No reason to bear the risk for such little reward, I think your decision (to buy back) was right.

I’m not a fan of such long term options, a lot can happen in 8 months

Replying to your recent update of the Fat Years Chronicles thread.

My recent activities were (aka “talk your book”):

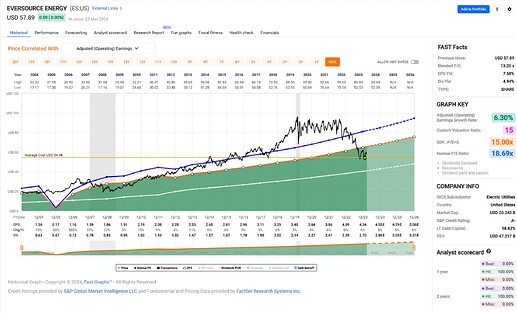

- $ES

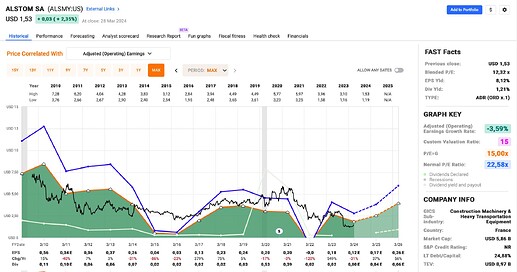

- Bought an initial position of $ES in February. It’s not in a prolongued bear market (yet)* and it’s not the most exciting company in my portfolio (a utilty!). However, it has a small margin of safety, the company has a stellar track record growing their earnings and their dividend, nice current earnings yield of 7.5% and dividend yield of about 5%, great A- credit rating and a nice moat IMO. If anything, a little too much debt, but still acceptable. Payout ratio is rather high, but normal for utilities. Chart, courtesy of FastGraphs:

If you believe in macro (I don’t, but I still find it entertaining):- I believe $ES stock price is suffering from elevated interest rates. This will probably pass later this year or next year. I don’t care that much, they can also stay elevated for a couple more years, allowing me to further buy into the company until I have a full position.

roll … waaaaait for it … AI! If AI takes off as projected by $NVDA’s price, all these CPUs and data centers actually need electricity!

roll … waaaaait for it … AI! If AI takes off as projected by $NVDA’s price, all these CPUs and data centers actually need electricity!

<insert some impressive hand waving here, including waving around the newest NVDA AI training CPU>

This rising AI tide will clearly lift all boats, including boring utilities. $ES PE will be back at its February 2020 PE of 23x real soon now!

- Sold an $ES Oct24 50P in mid March. Didn’t pick the perfect day to sell a put on this company, but was kind of eager to put my first batch of cash at my IBKR account to work.

- Bought an initial position of $ES in February. It’s not in a prolongued bear market (yet)* and it’s not the most exciting company in my portfolio (a utilty!). However, it has a small margin of safety, the company has a stellar track record growing their earnings and their dividend, nice current earnings yield of 7.5% and dividend yield of about 5%, great A- credit rating and a nice moat IMO. If anything, a little too much debt, but still acceptable. Payout ratio is rather high, but normal for utilities. Chart, courtesy of FastGraphs:

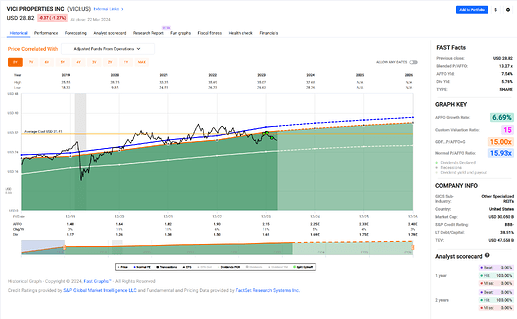

- $VICI

- purchased my last tranche to a full position. Similar arguments as above, better debt situation, slightly worse credit rating. I’d buy more, but I have a full position now.

- purchased my last tranche to a full position. Similar arguments as above, better debt situation, slightly worse credit rating. I’d buy more, but I have a full position now.

- $MO (and a bunch more from my existing portfolio): I have a full positions already, but I find them attractive at their current valuation.

* I’m sure though Mr. Market is listening to this and uses my purchase as one of his signals to decide whether to now send $ES into a protracted multi-year bear market. ![]()

never heard of ES.

I sold MO in favour of BTI. I would like MO more if they got rid of the management and just milked their legacy business. I got fed up with the litany of value-destructive deals.

