. You need roughly $1 of fixed assets and working capital for each $1 of revenue (which is in line with TSLA’s 2020 numbers: revenues of $31 billion, whereas Property, plant and equipment + working capital is roughly $33 billion. Let’s assume that each vehicle will be sold at $40’000 per unit. That represents revenues of $400 billion, and the company will surely need to make investments of the same magnitude to manufacture all these cars. Gigafactories are not free! Given that the company is barely profitable, you cannot count on reinvested profits to fund the growth.

But then we enter in the magical ARK’s world, where capital growth is free:

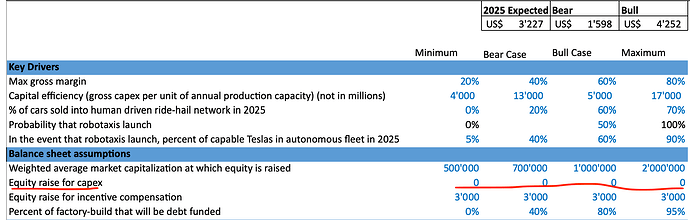

- No equity raise needed to build gigafactories, even in the BEAR case:

- When the volume of cars sold is multiplied by 20, the working capital does not move a bit. Of course, the inventory needed to build those cars is free!

There is absolutely zero analytical rigor in this forecast. Even a junior analyst fresh out of school could call it for what it is: a big, fuming pile of bullshit.

But hey, at least they can say they used a Monte-Carlo simulation!