VICI I hold and would buy more if price is right (i would look at it again if <$28).

Regarding $MO:

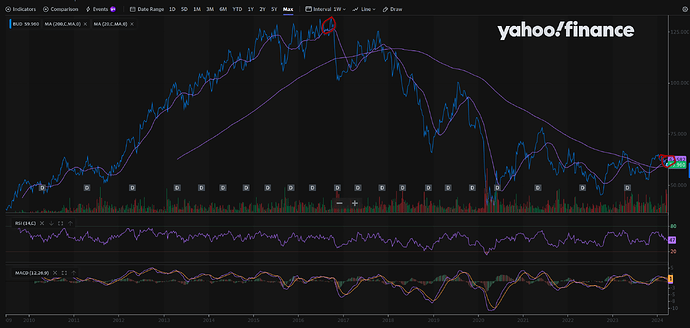

![]()

I of course agree with your assessment but continue to hold Altria (as well as BTI), believing this will fix itself over a few more years. Altria’s steady earnings growth continues to impress me and getting paid almost 10% while waiting is sufficient compensation for me.

Just to illustrate management prowess. For no apparent reason, they decide to buy over 10% of InBev. Did they do so when the stock was down and out and grab a great bargain?

No. They literally bought it at the absolute peak and in the last days announced they were selling off part of it.

What other great deals did management come up with? JUUL. Losing 95% of the $12.8bn investment in just a few years (a mind-boggling 16% of the current market cap of MO!!). I recall they also invested in some cannabis companies too - I can’t be bothered to check now, but I’d be surprised it they didn’t buy that at the absolute top too…

AT&T is another potentially great business that is constantly ruined by terrible management.

Since people never seem to post about their losses (or maybe they do, on this fine forum, and I don’t see much of it, because almost everyone is an ETF buyer where you don’t learn much about your individual losers in those), looking at my stock picking portfolio, here’s one I regret having bought, ever, but especially today: $CMP, down almost 20% today as we speak!

Can’t recall exactly* why I bought them, probably a mix of being very new to stockpicking, not knowing about sectors and industries and their peculiarities, having heard about it by a fellow (probably also new) stock picker in a webinar by my main stock picking teacher, etc etc.

Lessons learnt:

- Basic Materials: good luck!

- Companies occasionally cut their dividend but re-instate it quickly, but they’re usually not in sector Basic Materials

- Never buy on other people’s hunches, always build your own conviction

- When buying microcaps, be especially aware of ratings below investment grade

- Don’t be fooled by your speculative Basic Materials investment going up after a crash dip like Corona - fundamentals will eventually catch on

Luck had:

- diversification: position only contributes to $48 of my yearly cash flow (it originally contributed $185).

Total cash flow is $150k.

Plans forward:

- I should have sold my position and I should sell it even now.

- I’ll keep it as a reminder to myself - think of it as a not really painful but vivid thorn in my flesh and a redhot reminder on days like today, when I look at my portfolio spreadsheet - to never make an investment like this one again.**

Opportunity cost: a little over a thousand bucks of its current sell value.

Opportunity: as stated, vivid reminder to think twice about investments in cyclical businesses, especially Basic Materials.

* A trading journal would help here, I keep going back and forth about this.

** Which I am bound to make again: the goal is just to reduce the number of mistakes like this one.

I struggle to find anything now.

Talk your book 2.0:

So, I have some cash on the sidelines that I want to deploy soon’ish. I just went through my current holdings and updated my potential shopping list for the next month or so.

First pass - undervalued, but no visible headaches looming (like BMY* or MMM**), growth intact - gives me about 28 potential buys*** and 7 potential sells.****

Second pass - taking into account personal preferences like acceptable dividend for my needs, existing open cash secured puts, etc - boils it down to these shortlists:

- Buys: BK, CVS, ES, OZK, STT

- Buys, but excluded for personal risk management (my positions are full): BTI, CMCSA, GWO, IMB, LNC, MAIN*****, MTB, NFG, O, UNM, VICI

This is just screening through current and (for the sells including) past holdings.

I might update the shopping list after screening through my full watchlist if I get to it during this Easter break.

Anyway, point is that the the market is reaching new highs, but I feel I can still deploy cash in some corners of the market that seem undervalued.******

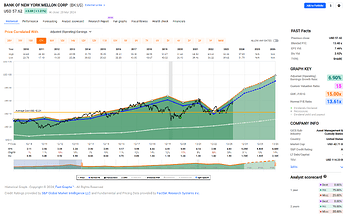

FastGraphs for my shortlist if you are interested:

-

Bank of New York Mellon (BK)

+: Nice growth expectations, acceptable dividend yield, nice credit rating, no debt (?!?).

-: Only just fairly valued, average growth since the GFC. -

CVS Health (CVS)

+: Clearly undervalued, ok dividend yield (but good dividend growth again), good credit rating.

Also, look at that steadily growing earnings chart - what a beauty!

-: Didn’t they just do another acquisition? I’ll need to look into that. -

Eversource Energy (ES)

Mentioned before, see above. -

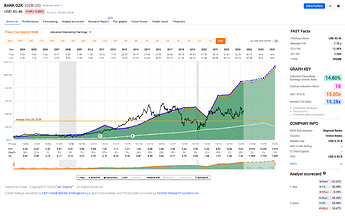

Bank OZK (OZK)

+: Dividend growth, severly undervalued, acceptable dividend.

-: Regional bank. Seems solid to me, but dragged down from debt duration fiasko which might or might not be justified. -

State Street (STT)

+: Nice expected growth, undervalued, nice dividend, nice dividend growth.

-: Flat stock price for about a decade (or longer, if you include the GFC).

Good luck and good night!

* BMY: Negative growth over the next couple of years, otherwise fine.

** MMM: Unresolved lawsuits, otherwise fine.

*** Buy longlist: ADM, BK, BTI, CVS, ES, GPK, GPN, GWO, IMB, JNJ, LNC, MAIN, MET, MTB, NFG, O, OC, OZK, SJM, STT, SWKS, T, TD, UGI, UNM, VICI, VZ, WAL.

(includes full positions of mine that I won’t add to or only hesitantly add to)

**** Sell longlist: GD, IBM, IRM, LOW, PG, SO, WSM.

***** I keep DRIPping into MAIN despite having a full position, but I don’t won’t to increase my position outside DRIP.

****** Famous last words, I know.

CSCO was my last (begrudging) purchase. I think I’m now pushed into esoteric investments which, IMO is a warning sign.

Maybe I look for more shorting opportunities instead, but it is difficult and dangerous to short such a bullish market with potentially a lot further to run.

I might instead just settle for lower and safer returns for a while. Which could be:

- BOXX - tax-free T-bill like returns

- Pillar 2 - 1.5% CHF return with marginal tax rate saving kicker

- Mortgage repayment

Or chase for gains in:

- Emerging markets

- Bitcoin - with ETFs creating new long term bagholders, it might be worth buying and selling to the next idiot without becoming that next idiot

What do you guys think about Alstom SA (ALO)?

And does anybody use/recommend AlphaSpread as a screener ALO Intrinsic Valuation and Fundamental Analysis - Alstom SA - Alpha Spread?

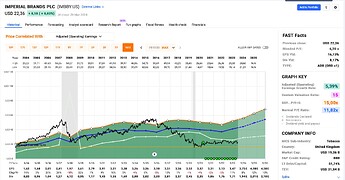

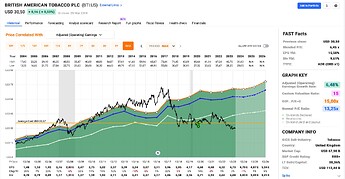

what’s your take on IMB (imperial brands) vs. BTI & MO?

I like all of them for their dividend yield.

From a fundamentals perspective (FASTgraphs below) I probably like Altria best. I mean, look at their steady earnings growth! Albeit a bit slower in recent years, but no cyclicality, none whatsoever. Even JNJ occasionally has a down year. Altria has the highest (dividend) payout ratio of the three, but it’s their stated shareholder policy. Having such a high payout ratio also leaves less room for management to do dumb things, but as stated above by @PhilMongoose, they still manage to allocate capital in, ahem, improvable ways. ![]()

Second in line (from fundamentals) is probably British Tobacco. Some cyclicality,* but overall nice steady growth as well.

Imperial Brands seems to have had a bad stretch (in earnings) for almost decade (2013-2022), but last year was up again and at least analysts see steady growth ahead. We’ll see.

I also like it because I can dividend re-invest into it via corporate actions at (almost) no cost.**

From a valuation or price perspective the order reverses. I have full positions in all three of them (just reached it with IMB in January), but I would*** add to IMB first, BTI second and MO third. To be clear, I would be fine with adding to all three of them, but I believe the currently over 16% earnings yield**** of IMB is eyepopping and their ~double digit p.a. growth expectation for the next couple of years looks best of the three.

By the way, I’m tempted to buy into additional Tobacco companies as well, but since this industry already makes up 5.5% of my dividend income, my risk sense tells me not to.

* Some (or all?) probably due to me looking at the chart in USD instead of GPB.

** Which is only an issue because I hold the stock at Swissquote where purchase fees remain outrageous.

*** Actually, I’ll keep adding to IMB through DRIPing despite having reached a full position.

**** Imagine buying the entire company for 20 billion now and henceforth making 16% x 20 = 3.2 billion in earning every year even if earning remain flat going forward.

What do you guys think about Alstom SA (ALO)?

Too cyclical for me even if their expected growth for the next couple of years looks spectacular.

Also, I rely on a steady and growing dividend which they don’t provide.

I also own IMB and liked it for a while as it looked like they weren’t going to spend a lot of money going into next generation products and instead just milk the legacy business (which is the strategy that I would have liked MO to employ!).

I think that might have changed, but I haven’t followed the company closely (it was for me a no-brainer purchase at 1250). BTI was for a while my biggest holding at around 20%, until I reminded myself it was stupid to hold so much in a single stock and so trimmed it.

I do wonder whether profits could fall more rapidly than expected as, anecdotally, it seems that younger generations are more health conscious - there could be a hidden cliff edge in profitability that is not fully accounted for.

I do wonder whether profits could fall more rapidly than expected as, anecdotally, it seems that younger generations are more health conscious - there could be a hidden cliff edge in profitability that is not fully accounted for.

I feel I’m observing the opposite (anecdotally). Gen X and maybe Gen Y (don’t know that many outside work) seem more health conscious, but Gen Z has reversed. At my son’s 18th birthday party last year about 20 friends came. Two didn’t smoke (one of them is my son).

Also, when I travel, I keep feeling amazed about how many people smoke, even in first world countries.

In developing countries it’s seems like the exception to not smoke.

Anyhow, I feel like tobacco is lindy: it’s been around for thousands of years. I feel it’ll stick around.

I guess that’s why anecdotal evidence is pretty useless. However, it seems that unit volumes are on the decline and I would be surprised if that trend reverses.

- Buys, but excluded for personal risk management (my positions are full): BTI, CMCSA, GWO, IMB, LNC, MAIN*****, MTB, NFG, O, UNM, VICI

I am such a pro, please stand back for safety reasons. You might even want to put on your shades, too, as I am such a bright star at managing even the very basics: I just noticed my VICI position is only 3/4 full …

Must be Goofy’s revenge for me having chosen him as my avatar recently. ![]()

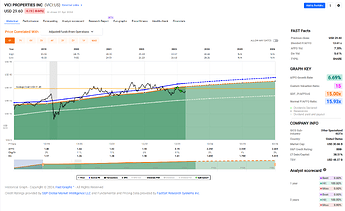

Since my above referenced post on this at the end of March I already lit some* dry gunpowder on OZK yesterday - which just raised their quarterly dividend again - and CVS (upon it tanking today)**, but since VICI is now back on my personal radar, here’s the thesis, for completeness:

VICI Properties (VICI)

+: Nice dividend yield, growing earnings and dividend at an acceptable rate.

-: Relatively short track record, only a tiny margin of safety.

* Moved my surplus cash from Swissquote to IBKR and just love the fees there with my first couple of trades. Not only did the Swissquote fee penalty not influence my decision to buy long/sell short***, I was actually provided with provisions from IBKR (for providing liquidity to the market) on three of the four trades I executed so far. Yay!

(I don’t expect that going forward as I was kind of catching falling knives with buying OZK yesterday and CVS today)

** Expressed as extending my long position and selling a put.

*** Some would possibly argue that this is bad, as the low fees grease my decision making process and allow me to “trade” more. I’m fairly chilled about this, as previously, with Swissquote fees, I would calculate the expected fee and think “Oh no, with this small position size, I’ll have a 1% trading fee, let’s wait until I can buy as much as twice the amount with a 2/3 % trading fee instead”. Sometimes, this would work in my favor, most of the times not.

The recent four trades at IBKR cost me $~0 and would have cost me in the order of about $130 at Swissquote.

After a long time without any trades, I got itchy fingers today:

MO+400, NG.L+1000, PCG+600, ED+100, SO+70, BOXX-491

After a long time without any trades, I got itchy fingers today

I get less itchy on green days like today* and wasn’t tempted to do any shopping today. Almost everything I’m interested in was marked up today!

Also slightly low on cash … well, not really, but I like my open cash secured puts covered with actual cash.

But I did add to a few positions in the past two weeks:

| ticker | date | # |

|---|---|---|

| SOLV | 04/03/2024 | 82** |

| STT | 04/05/2024 | 100 |

| OXSQ | 04/09/2024 | 7 |

| BK | 04/09/2024 | 100 |

| LON:IMB | 04/10/2024 | 32 |

| TD | 04/10/2024 | 100 |

| VICI | 04/10/2024 | 100 |

| MAIN | 04/12/2024 | 6 |

| ADM | 04/12/2024 | 10 |

| JNJ | 04/16/2024 | 20 |

| ENB | 04/16/2024 | 100 |

| MAIN | 04/18/2024 | 4 |

SOLV arrived by itself as a new position through a spin-off from 3M.

IMB, OXSQ and MAIN were automated dividend reinvestments.

ADM was more of of a silencing-my-itchy-fingers trade to make my odd lot of 90 full, having scratched the itch for that day to then contently remain sitting on my fingers for the rest of that day.

Ditto for JNJ.

MO+400, NG.L+1000, PCG+600, ED+100, SO+70, BOXX-491

Altria! I like your tolerance for further pain … ![]()

It’s actually also on my shopping list but currently manually blocked until I can convince myself that my max position size (measured in total dividends received per company) can go above 2%.***

National Grid plc wasn’t on my radar, thanks for mentioning it. Might take a look at it.

I like the other utilities you mention (and I own SO), but I’d prefer a better margin of safety for both of them. Are the purchases motivated by the secondary effect AI effects narrative wise, or do you like them for a different reason?

BOXX. I’ve heard about it from Wes Gray, the “ETF architect”, mentioning it on several podcasts I subscribe to ever since interest rates went up, and Wes comes across as a very interesting and smart guy. Nevertheless, the product never felt like it would fit anywhere in my portfolio with my current thinking.

Any reason you trimmed the position? (Or initiated it in the first place)

* Green days as measured by my watchlist and portfolio. Literally everything currently approved for purchase (as updated a week or two ago) on my watchlist went up today (as well as the entire stockpicking portfolio, but I dislike saying that aloud, as the market gods always listen and will undoubtedly punish me in time).

** Actually, I was granted 82.5 shares, but Swissquote, in this time and age, cannot deal with fractional shares yet and sold the 0.5 for me. Future sufficiently advanced technology (indistinguishable from magic) will solve this, eventually.

*** I have already breached the 2% with some of my positions like IMB or MAIN that allow DRIP through corporate actions. Admittedly, this is mainly motivated because I can DRIP without fees at Swissquote … I should think this over now that I’ve added a low fee broker to my custodian portoflio.

I also received SOLV from MMM.

I was planning to buy MO around sub-40, but in the last weeks, I was so busy on projects I didn’t pay any attention to the portfolio and missed that MO got close to 40. I figured it was close enough and I probably will not have much time over the next few weeks so added a bit now already. I would have liked to add to BTI, but the holding is already too big.

I’d sold off utilities 3 years ago thinking that they were horrifically over-valued. I bought SO at the same price I sold 3 years ago! I still don’t like the price, but figure that there’s some extra safety from AI mania.

Selling BOXX was to fund the other purchases.

Also slightly low on cash … well, not really, but I like my open cash secured puts covered with actual cash.

What about assignments ? Most of my CSPs were assigned during the last 10 days ![]()

What about assignments ? Most of my CSPs were assigned during the last 10 days

No assignments as I have nothing expiring until June. Recently sold CSPs are however more expensive now than when I sold them.

Open CSPs, in order of sell date:

- 42.5P CSCO Jun24: OTM (SQ)

- 65P CVS Jan25: OTM (SQ)

- 40P OZK Sep24: OTM (SQ)

- 20P UGI Sep24: OTM (SQ)

- 50P ES Oct24: OTM

- 65P CVS Sep24: OTM

- 55P TD Oct 24: OTM

- 27.5P VICI Jan 25: ATM

- 55P ADM Sep 24: OTM

The first four are unfortunately at Swissquote and I hope I can let them expire worthless as SQ’s fees for trading options are astronomical and assignments come with as much fees as purchasing outright.